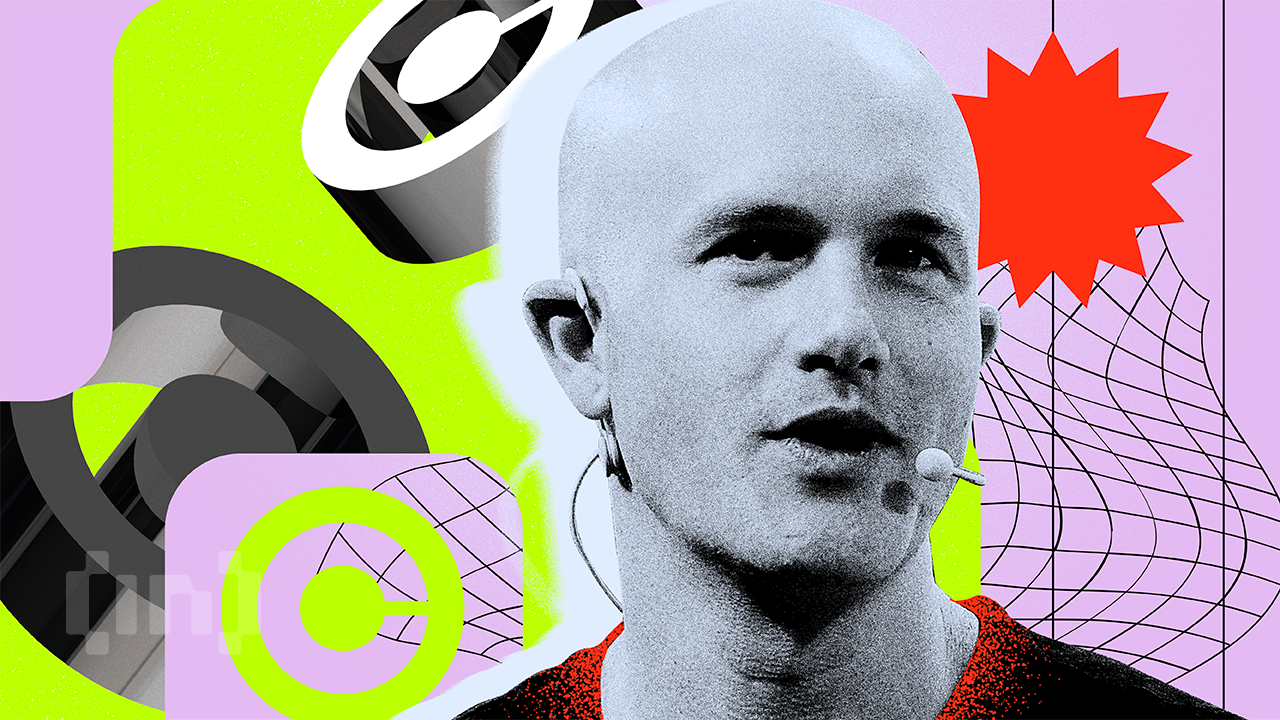

Coinbase CEO Brian Armstrong and expertise billionaire Elon Musk have accused distinguished political figures, together with Senator Elizabeth Warren and SEC Chair Gary Gensler, of orchestrating a “mass debanking” marketing campaign focusing on the expertise and cryptocurrency sectors throughout the Biden administration.

Their remarks comply with revelations about secretive actions that allegedly resulted within the closure of financial institution accounts for dozens of tech entrepreneurs with out discover or recourse.

Crypto Leaders Sturdy Rebuke of the Biden Administration

In a submit on X (previously Twitter), Armstrong labeled the debanking incidents as “unethical and un-American.” He pointed fingers at Warren and Gensler, accusing them of trying to “unlawfully kill” the cryptocurrency business.

Brian Armstrong argued that such actions contributed to the Democratic Celebration’s loss within the latest election. The Coinbase government cautions the occasion to distance itself from Warren if it seeks political restoration.

He additionally revealed that Coinbase is utilizing Freedom of Data Act (FOIA) requests to uncover the total scope of the difficulty, elevating questions on potential authorized violations.

“We’re nonetheless amassing paperwork through FOIA requests, so hopefully the total story emerges of who was concerned and whether or not they broke any legal guidelines. Warren and Gensler tried to unlawfully kill our whole business, and it was a significant factor within the Dems dropping the election,” Armstrong said.

Armstrong’s remarks amplified an argument shared by Elon Musk, who was recognized for his advocacy of free speech and innovation. The SpaceX CEO referenced a Joe Rogan interview with Marc Andreessen, co-founder of Andreessen Horowitz.

“Do you know that 30 tech founders have been secretly debanked?” Musk remarked.

Within the interview, Andreessen alleged that 30 tech founders have been “secretly debanked,” describing it as an train of “silent authorities energy.” This raises consideration to the shortage of transparency and warns of broader implications for freedom and innovation.

Custodia Financial institution’s Caitlin Lengthy Joins the Criticism

Caitlin Lengthy, founder and CEO of Custodia Financial institution, additionally weighed in, sharing her private expertise with repeated debanking. Custodia, a pro-crypto financial institution, has confronted regulatory hurdles, culminating in layoffs attributed to the Federal Reserve’s delays in granting the establishment a grasp account. Lengthy’s ongoing lawsuit towards the Fed seeks to handle these challenges, with oral arguments scheduled for January 21, 2025.

“Sure—debanked repeatedly, in my firm’s case (Custodia Financial institution). Keep watch over our pending lawsuit towards the Fed. Oral argument is scheduled for Jan 21 (the day after Inauguration Day),” Lengthy commented.

The allegations come amid broader issues over regulatory overreach within the crypto area. Warren and Gensler have been vocal critics of the business, and the SEC, below Gensler’s management, has pursued a number of enforcement actions towards crypto corporations. Critics argue these measures stifle innovation and disproportionately goal rising applied sciences.

Custodia Financial institution’s struggles, amongst others like Consensys, mirror the challenges going through crypto-friendly monetary establishments. The fallout from these allegations might reshape the connection between the tech sector and US policymakers.

Brian Armstrong’s assertion that these actions contributed to the Democrats’ electoral losses highlights the political threat of alienating the tech and crypto communities. Moreover, Lengthy’s lawsuit might set a precedent for the way courts tackle claims of regulatory overreach.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.