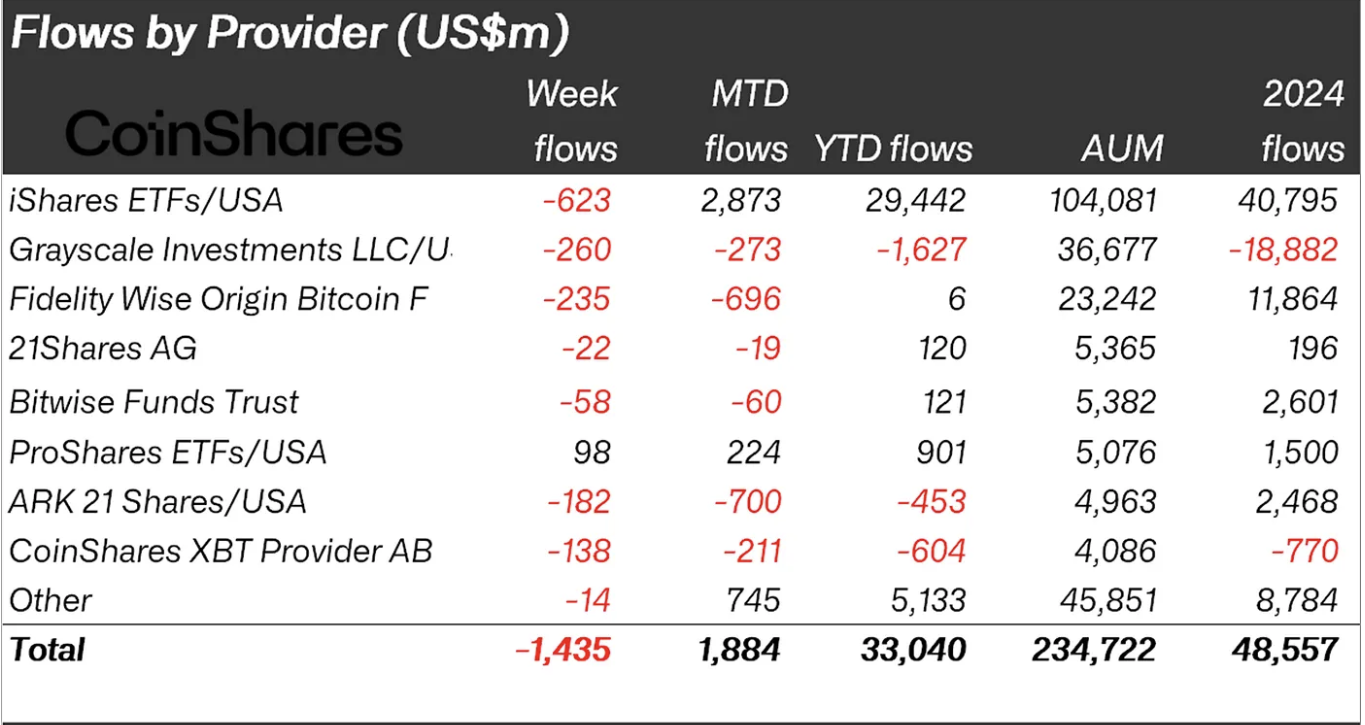

CoinShares launched a report on weekly digital asset funding, analyzing the extraordinary outflows throughout the crypto ETF market. In whole, crypto funding merchandise noticed $1.43 billion in outflows within the final week.

Diminished hopes of lowered rates of interest powered a whole lot of this pessimism, however there’s been one thing of a comeback. Nonetheless, the scenario is risky, and it’s unclear what’s going to occur subsequent.

Crypto ETF Outflows Final Week

Crypto ETF funding took the world by storm since early 2024, however a latest sample of outflows has been making traders nervous. Shortly after ETH ETF inflows surpassed Bitcoin, the entire asset class started posting heavy losses.

CoinShares launched a report on this development to higher analyze it:

Primarily, the report posits that bearish hopes for a US rate of interest reduce spurred these ETF outflows, and Jerome Powell’s sudden reconciliation efforts throughout his Jackson Gap speech blunted a number of the hostile momentum. Nearer evaluation of every of the main funds and tokens gives useful clues.

The Significance of Institutional Buyers

For instance, Ethereum was extra delicate than Bitcoin to those swings, reflecting its standing as a scorching commodity amongst institutional traders.

All through August 2025, ETH inflows exceeded BTC’s by $1.5 billion, a really sudden turnaround. In different phrases, the brand new funding narratives for Ethereum are having an actual affect.

Presently, it appears that evidently institutional traders are the first market mover right here. Impartial information from different ETF analysts helps this speculation:

CoinShares checked out all digital asset fund investments, not simply ETFs, so its outflow information has just a few attention-grabbing tidbits.

For instance, XRP and Solana carried out higher than Bitcoin and Ethereum on this sector, however their related ETFs haven’t received approval.

In different phrases, digital asset treasury (DAT) funding might make up a few of this whole.

To be clear, although, this sector can also be significantly weak to macroeconomic elements.

Regardless of large DAT inflows this month, investor misgivings and inventory dilution considerations have brought about vital issues for a number of main companies. Even Technique, a transparent market chief, has confronted just a few key warning indicators.

All that’s to say, the present scenario is slightly risky.

It’s troublesome to extrapolate this information to make a future prediction, however one factor appears clear. Ethereum’s new prominence may be very seen, and it might have large implications for altcoins.

The publish Institutional Buyers Energy Crypto ETF Outflows as ETH Takes the Highlight appeared first on BeInCrypto.