Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has dropped 1.6% within the final 24 hours to commerce at $4,439.05 as of 5:20 a.m. EST on a 37% improve in every day buying and selling quantity to $31.7 billion.

The stoop within the ETH worth comes even after an OG Bitcoin whale with over $5 billion in BTC transformed greater than $400 million value of Bitcoin into Ethereum in current days. The whale bought 4,000 BTC, adopted by one other 1,000 BTC, then used the funds to purchase over 96,000 ETH in a single batch.

This lifted the whale’s Ethereum holdings to greater than 800,000 ETH, value over $4 billion, with most of it staked, signaling long-term dedication.

I’m 100% aligned with virtually all of what Tom @fundstrat says right here.

Sure, Wall Avenue will stake as a result of they at present pay for his or her infrastructure and Ethereum will exchange a lot of the numerous siloed stacks they function on (e.g. JPMorgam most likely operates on a number of siloed stacks… https://t.co/bW93kkX1gW

— Joseph Lubin (@ethereumJoseph) August 30, 2025

This high-stakes rotation from BTC to ETH comes as Ethereum demand amongst institutional traders grows, serving to ETH outperform BTC lately. Asset managers like BlackRock and VanEck, with new ETH ETF approvals, have introduced billions of {dollars} into Ethereum for purchasers’ portfolios.

Main expertise and gaming companies, in addition to treasury firms similar to Sharplink Gaming, now maintain billions in ETH on their stability sheets as they arrange ETH treasury companies.

BlackRock simply filed for a $ETH Staking ETF.

This can appeal to a brand new wave of institutional traders.

What comes subsequent may very well be completely large. pic.twitter.com/6vj8PIi3gV

— Crypto Rover (@rovercrc) July 18, 2025

On the prediction entrance, Ethereum co-founder Joseph Lubin and Fundstrat’s Tom Lee each envision Ethereum’s worth multiplying 100x within the years forward, thanks largely to institutional adoption.

Lubin believes that as Wall Avenue strikes enterprise infrastructure to the Ethereum blockchain, and as extra main banks take part, ETH will cement its position as the first digital asset for institutional treasuries worldwide.

Joseph Lubin and Tom Lee have blazed the path for ETH Treasury firms. It might probably’t be overstated how bullish that is for $ETH.

Simply getting began. Unfathomably greater.

Monitor ETH treasury firm business at https://t.co/27787dmiRp pic.twitter.com/IsmfimLfFL

