WLFI (World Liberty Finance) formally launched on spot exchanges yesterday, and merchants didn’t waste time testing its limits. After surging to an early all-time excessive close to $0.35 on Spot exchanges, the token has since corrected sharply, dropping greater than 19% up to now 24 hours.

Whereas elements of the market look bearish, a deeper look reveals one unlikely momentum driver that would push WLFI past its latest excessive.

Spot Market Exhibits Early Weak spot

On-chain flows over the previous 24 hours spotlight why the spot market appears fragile for WLFI.

Prime 100 addresses offloaded nearly 216.54 million WLFI, price near $49.15 million on the common value of 0.227. Good Cash did decide up greater than 102.78 million WLFI throughout the identical interval, nearly $23.33 million in worth. Public Figures, which embrace identified KOLs and distinguished market personalities, dumped near $546.40 million.

Whales holding between one and ten million tokens added 26.85 million WLFI, price near $6.10 million. Whereas this accumulation appears massive in share phrases, it’s inconsequential when in comparison with the dimensions of outflows from the Prime 100 addresses and Public Figures.

Taken collectively, the spot market exhibits clear early weak point, with internet promoting strain dominating. This makes it unlikely that patrons on the spot alone can drive WLFI greater within the close to time period. As an alternative, consideration turns to the derivatives market, the place liquidation maps and positioning trace at a really totally different story.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Derivatives Positioning Indicators a Potential Set off

If spot demand falters, derivatives usually step in as the primary unlikely short-term catalyst. WLFI’s perpetual contracts have been reside since August 23, even earlier than spot buying and selling. That makes the spinoff charts particularly helpful for early alerts.

Throughout Binance, Bitget, and Hyperliquid, the image is strikingly comparable: quick positions dominate. On Binance alone, shorts account for practically double the lengthy liquidations. At Bitget, quick liquidations sit above $23 million, in contrast with simply $16.6 million for longs. Hyperliquid’s seven-day liquidation map exhibits clusters close to $0.28, a vital threshold.

This imbalance creates the circumstances for a brief squeeze — when rising costs pressure shorts to cowl, accelerating the rally. If WLFI clears $0.28, these clusters may unwind rapidly, doubtlessly propelling the token towards $0.32, its earlier swing excessive.

It’s price noting that if the WLFI value corrects, the token additionally turns into a protracted squeeze candidate, which might then invalidate the near-term bullish outlook. Extra about this within the value evaluation section.

WLFI Worth Motion and the Hidden Bullish Divergence

The perpetual chart provides vital context for WLFI value. Between 27 and 29 August, the token confirmed a short-term setup the place the WLFI value made a better low whereas RSI printed a decrease low. That divergence helped gasoline the late-August rally.

Now, zooming out, a broader model of the identical sample has emerged. From August 24 to September 1, the WLFI value once more fashioned greater lows, whereas RSI prolonged to recent decrease lows. This sort of divergence throughout a wider timeframe usually alerts that draw back momentum is weakening regardless of the spot market, creating room for an additional upside try.

WLFI’s perpetual contracts went reside on August 23, 2025, forward of the token’s spot listings throughout exchanges. At launch, they operated underneath a capped value mechanism, that means buying and selling was constrained inside a set vary till an official spot index turned obtainable.

