Be part of Our Telegram channel to remain updated on breaking information protection

The crypto market tumbled nearly 2% within the final 24 hours as Bitcoin slid beneath the essential $110,000 assist stage, initiating a large sell-off throughout prime digital property, together with Solana, Ethereum, and Dogecoin.

The Bitcoin worth dropped to as little as $109,300 earlier than recovering to commerce at $110,329 as of three:56 a.m. EST, with buying and selling quantity surging 13% to $54.3 billion.

SOL tumbled 5%, ETH dropped nearly 4% and DOGE greater than 4% in the final 24 hours.

FARTCOIN led the highest losers with a 13.6% drop, adopted by Curve DAO Token (CRV), Virtuals Protocol (VIRTUAL), and Chainlink (LINK), which dropped 8.2%, 7.8%, and seven.6%, respectively, in line with CoinMarketCap knowledge.

Over 180,000 merchants had been liquidated, with whole liquidations coming in at $833.32 million, in line with Coinglass.

The highest gainer amongst main cryptos was Hyperliquid, which climbed 2.2%, adopted by Cronos (CRO), 4 (FORM), and UNUS SED LEO (LEO) with positive aspects starting from 1.3% to 0.7%.

Bitcoin Triggers Market-Vast Crypto Crash

Bitcoin dropped beneath the $110,000 stage for the primary time since early July, which triggered a market-wide swoon after a whale unloaded 24,000 BTC price $2.7 billion on Sunday.

Crypto analyst Willy Woo, with over 1.2 million followers on X, says that BTC is rising so slowly this cycle as a result of early whales with big low-cost holdings are steadily promoting, and it takes huge new capital inflows to soak up their provide.

Why is BTC transferring up so slowly this cycle?

BTC provide is concentrated round OG whales who peaked their holdings in 2011 (orange and darkish orange).

They purchased their BTC at $10 or decrease. It takes $110k+ of latest capital to soak up every BTC they promote. pic.twitter.com/7CbWXsvX2l

