Bitcoin could also be gearing up for an additional downturn as on-chain knowledge indicators sustained promoting stress. A latest report from CryptoQuant reveals an uptick in selloffs amongst spot and futures merchants.

If this pattern persists, BTC dangers sliding beneath the crucial $110,000 value mark.

Bitcoin Promote Stress Intensifies

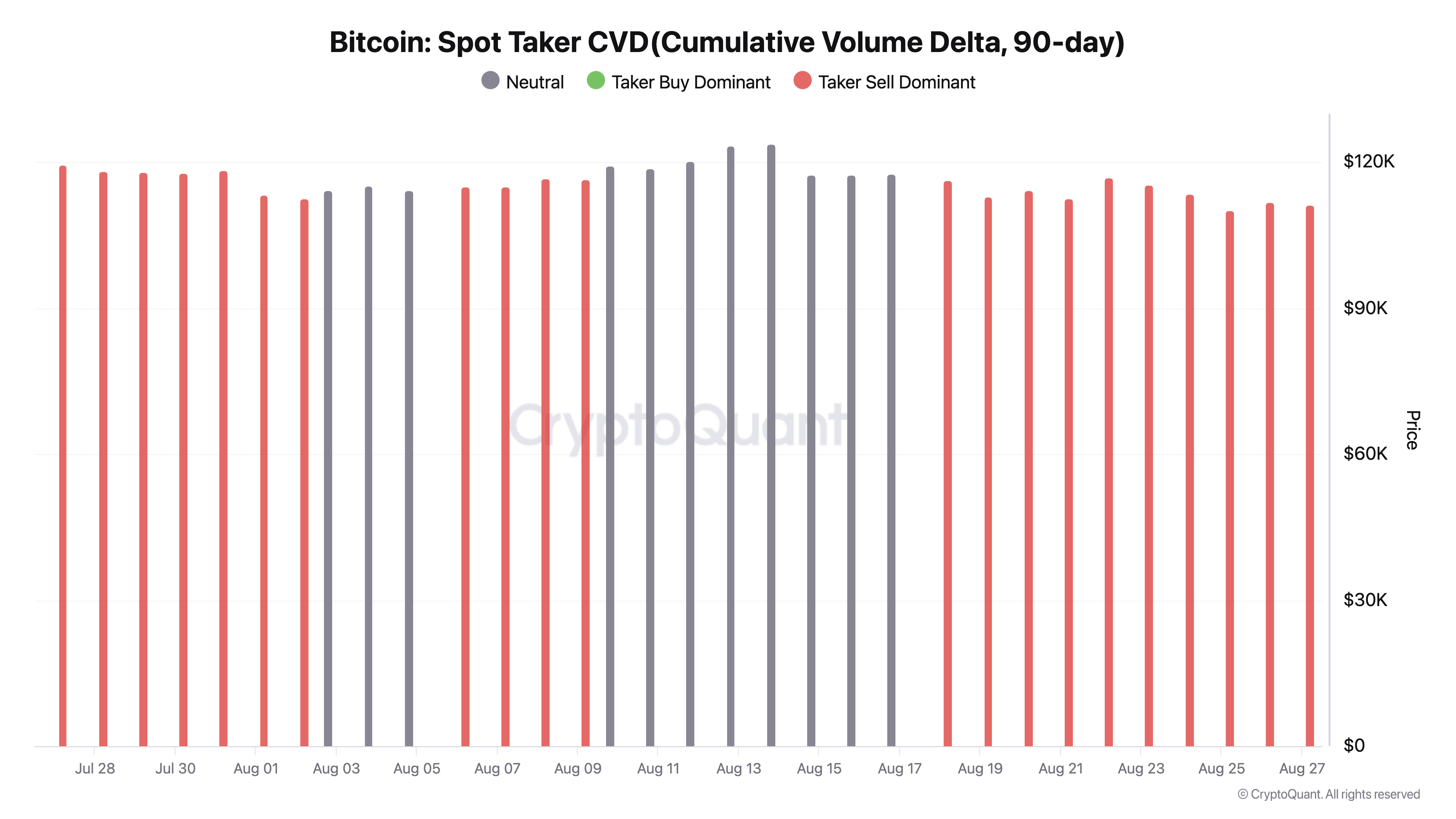

In response to a just lately printed report on CryptoQuant, Bitcoin has seen a surge in selloffs from each spot and futures merchants, as mirrored in two key indicators—the Spot Taker Cumulative Quantity Delta (CVD, 90-day) and the Taker Purchase/Promote Ratio.

The Spot Taker CVD, which tracks whether or not market takers are predominantly consumers or sellers, has flipped crimson after months of buy-side dominance. This shift indicators renewed promoting stress, a sample that has traditionally preceded corrections.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

It displays a cooling of aggressive shopping for curiosity and a rising willingness amongst BTC spot merchants to dump positions, signaling exhaustion out there.

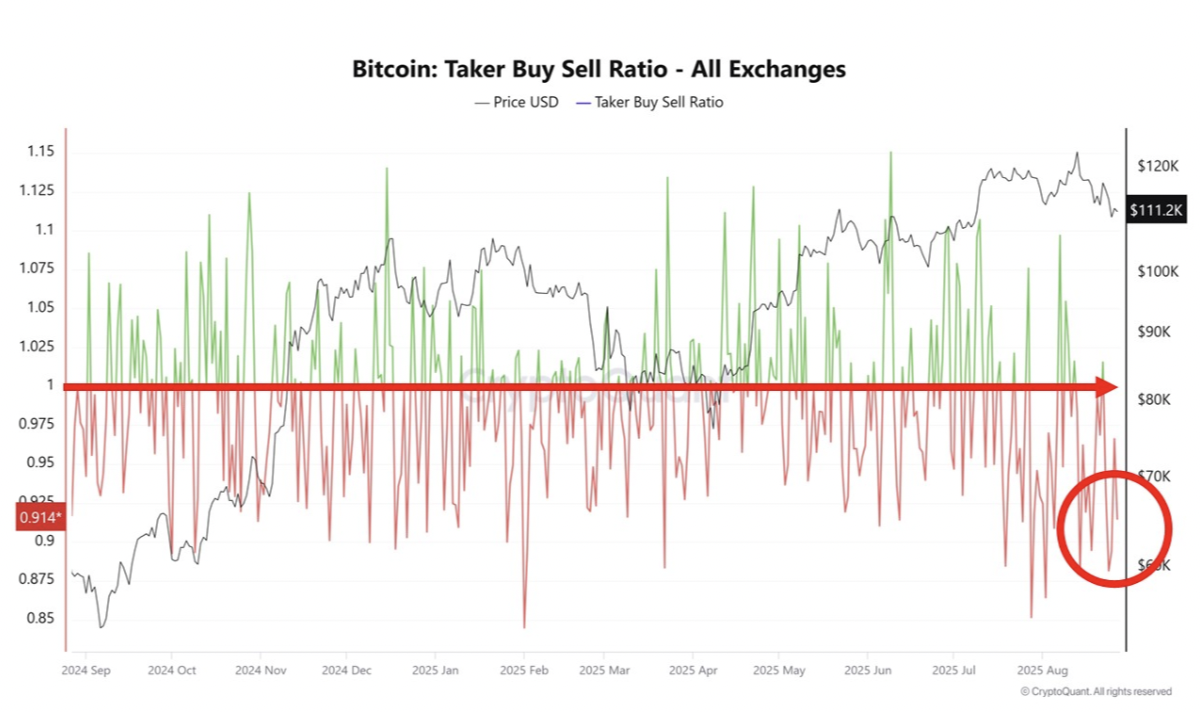

Additional, in line with the report, BTC’s Taker Purchase/Promote Ratio has slipped to 0.91, falling beneath its long-term baseline of 1.0. This means that promote orders now persistently outweigh purchase orders throughout the coin’s futures market.

An asset’s taker buy-sell ratio measures the ratio between the purchase and promote volumes in its futures market. Values above one point out extra purchase than promote quantity, whereas values beneath one recommend that extra futures merchants are promoting their holdings.

This confirms the mounting sell-side stress and weakening sentiment, which might worsen BTC value declines if it continues.

Can the $112,000 Help Gas a Contemporary Rally?

BTC trades at $112,906 at press time, resting above the assist flooring at $111,920. If demand grows and this value flooring strengthens, it might propel BTC’s value towards $115,764. A profitable breach of this degree might open the door for a rally to $118,922.

Conversely, if sell-side stress mounts, BTC dangers plunging beneath $111,920 and falling towards $109,267.

The publish Bitcoin Braces for One other Dip as On-Chain Knowledge Warns of Spot and Futures Selloffs appeared first on BeInCrypto.