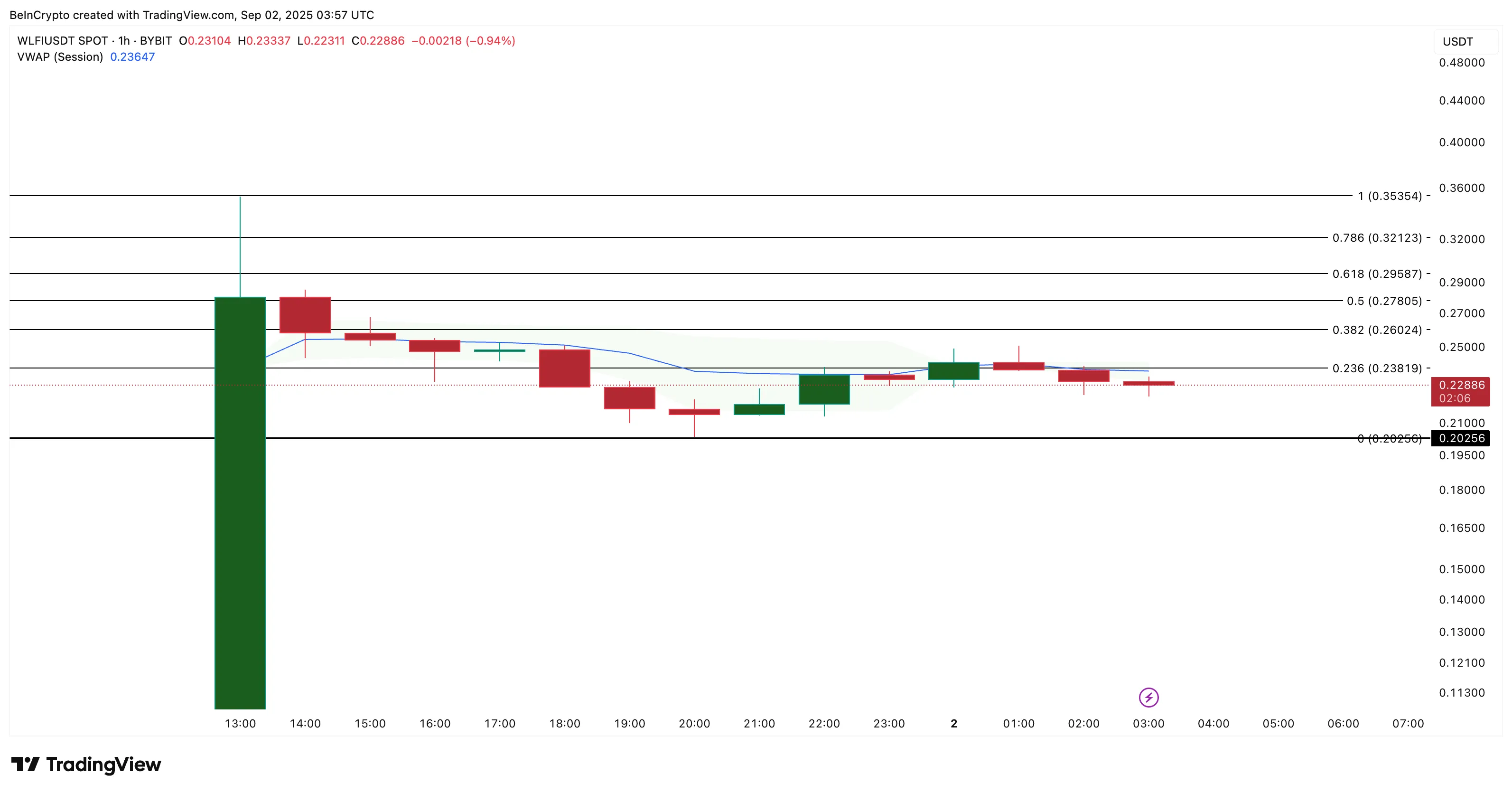

On the Bybit spot chart (1-hour), WLFI trades just below the VWAP (Quantity-Weighted Common Worth) line close to $0.23. VWAP tracks the typical value weighted by quantity and is commonly handled by merchants as dynamic help or resistance. WLFI has already tried to cross VWAP however failed, making it a near-term hurdle.

A decisive transfer above $0.23 would align technical momentum with derivatives positioning.

If that alignment holds, the domino impact is obvious: breaching $0.29 may liquidate shorts, $0.32 would retest the excessive, and past that, the WLFI value would enter value discovery, opening the door to a brand new all-time excessive.

Nevertheless, a dip underneath $0.20 would herald lengthy liquidations in play, defeating the near-term bullish outlook and pushing the value into the untested draw back territory.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.