— Willy Woo (@woonomic) August 24, 2025

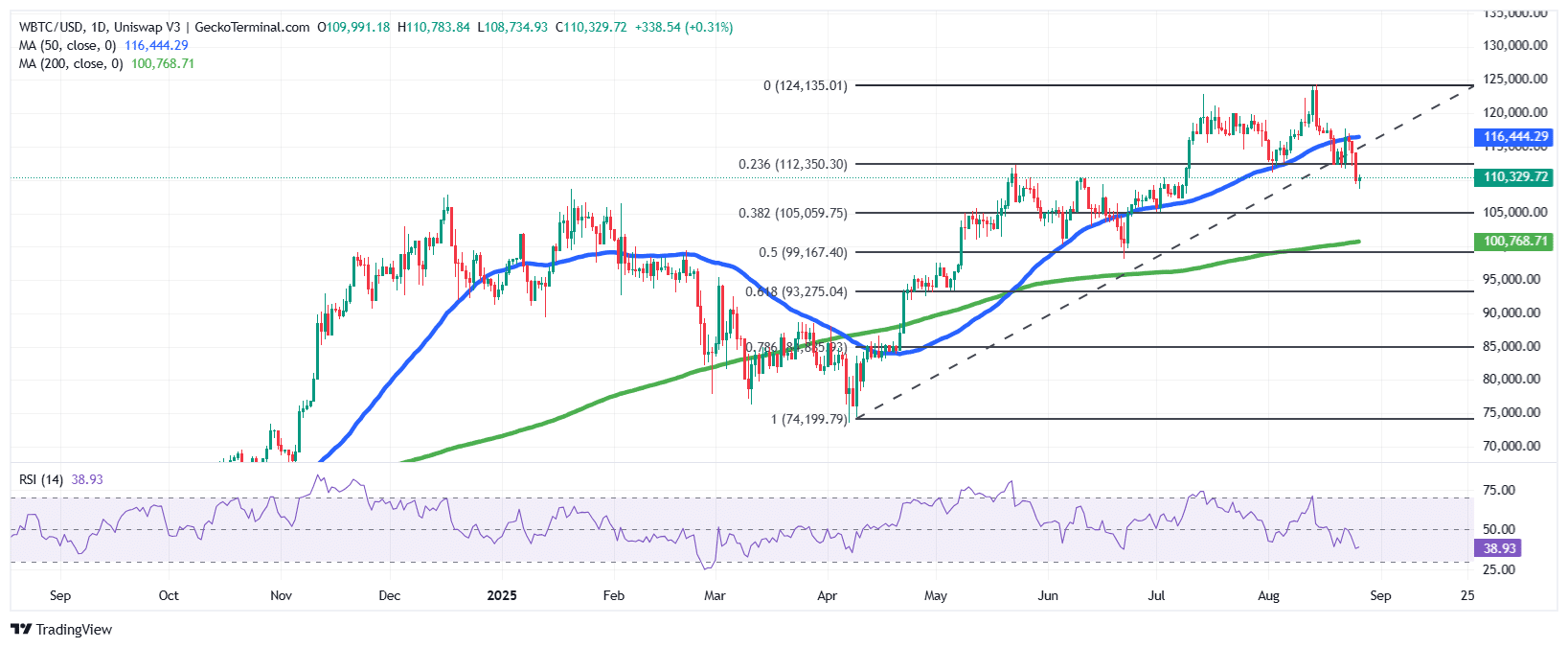

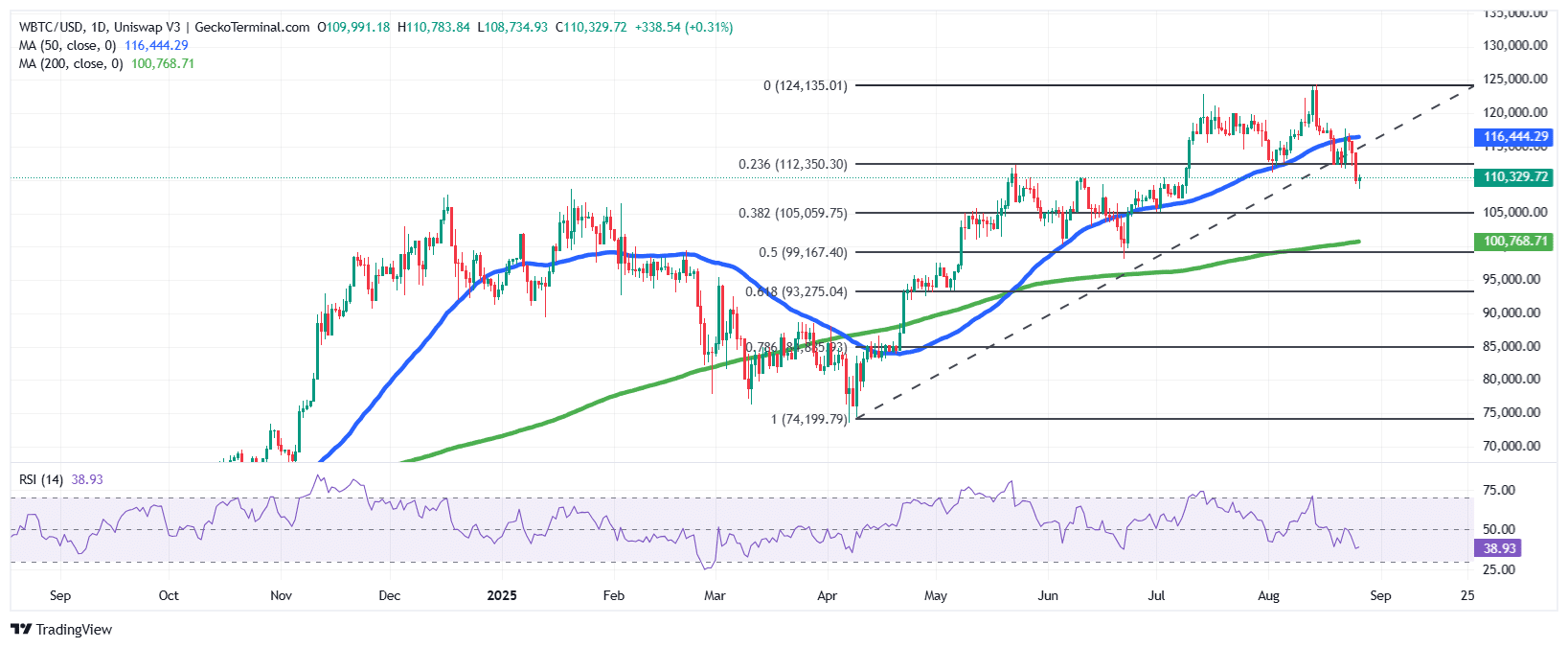

BTC continues to point out some bearish prospects. On the each day chart, the BTC worth has damaged beneath its 50-day Easy Transferring Common (SMA) ($116,444), signaling weak spot after failing to maintain its current highs close to $124,000.