— 🅿🅴🅿🅴🐸🦧🅺🅾🅽🅶(🪈,🪈) (@ThePepeKong) August 8, 2025

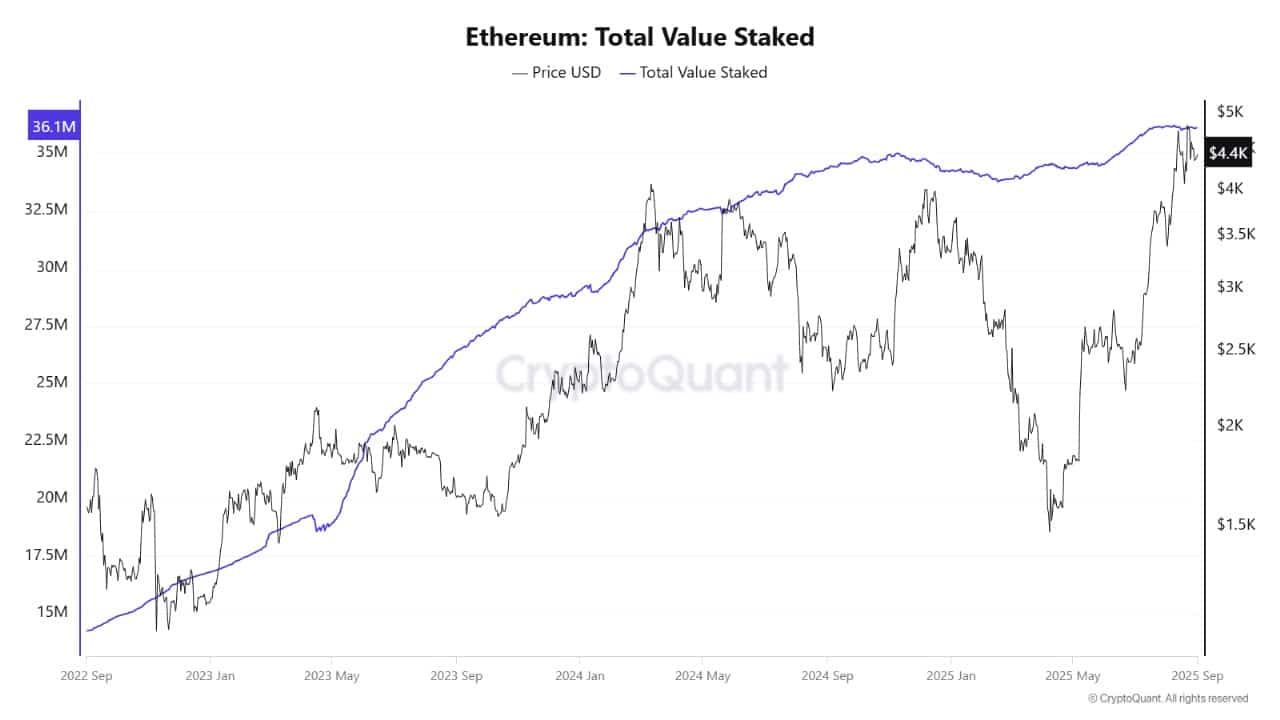

Ethereum Worth, Pockets Progress, and Staking Exercise

On-chain metrics present sturdy indicators supporting the newest ETH worth development. Massive holders are more and more staking their cash, decreasing liquid ETH on exchanges and tightening provide. Almost 5% of Ethereum’s whole circulation has moved into treasury and fund holdings for the reason that begin of the yr.

