Bitcoin’s position has shifted this yr from a fringe asset to a mainstream treasury play, with public firms now treating it like gold on their stability sheets. That development has formed a lot of 2025’s company finance recreation plan.

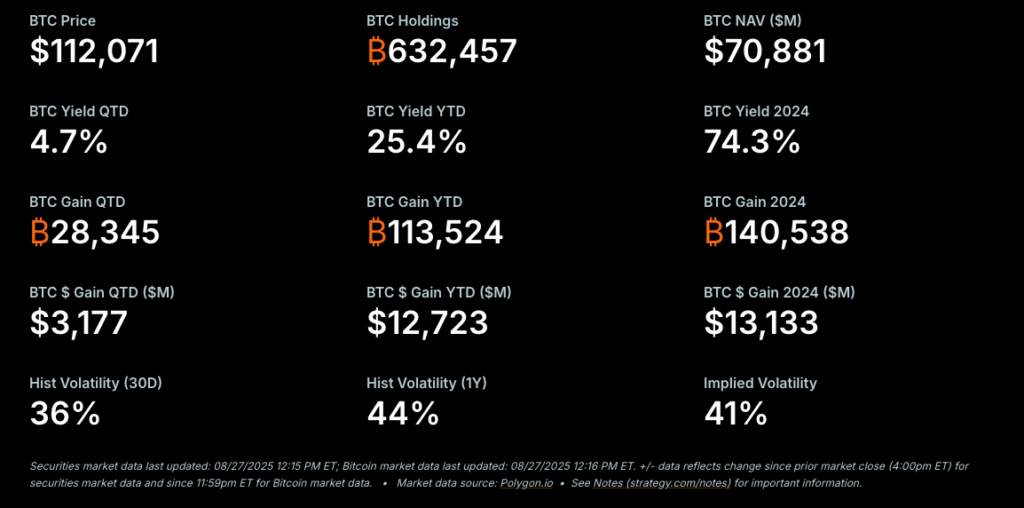

The standout, in fact, is MicroStrategy – now doing enterprise as Technique. It simply raised about $310 million by issuing new frequent inventory, and put the funds towards a brand new buy of three,081 BTC – a $357 million funding that provides to Technique’s whole stockpile of 632,457 BTC.

However on the similar time, one other company experiment is gaining floor. HYLQ Technique is now mirroring Technique’s mannequin – solely as a substitute of Bitcoin, they’re specializing in Hyperliquid’s HYPE token. Might HYLQ be one of the best crypto inventory to purchase now?

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Breakdown of MicroStrategy’s Newest Bitcoin-Funded Inventory Sale

Technique has as soon as once more leaned on its at-the-market fairness program to purchase Bitcoin. The agency not too long ago bought $310 million price of recent frequent shares, and used the proceeds to seize nearly $357 million price of BTC final week – its first equity-funded purchase in almost a month.

The transfer adopted the loosening of a self-imposed rule that had restricted share issuance beneath sure valuation thresholds. This variation offers Technique extra flexibility to subject shares each time it sees a great likelihood to stack BTC.

Promoting new shares on this method does dilute the possession stakes held by present buyers – however it may possibly additionally work in shareholders’ favor if the inventory trades at a premium to its web asset worth (NAV), which is the per-share worth of the Bitcoin that Technique holds. In that case, Technique is mainly turning its premium-priced inventory into much more Bitcoin.

With this newest purchase, Technique’s whole holdings have climbed to 632,457 BTC – solidifying the corporate’s spot as the biggest company Bitcoin holder on the earth.

MicroStrategy’s Relentless Accumulation Evokes Extra Company BTC Buys

Final week’s buy wasn’t a one-off. Technique has been on an aggressive accumulation streak all through 2025, utilizing each frequent and most well-liked inventory gross sales to fund even larger Bitcoin buys.

Again in mid-June, Technique spent over $1 billion to amass 10,100 BTC. By the tip of that month, one other 4,980 BTC was added for greater than $530 million. July introduced two extra enormous buys: first 4,225 BTC for almost $473 million, then an enormous $2.5 billion increase that funded a purchase order of 21,000 BTC.

This playbook is not Technique’s alone. Semler Scientific within the U.S. is utilizing an analogous method, and has constructed a stack of over 5,000 BTC, whereas Japan’s Metaplanet can also be making ready an $880 million share sale largely meant to purchase extra Bitcoin.

Technique may need created the mannequin, however 2025 is proving that everybody needs to use it – so we may even see extra firms undertake related treasury methods in 2026.

Why HYLQ Technique Might Be the Finest Crypto Inventory to Purchase Now

MicroStrategy has clearly demonstrated {that a} company stability sheet can grow to be a car for crypto publicity. HYLQ Technique is doing the identical factor – however as a substitute of Bitcoin, it’s targeted on Hyperliquid’s HYPE token.

The Canadian-listed agency rebranded again in June to mirror this new course, calling itself a “publicly traded Hyperliquid publicity” car. For fairness buyers who need publicity to the Hyperliquid ecosystem with out coping with wallets or exchanges, HYLQ provides a easy, direct proxy.

To this finish, the corporate has been steadily accumulating Hyperliquid’s native token, HYPE, and disclosed a number of purchases – constructing their holdings to almost 29,000 HYPE by early July.

This month, they accomplished a $5 million non-public placement to fund much more HYPE accumulation and ecosystem investments. HYLQ additionally introduced a partnership with Kinetiq, a liquid-staking protocol on Hyperliquid, which exhibits they wish to do extra than simply maintain HYPE.

For buyers, the attraction is simple. HYLQ trades on the Canadian Securities Alternate (CSE:HYLQ) and has an OTC itemizing (HYLQF) for U.S. merchants. The mannequin is acquainted – identical to MicroStrategy’s – nevertheless it’s utilized to a community nonetheless early in its growth and enlargement cycle.

If Hyperliquid’s development continues, HYLQ shareholders may very well be well-positioned to learn – making it the most effective crypto shares to contemplate investing on this month.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, straight or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to use of or reliance on any content material, items or providers talked about.