BTC is now hovering round $110,000, with the Fibonacci 0.236 retracement at $112,350 appearing as fast resistance.

The Relative Energy Index (RSI) is at present at 38.9, indicating bearish momentum and edging towards oversold territory.

In the meantime, the 200-day SMA at $100,768 stays a crucial assist stage. If the value of Bitcoin holds above $110,000, it may try a bounce towards $112,350 and reclaim the 50-day MA.

A failure to keep up present ranges dangers a slide to $105,000 and probably $99,000, the place the 0.382–0.5 Fibonacci zone aligns with prior demand.

Peter Schiff is predicting a fall to as little as $75,000, and says that traders ought to promote now and purchase again decrease.

Bitcoin simply dropped beneath $109K, down 13% from its excessive lower than two weeks in the past. Given all of the hype and company shopping for, this weak spot needs to be trigger for concern. At a minimal, a decline to about $75K is in play, slightly below $MSTR‘s common value. Promote now and purchase again decrease.

— Peter Schiff (@PeterSchiff) August 26, 2025

Nevertheless, on August 25, BTC spot ETFs (exchange-traded funds) recorded over $219 million in internet inflows, in line with Coinglass.

Billionaire investor Tim Draper stays bullish, reiterating his $250k worth goal.

🇺🇸 BILLIONAIRE TIM DRAPER JUST SAID LIVE ON CNBC THAT THIS IS THE BEST TIME TO BUY #BITCOIN

HERE WE GO!!! pic.twitter.com/frwN3HwUPj

— Vivek Sen (@Vivek4real_) August 25, 2025

Ethereum Stays Bullish Regardless of Current Drop

Regardless of the broader market decline, Ethereum trades at $4,418 inside a rising channel sample.

After pulling again from a excessive close to $4,800, the ETH worth stays above the channel’s midline, with the 50-day SMA at $3,836 offering dynamic assist and the 200-day SMA at $2,633 reinforcing a long-term bullish construction.

In the meantime, the RSI sits at 54.6, displaying wholesome momentum with out being overbought.

So long as ETH stays above $3,800, continuation towards $4,800 and probably $5,000 stays possible. A breakdown beneath $3,800 may set off a check of $3,200, however the prevailing bias stays bullish inside the channel.

Constructive social media sentiment noticed by fashionable dealer Ali Martinez could drive additional curiosity and Fundstrat managing companion Tom Lee stated that ETH has bottomed out after the current pullback to round $4,300.

Mark @MarkNewtonCMT once more at it.