Ethereum Complete Worth Staked Evaluation Supply: CryptoQuant

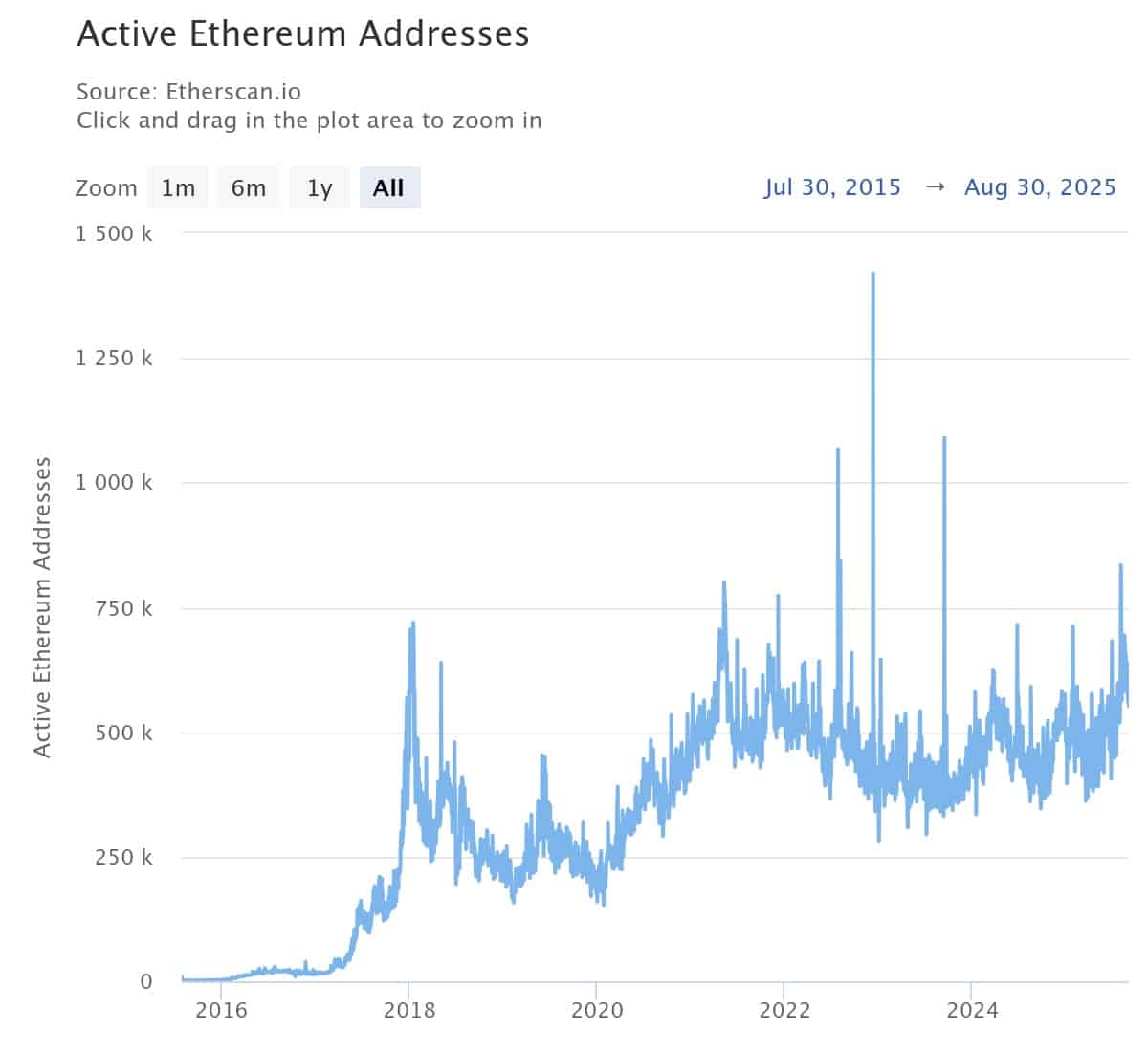

This implies fewer ETH can be found on the market, fueling stability and pushing costs upward. Community participation is excessive, as mirrored in sturdy transaction volumes and energetic addresses. Staking continues to rise, which appeals to each particular person and institutional traders searching for yield and long-term progress.

Analysts additionally observe rising pockets diversification, exhibiting that not solely whales however many new contributors are becoming a member of the Ethereum ecosystem. These tendencies mix to maintain the ETH worth buoyant, even when the broader market faces turbulence.

Ethereum Worth: Set To Take a look at New Highs?

Trying on the weekly ETH/USD chart, the Ethereum worth is trending upward and lately closed round $4,438. The coin has rebounded laborious from earlier 2025 lows, making greater highs with each transfer.

ETH at present trades above key help ranges: the 50-week easy shifting common at $2,901 and the 200-week at $2,446, highlighting a wholesome long-term uptrend.

The fast help zone sits between $4,323 and $4,375, whereas resistance is seen close to the $4,482 to $4,592 vary. The crucial $5,000 stage is the following psychological barrier and will quickly come into play if the bullish momentum continues.

ETHUSD Evaluation 1-Week Chart. Supply: TradingView

Momentum indicators again the constructive view. The Relative Energy Index (RSI) has risen to 67.2, an indication of sturdy shopping for however not but excessive overbought circumstances. The MACD stays in bullish territory, although merchants are expecting any flip in these indicators that may sign a pause or correction.

Quantity spikes on breakouts by way of resistance affirm actual demand. If ETH stays above its help ranges, analysts see a robust likelihood of testing $4,850–$5,000 within the coming weeks. On the draw back, a drop beneath $4,323 might set off promoting that may check the decrease averages close to $2,900.

The Ethereum worth is gaining power from main whale buys, institutional inflows, and bullish predictions from business leaders. With Joseph Lubin’s 100x prediction echoing throughout Wall Avenue, the ETH worth could quickly check new highs.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection