Bitwise CIO Matt Hougan took intention at JPMorgan, difficult America’s greatest banks’ strikes to push lawmakers to curb stablecoin yields.

It comes as crypto’s conflict with Wall Avenue escalates, culminating in certainly one of Washington’s most explosive lobbying battles in years.

Bitwise Rebukes JPMorgan Amid Wall Avenue–Crypto Showdown

The Bitwise CIO slammed JPMorgan, following feedback from Financial institution Coverage Institute members and different banking lobbies.

“I believe JPMorgan Chase is confused. Can somebody inform them that the 0% curiosity rule is just for stablecoins, not financial institution accounts?” wrote Huogan.

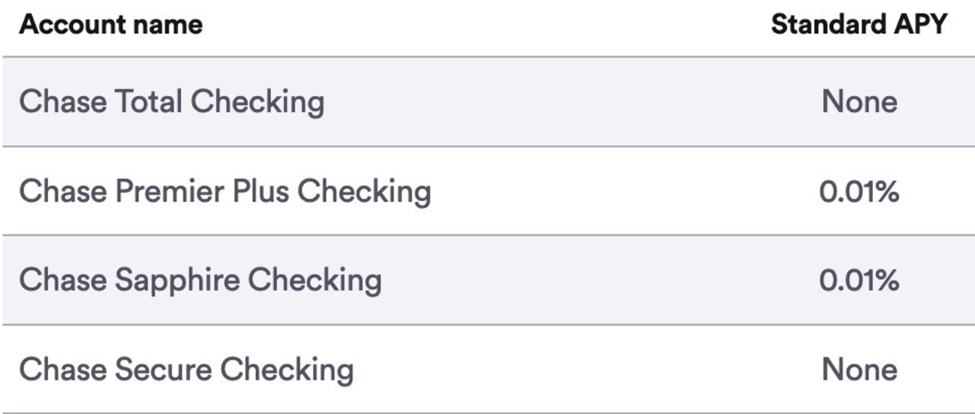

Matt Hougan highlighted JPMorgan Chase’s negligible rates of interest on checking accounts, 0% to 0.01% APY.

This contrasts with the GENIUS Act, handed solely not too long ago, which permits interest-bearing stablecoins, suggesting banks could also be lagging in aggressive monetary innovation.

TradFi media says JPMorgan’s highest Certificates of Deposit (CD) charges require a $100,000 deposit and a checking account relationship. This factors to a strategic barrier to entry for common prospects, probably driving curiosity towards stablecoins providing yields as much as 5%.

Towards this backdrop, banks argue {that a} loophole lets exchanges corresponding to Coinbase and Binance reward stablecoin holders.

Lobbies press Congress to amend the GENIUS Act, which set the primary federal guidelines for stablecoins. In hindsight, the Act banned issuers like Circle (USDC) and Tether (USDT) from paying curiosity immediately.

Due to this fact, and in the identical tone as Hougan, Ryan Sean Adams, host of the Bankless podcast, accused banks of rent-seeking.

“The banks are attempting to cease Americans from getting yield on their financial savings. They wish to preserve it for themselves…Stablecoin yield belongs to the individuals, not the banks,” he noticed.

Stablecoins’ Rising Systemic Weight Amid Washington’s Lobbying “Civil Battle”

Conventional finance (TradFi) gamers just like the American Bankers Affiliation, Financial institution Coverage Institute, and Shopper Bankers Affiliation warn that permitting stablecoin yields may set off an unprecedented exodus of deposits, probably reaching $6.6 trillion.

Such a shift would elevate borrowing prices, scale back lending capability, and severely have an effect on small companies and households.

“It appears like there’s a transfer to interchange us,” a TradFi media reported, citing Christopher Williston, CEO of the Impartial Bankers Affiliation of Texas.

But crypto advocates dismiss the panic. Coinbase CLO Paul Grewal stated the banks’ warnings are merely an effort to defend themselves from competitors.

The stakes rise as stablecoins develop from area of interest cost tokens into potential macroeconomic drivers. Coinbase Head of Analysis David Duong not too long ago projected that stablecoins may broaden to $1.2 trillion by 2028.

TradFi sees the battle as a lobbying civil conflict. Republicans are making ready to advance a bigger crypto market construction invoice this fall, which may cement stablecoin yield as a pillar of US digital asset coverage. Wall Avenue, in the meantime, is mobilizing to dam it.

Banks are combating to protect their deposit base, whereas crypto is combating to democratize yield.

With stablecoins more and more entangled in US fiscal mechanics, the struggle over who controls curiosity in America might outline monetary coverage sooner or later.

The put up Bitwise Slams JPMorgan as Stablecoin Yield Battle Heats Up in Washington appeared first on BeInCrypto.