➡️Calling ETH backside to occur in subsequent few hours

Tickers: $BMNR $GRNY pic.twitter.com/038efU7cZH

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) August 26, 2025

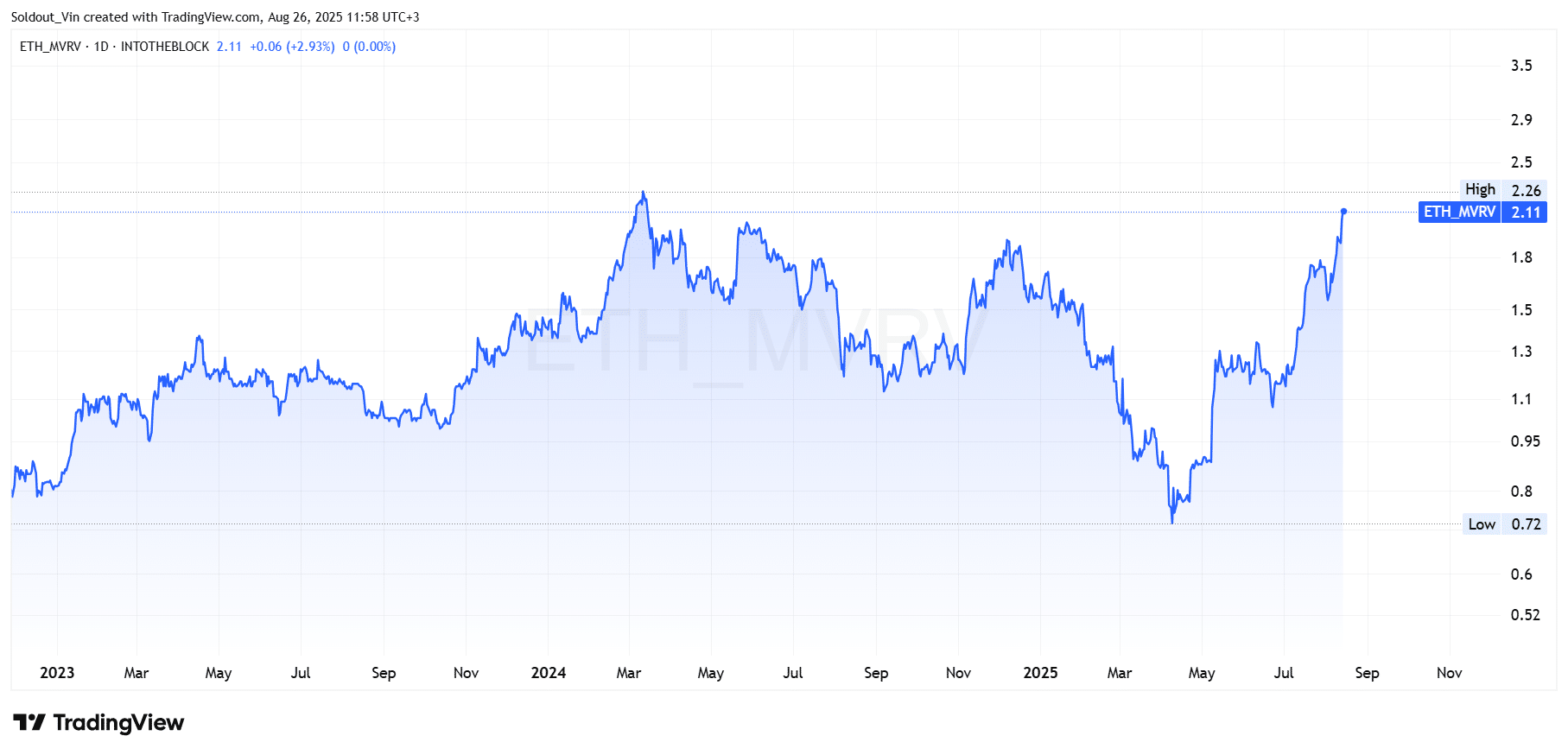

