An analyst who nailed Bitcoin’s pre-halving correction this 12 months says BTC might have entered a market cycle part the place steep rallies are in sight.

The analyst pseudonymously often called Rekt Capital tells his 100,000 YouTube subscribers that the act of Bitcoin breaking above the resistance zone that fashioned across the 2021 cycle excessive of slightly below the $70,000 worth is “primarily the very first sign to kickstarting the parabolic part.”

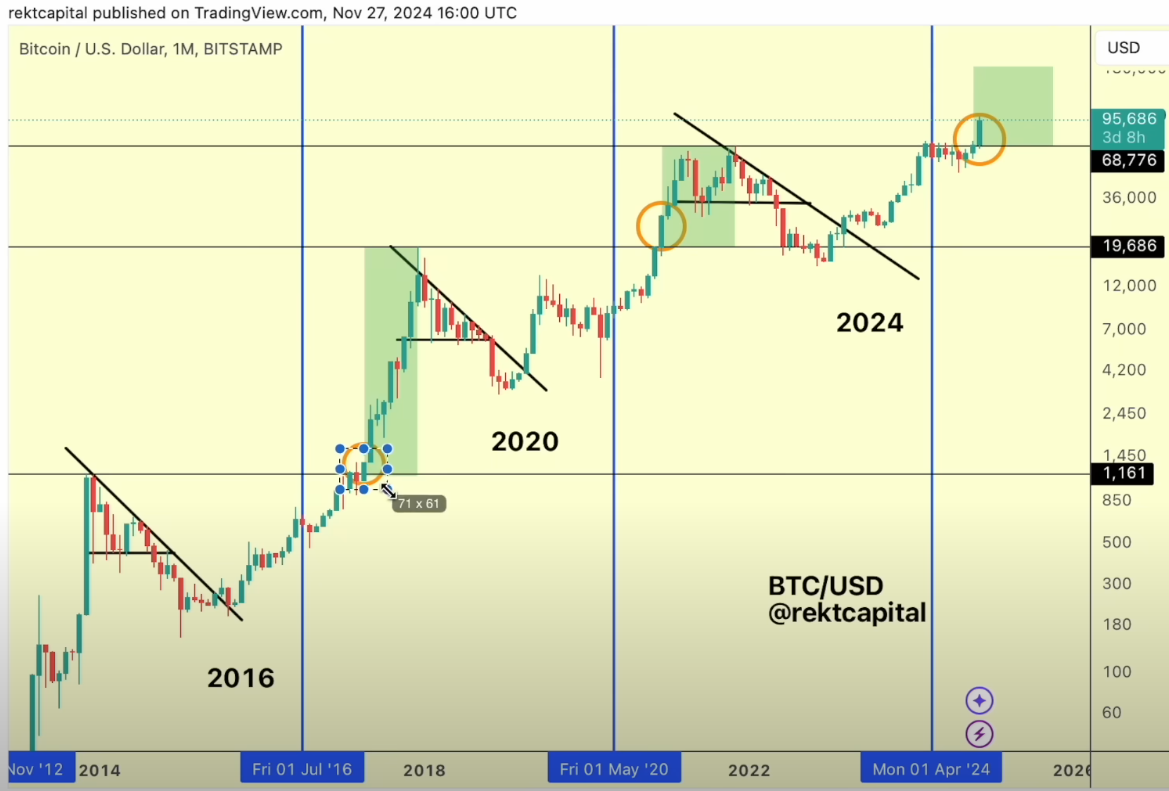

“We see the analogous stage like this throughout cycles. In 2020 and 2021 this was the extent: $19,000, roughly talking $20,000. That was the outdated all-time excessive resistance.

Right here on this cycle, the analogous stage was $69,000. And within the earlier cycle of 2017 it was after all a bit of bit decrease than that – $1,200 roughly talking.

And so in every of those cycles breaking the outdated all-time excessive main resistance, that first month-to-month candle is the very early signal of that parabolic part of the cycle starting.”

In keeping with the pseudonymous analyst, Bitcoin might expertise a number of months of upside based mostly on historic precedent.

“We’ve seen prior to now that we are able to see fairly a number of month-to-month candles produced within the coming months. So on this cycle over right here [2017] it was… 9 months value of upside.

On this cycle in 2020/2021… we noticed 9 months of upside…

So if we’re speaking about 9 months of upside, 12 months of upside that is month one [November of 2024] out of a potential 9 as a minimum or a potential 12 at most.”

On when Bitcoin might hit the cycle peak, Rekt Capital says,

“We’re going to see this parabolic upside happen deep into 2025. After which we’re going to have to think about a bear market coming after 2025, nearly all of which goes to play out in 2026.”

Bitcoin is buying and selling at $96,718 at time of writing.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney