Cronos (CRO) worth has prolonged its beautiful run, buying and selling at $0.34 at press time, up 55% in 24 hours and nearly 140% previously week.

The transfer has been fueled by ongoing Trump Media hype and speculative momentum, however key on-chain indicators now recommend the rally could also be weak to profit-taking.

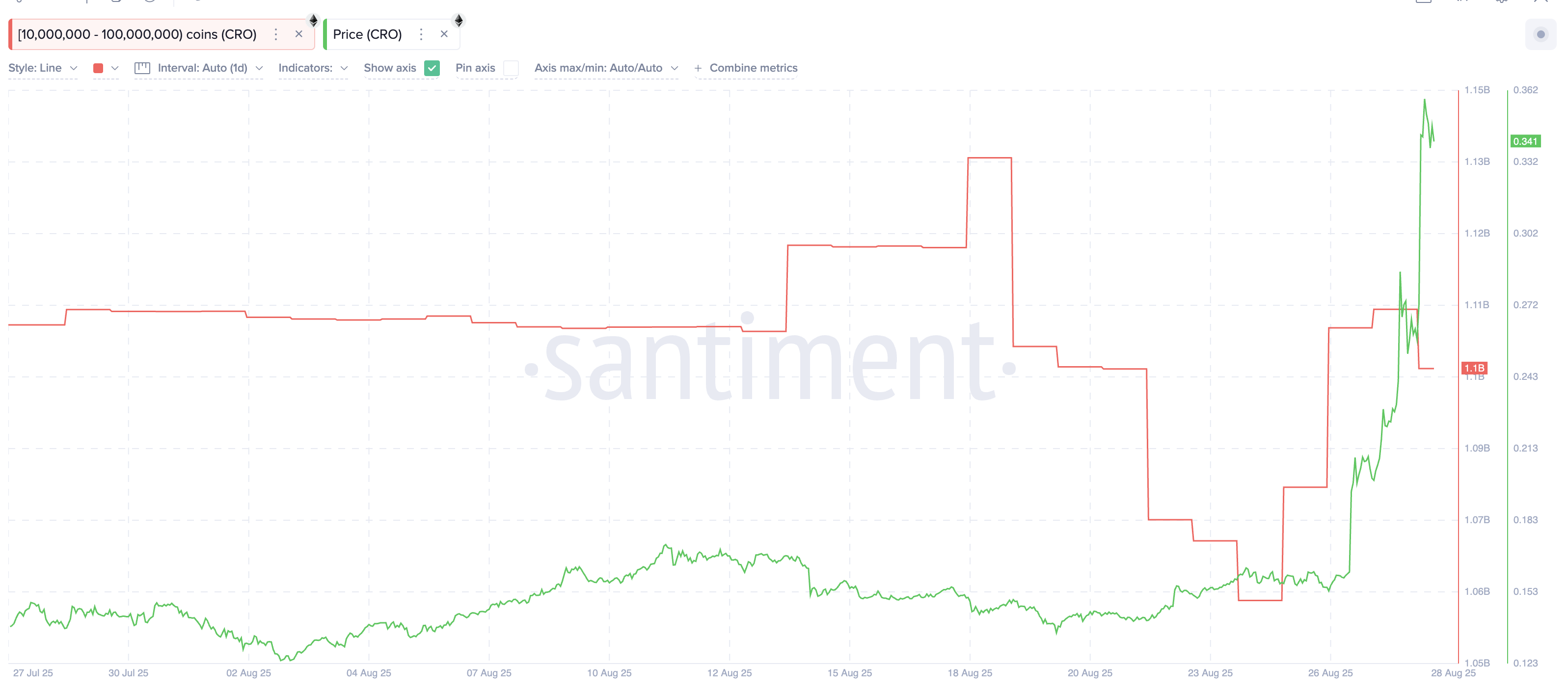

Whales Trim Holdings for the First Time Since August

For the primary time in practically two weeks, giant holders within the 10 million–100 million CRO cohort have lowered their positions. Their wallets fell from 1.11 billion CRO to 1.10 billion CRO, a lower of roughly 100 million CRO value $34 million at present costs.

Whereas the discount seems small in comparison with their whole holdings, the timing is essential. Till now, whales had solely collected throughout the rally. Their first transfer to promote into energy indicators a shift in sentiment that might ripple into broader market exercise.

This early whale motion ties straight into the profit-taking habits mirrored throughout the broader community.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

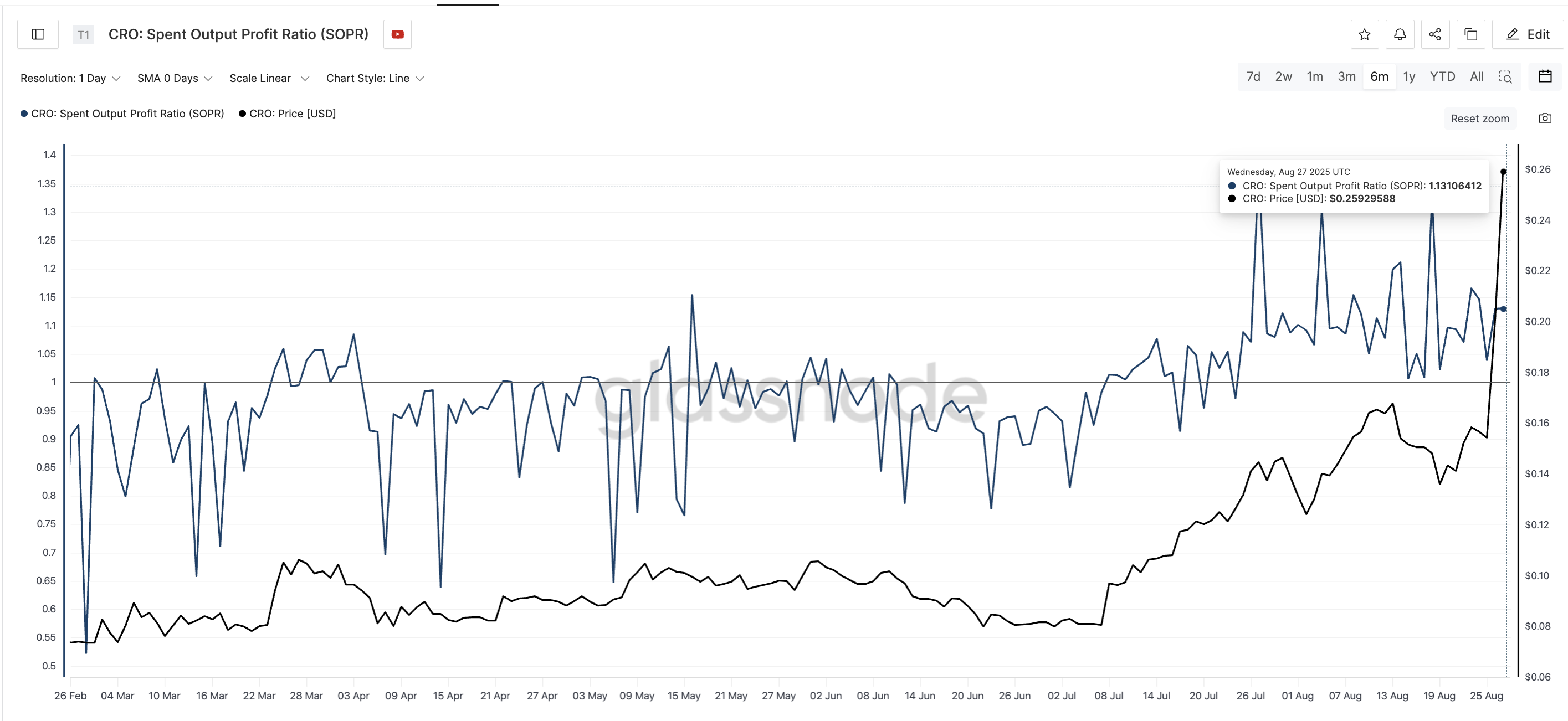

SOPR Peaks, Confirming Revenue-Taking Alerts

The profit-taking sign turns into clearer when taking a look at Cronos’ Spent Output Revenue Ratio (SOPR), which climbed to 1.13 this week — its second-highest studying in six months. An SOPR above 1 means most cash being moved are being bought at a revenue.

The Spent Output Revenue Ratio (SOPR) tracks whether or not cash are being bought at a revenue or a loss. Rising SOPR alongside rising costs typically indicators heavy profit-taking, which might sluggish or reverse rallies.

The final time SOPR hit such elevated ranges in July, the Cronos worth corrected from $0.14 to $0.12. This marked a pullback of 14%. If an analogous 14% correction have been to unfold from as we speak’s worth of $0.34, it could carry the CRO worth again round $0.28. This stage coincides with the $0.28–$0.32 assist zone.

This overlap strengthens the case that present profit-taking might take a look at these helps. And it might probably flip the short-term bias in the event that they fail.

With whales now trimming and SOPR flashing comparable warnings, historical past suggests {that a} cooling part might comply with even amid bullish momentum.

Cronos Value Ranges to Watch

Amid these warning indicators, the construction for the Cronos (CRO) worth stays bullish. The token has cleared the $0.28 and $0.32 resistances and is now testing $0.34. The instant upside goal is $0.38, which the Cronos worth should break convincingly for the rally to proceed.

On the draw back, assist lies at $0.32 and $0.28, with a deeper reversal possible provided that CRO dips beneath $0.25, led by the revenue reserving strain. Importantly, Cronos remains to be 64.5% beneath its all-time excessive of $0.96, leaving important room for upside if momentum sustains.

At current, if the CRO worth manages to carry above $0.32, it’d simply be capable of survive the profit-booking strain. After which it might validate the bearish outlook, trying a rally continuation.

The submit Revenue-Taking Alerts Emerge After Cronos (CRO) Surges 140% in a Week appeared first on BeInCrypto.