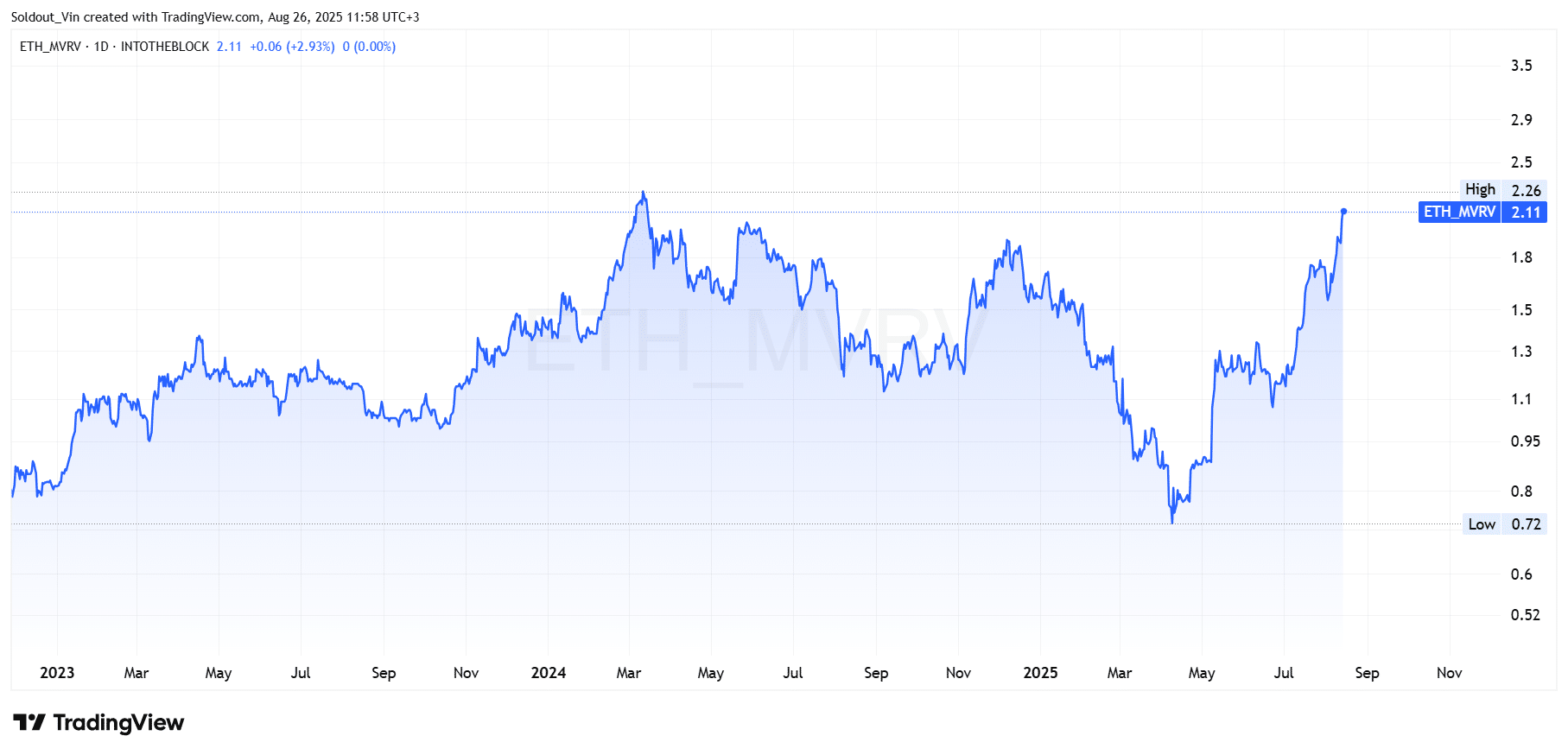

Nevertheless, in line with TradingView knowledge, Ethereum’s MVRV ratio is now 2.11, which reveals that almost all holders are up greater than 2X on common, a stage which regularly ends in volatility and profit-taking.

Solana And Dogecoin Present Blended Indicators

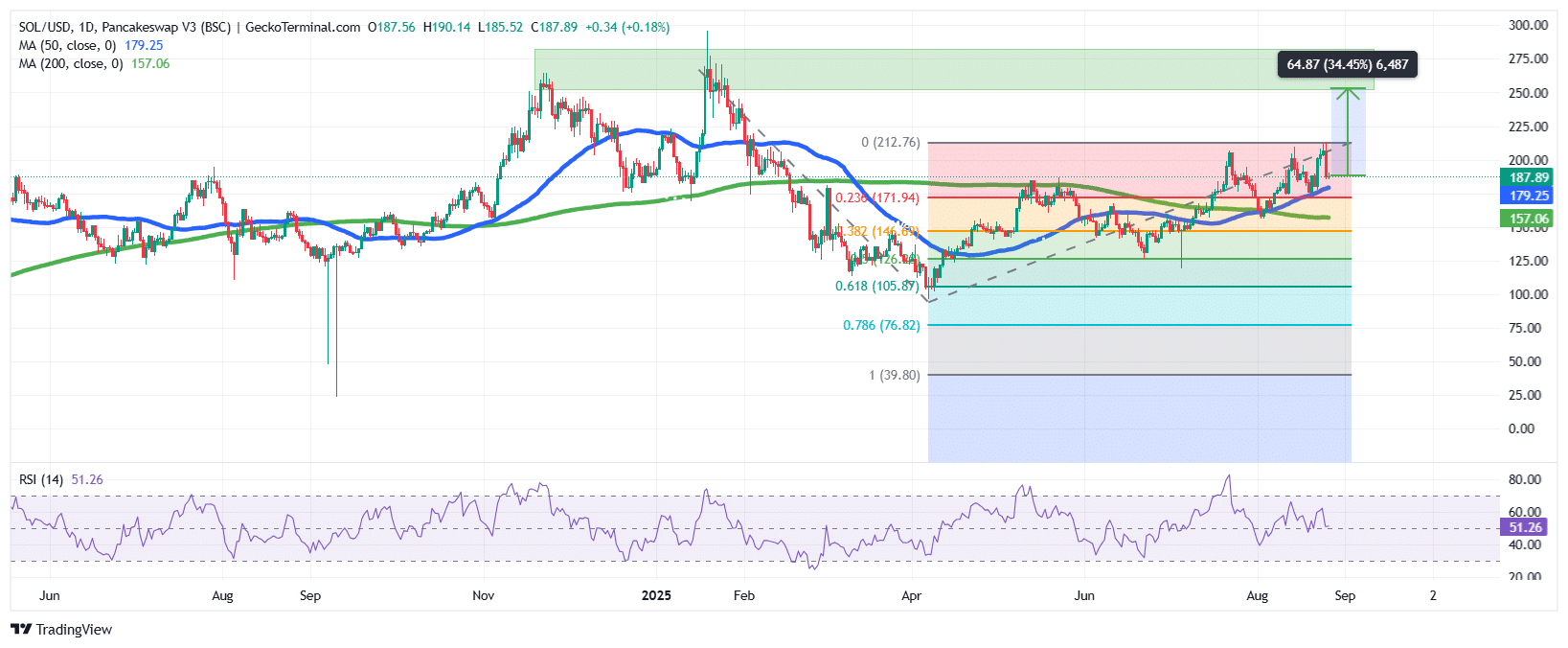

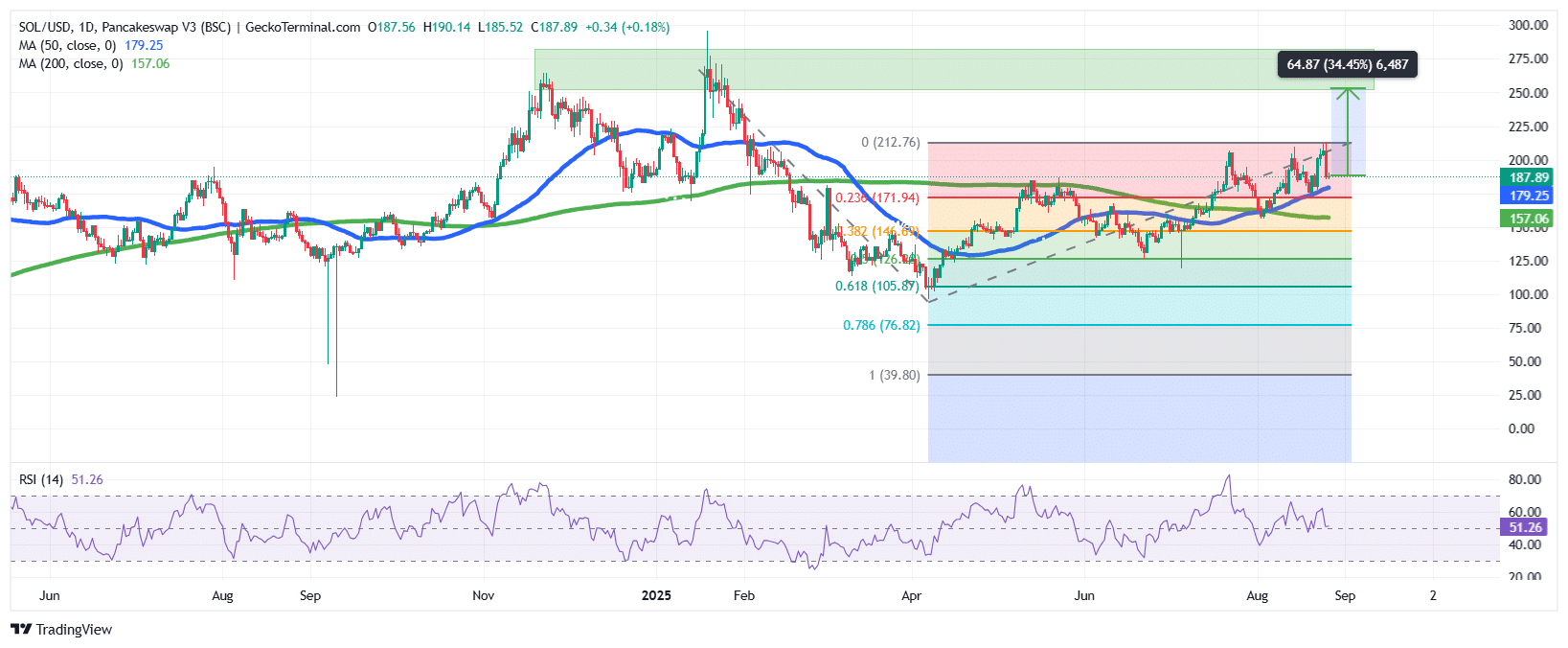

Solana is at present buying and selling at $187.89, with buying and selling quantity down 26% to $9.7 billion. SOL is bullish, buying and selling above each the 50-day and 200-day SMAs with impartial RSI at 51.

The Solana worth has cleared key resistance and will goal $250 if momentum holds, whereas $170 stays robust assist.

In keeping with REX Monetary CEO Greg King, Solana will be the future platform for stablecoins.

“Solana is quicker (than eth).. frankly when i noticed the large debate about secure cash all being constructed on Eth I used to be like this can be a big oversight. I believe Solana is the story for the longer term so far as secure cash go” – Greg King on IQ right this moment 🔥 https://t.co/jpIZJ0BMjS

— Eric Balchunas (@EricBalchunas) August 25, 2025

A fashionable crypto analyst on X referred to as Pentoshi stated SOL might be headed for the $250 zone, regardless of the current downtrend.

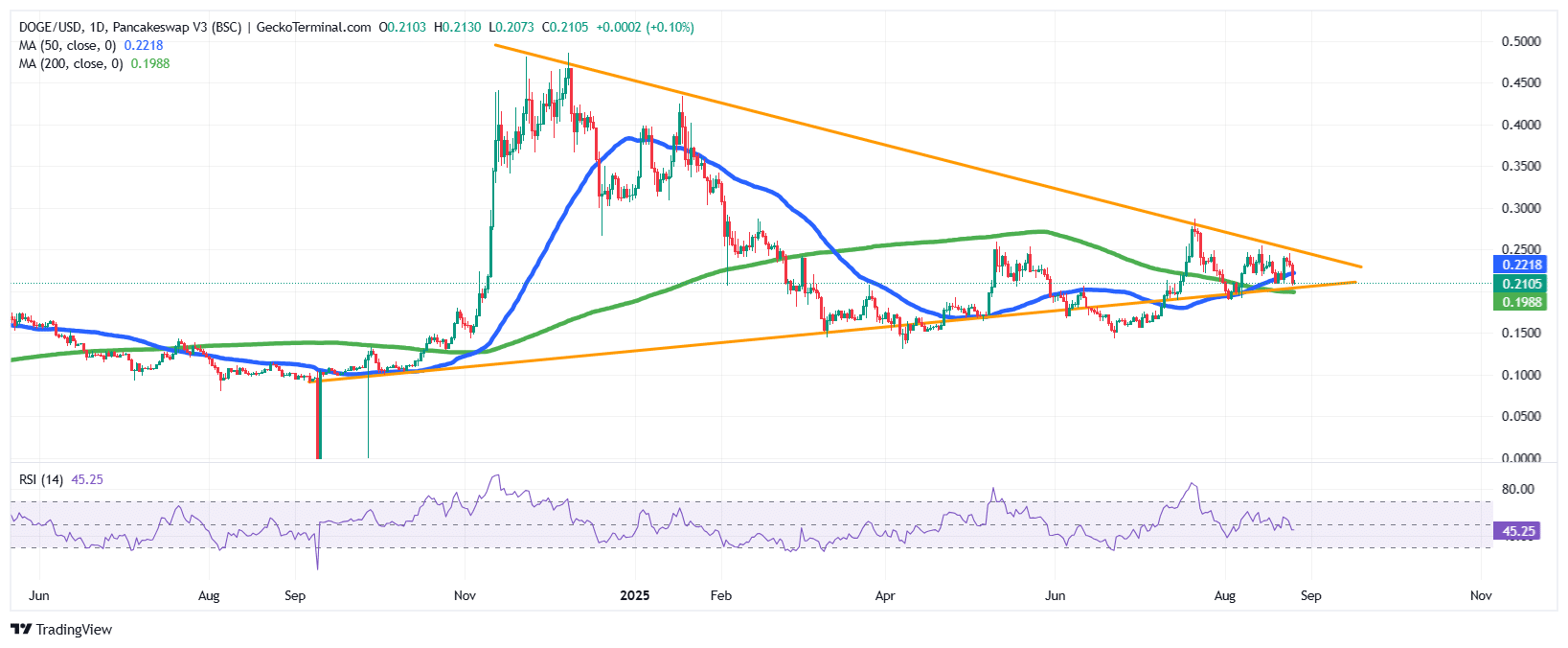

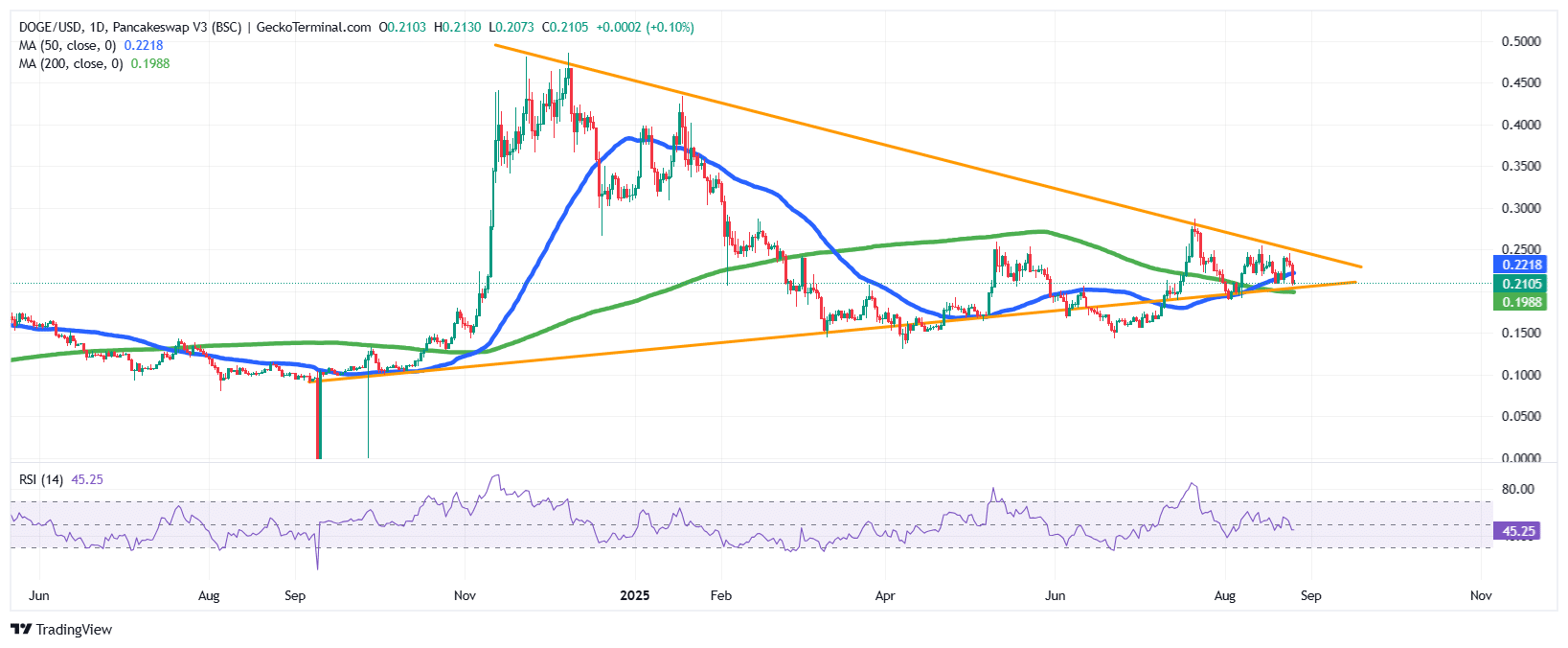

In the meantime, prime memecoin Dogecoin is consolidating in a symmetrical triangle, squeezed between $0.25 resistance and $0.20 assist, because it at present trades at $0.2105.

The RSI at 45 reveals indecision. A breakout may push it towards $0.30–$0.35, whereas a breakdown dangers $0.17.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection