- Bitcoin nonetheless grappling with draw back liquidity, however a snap reversal towards $126K–$141K stays potential.

- Ethereum’s chart seems to be weaker, with liquidity clusters beneath, hinting liable to near-term reversion.

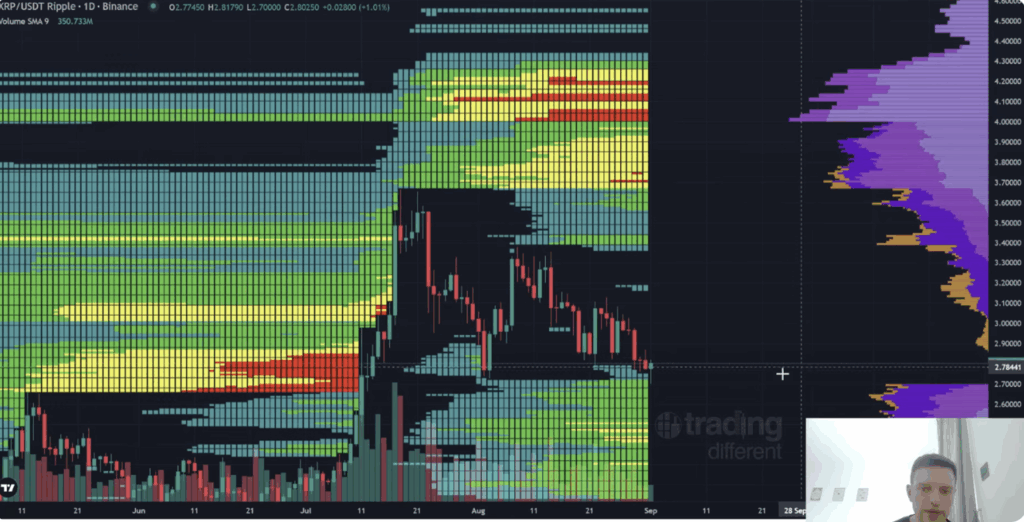

- XRP stands out with overhead liquidity and a flipped help zone, positioning it to probably lead the subsequent breakout.

Crypto analyst CryptoInsightUK is making the case that XRP would possibly lead the subsequent massive leg larger in crypto, even outpacing Bitcoin and Ethereum within the quick run. In a recent video breakdown, he pointed to liquidity heatmaps and structural divergences that present XRP sitting in a a lot stronger spot in comparison with BTC and ETH.

Bitcoin Nonetheless Wrestling With Draw back Liquidity

On Bitcoin, he defined that worth has been dragged towards draw back swimming pools sitting round $106K, and that these areas stay a magnet within the quick time period. Nonetheless, he famous there’s room for sharp reversals: if BTC flips momentum, it may rapidly dash again towards $126K–$128K, and perhaps even push into the $141K zone. He warned that when it does, “it’s going to be fairly aggressive and catch individuals off guard,” since numerous merchants are leaning the unsuitable means.

Ethereum Seems to be Softer, Threat of Imply Reversion

Ethereum’s chart, in contrast, seemed weaker. Based on him, ETH has already tapped some heavy liquidity overhead, leaving denser swimming pools beneath current lows. Liquidity is clustered within the $4,000–$4,450 vary, which makes ETH extra weak to imply reversion earlier than any new push larger. He described ETH’s setup as “a bit fingers off,” particularly for the reason that US vacation may throw intraday reads out of stability.

Why XRP Stands Aside

XRP, although, seems to be forward of the curve. On shorter timeframes, it’s already swept draw back liquidity and now has the “major liquidity above,” a setup he argues is extra favorable for an upside breakout. He additionally pointed to the XRP/BTC pair on the 4-hour chart, the place a previous resistance zone has flipped to help. Oversold wicks on momentum indicators have been met with constructive reactions, suggesting resilience.

On larger timeframes, XRP nonetheless has extra overhead liquidity to chase, which he framed as gasoline for continuation as soon as patrons step in. In comparison with Bitcoin, which nonetheless wants to wash up draw back ranges, and Ethereum, which is sitting in a extra fragile spot, XRP seems to be structurally stronger.

CryptoInsightUK was cautious to say his work isn’t a private prediction however a mapping of liquidity. Nonetheless, he caught to his broader thesis: “I’ve stated for the entire cycle, I believe XRP is main.” Whether or not or not XRP actually front-runs the altcoin market, he believes the subsequent few weeks will reveal if this divergence is the beginning of XRP’s management because the crypto cycle matures.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.