- Solana trades close to $203 after bouncing again above $200, however momentum seems to be fragile.

- NUPL and CDD metrics present long-term holders sitting on giant income and shifting previous cash, signaling profit-taking threat.

- Key helps sit at $196, $191, and $175, whereas reclaiming $207 might cancel the bearish setup.

Solana’s worth was hovering round $203 at press time, clawing again after briefly dipping underneath the $200 mark earlier within the day. That tiny bounce stored each day losses restricted to about 1%, however the larger image nonetheless seems to be shaky. Bulls have managed to tug SOL again over $200, but on-chain knowledge hints that the restoration won’t final lengthy.

Lengthy-Time period Holders Sitting on Heavy Earnings

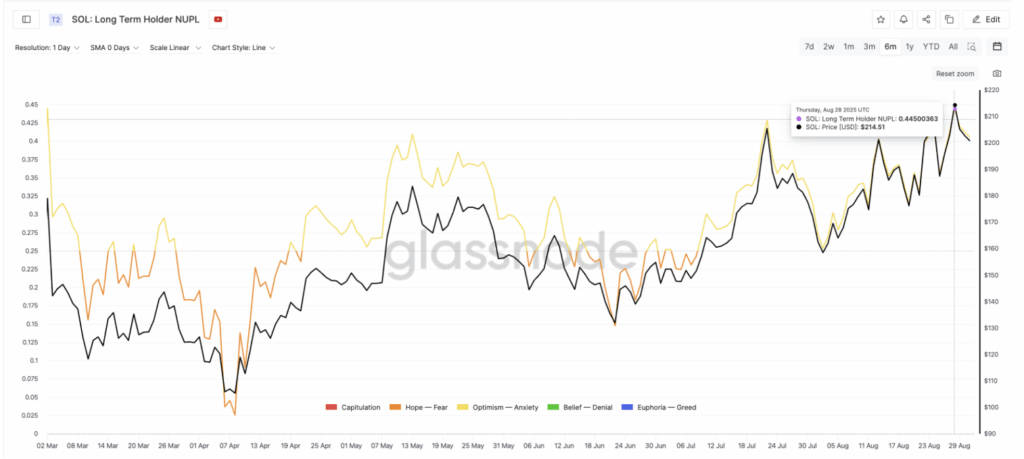

One of many first warning indicators is the Internet Unrealized Revenue/Loss (NUPL) metric for long-term holders. This mainly reveals if buyers are sitting on paper income, and when the quantity runs excessive, there’s at all times the temptation to money out. On August 28, Solana’s long-term NUPL hit 0.44 — the very best in half a yr and really near its March peak at 0.4457. That final time, SOL tanked from $179 to $105 in underneath two weeks, a brutal 41% correction. An identical transfer in July noticed the value drop 23% after one other NUPL spike. Proper now, the studying has cooled a bit to 0.40, however that’s nonetheless effectively above regular ranges, flashing profit-taking threat.

Outdated Cash on the Transfer Sign Promoting Strain

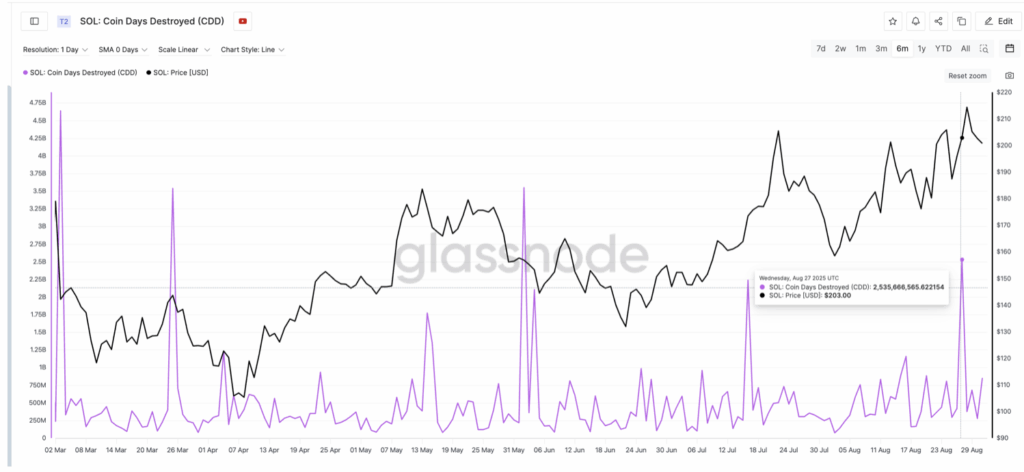

This threat isn’t simply theoretical both. The Coin Days Destroyed (CDD) metric, which tracks older cash shifting on-chain, has spiked once more. Traditionally, every time this sign lit up, Solana’s worth corrected not lengthy after. Again in March, a CDD spike coincided with a drop from $142 to $118, whereas one other one pulled it from $143 to $105. Even in July, the correction was delayed, however SOL nonetheless fell from $205 to $158. The most recent CDD surge on August 27, proper as Solana hovered at $203, suggests long-term holders could already be quietly promoting into energy.

Key Ranges Outline the Subsequent Transfer

Technically, Solana is buying and selling at a fragile level. Proper now, it’s attempting to carry $201 as non permanent help after flipping that degree. For the bullish case to remain alive, SOL wants a each day shut above it. If it slips underneath $196 or $191, momentum turns bearish shortly, and a break beneath $175 might verify a a lot deeper correction. On the flip facet, a clear transfer above $207 — with a powerful candle shut — would fizzle out the bearish case and convey consumers again into play. Till then, the information suggests the rebound over $200 may be operating on skinny ice.

The publish Solana Value Rebound Above $200 Might Be Quick-Lived first appeared on BlockNews.