Be a part of Our Telegram channel to remain updated on breaking information protection

Crypto giants Galaxy Digital, Multicoin Capital and Soar Crypto are becoming a member of forces to boost $1 billion and type a Solana treasury firm.

In response to an Aug. 25 Bloomberg report that cited sources acquainted with the matter, the three corporations purpose to create the most important SOL treasury agency. They’ve additionally tapped Cantor Fitzgerald, who has over $14.8 billion in property underneath administration (AUM), because the lead banker.

As a part of the deliberate treasury, the three corporations will look to purchase out an organization that’s already publicly listed. The Solana Basis, a non-profit devoted to the expansion of the Solana blockchain, can also be backing the initiative.

Rising Quantity Of Firms Including Solana To Their Reserves

Bitcoin (BTC) and Ethereum (ETH) have been the preferred cryptos for corporations seeking to construct their very own digital asset reserves.

That development began when Technique started buying Bitcoin again in 2020. By means of a sequence of acquisitions since then, the agency has turn into the most important Bitcoin treasury firm with 629,376 BTC on its steadiness sheets, in accordance with Bitcoin Treasuries.

Different corporations have adopted Technique’s methodology of funding Bitcoin purchases by debt financing. 301 corporations now maintain 3.68 million BTC collectively on their steadiness sheets. That is after fourteen new corporations joined the development within the final month.

Some corporations have additionally began to construct a treasury round altcoin chief Ethereum (ETH). Most notably, Bitmine Immersion Applied sciences and SharpLink Gaming are the most important company ETH holders.

Bitmine at present holds 1.5 million ETH valued at $6.96 billion at present costs, information from StrategicETHReserve exhibits. In the meantime, SharpLink Gaming holds 740.8K ETH value $3.38 billion.

Whereas BTC and ETH have remained in style decisions for corporations seeking to construct a digital asset treasury, some corporations have additionally began to stockpile the smaller-capped altcoin SOL.

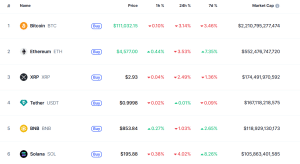

Largest cryptos by market cap (Supply: CoinMarketCap)

The biggest SOL treasury agency is Upexi Inc. It introduced on Aug. 5 that its Solana holdings surpassed 2 million SOL, value about $400 million at present costs. One other firm, DeFi Improvement Corp, holds between 1.2 million and 1.3 million SOL.

Different corporations corresponding to Sol Methods, Classover Holdings Inc, Torrent Capital, and SOL World Investments additionally maintain the altcoin on their steadiness sheets.

Sol Methods, a devoted Solana-focused funding firm, holds between 260,000 and 395,000 SOL, whereas Classover Holdings has round 52,000 SOL on its steadiness sheets.

Torrent Capital and SOL World Investments each have holdings of round 40,000 SOL.

The entire holdings of these corporations is 3,715,814 SOL, in accordance with information from CoinGecko. The worth of their complete holdings stands at over $727 million.

Companies Additionally Rush To Provide A Solana ETF

Firms are usually not simply seeking to create Solana treasuries, a number of corporations have additionally filed for a spot SOL ETF (exchange-traded fund).

That follows the profitable approval and launches of US spot Bitcoin and spot Ethereum ETFs final yr. These merchandise have seen billions of {dollars} in cumulative inflows.

Asset administration agency VanEck pioneered the SOL ETF race when it filed with the US Securities and Change Fee (SEC) in the midst of 2024. It has since amended its S-1s to handle staking language.

Others adopted, with 21Shares, Bitwise, Grayscale, Canary Capital, Franklin Templeton, Constancy and Coinshares all submitting S-1 varieties with the regulator for their very own spot Solana ETFs. Many of those functions have additionally been amended to handle staking.

The ultimate determination for the spot SOL ETF filings is anticipated by October 2025.

Earlier this yr in June, Bloomberg ETF analyst Eric Balchunas predicted a possible “Alt Coin ETF Summer time.” Him and his colleague, James Seyffart, additionally predicted a 90% likelihood that spot Solana ETFs will get authorised this yr.

Prepare for a possible Alt Coin ETF Summer time with Solana possible main the best way (in addition to some basket merchandise) by way of @JSeyff word this morning which incorporates recent odds for all of the spot ETFs. pic.twitter.com/UMzih4oou7

— Eric Balchunas (@EricBalchunas) June 10, 2025

Whereas US spot Solana ETFs might not have been authorised but, the REX-Osprey Solana + Staking ETF was listed on the Cboe BZX Change and is at present buying and selling. That is after the fund’s issuer was knowledgeable by the SEC that it had “no additional feedback,” giving it the greenlight to proceed.

The issuer took benefit of a regulatory workaround that was made doable by structuring the fund underneath the Funding Firm Act of 1940.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection