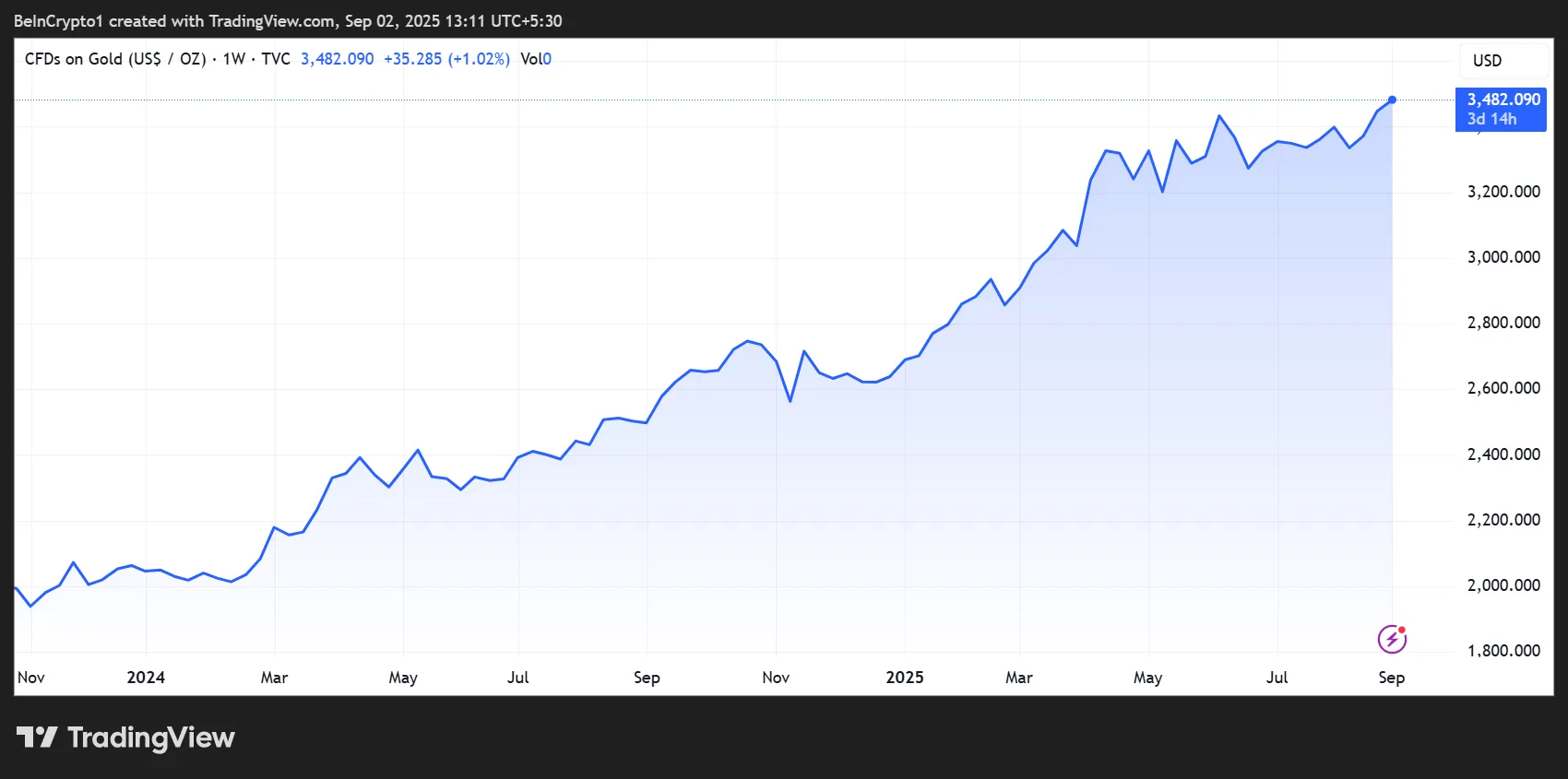

Gold has surged greater than 6% in simply 10 days, touching recent all-time highs (ATH) and sparking intense debate about its implications for Bitcoin (BTC).

As the final word safe-haven asset flashes power, analysts debate whether or not it is a warning signal for crypto or the setup for Bitcoin’s subsequent massive transfer.

Gold Surges Amid International Liquidity Backdrop

Gold was buying and selling for $3,482 as of this writing, after establishing a brand new ATH of $3,508 on Tuesday.

In accordance with Alpha Extract, the present gold rally will not be taking place in isolation. The analyst factors to a recurring market sample.

“International Liquidity is rising. There’s a recurring sample this cycle: when gold begins its run, Bitcoin typically consolidates—and vice versa,” the analyst shared in a publish.

They highlighted a mixture of forces driving gold increased, together with issues about Federal Reserve (Fed) independence, fiscal coverage dangers, and rising 30-year yields throughout world markets.

With the Fed poised to chop charges at the same time as inflation stays above the two% goal, strain is constructing throughout the monetary system.

Alpha Extract famous that world liquidity expanded by $0.13 trillion final week, a +0.09% improve, calling it the principle driver of danger belongings.

Whereas some short-term momentum indicators present weak point, the analyst argues the highest will not be in but.

On the identical time, the medium-term fashions have flipped detrimental, signaling warning. In the meantime, a reversal mannequin approaches oversold ranges, hinting at a possible inflection level for risk-taking.

Bitcoin at a Crossroads: Complement or Competitor to Gold?

For Bitcoin traders, the important thing challenge is whether or not gold’s rally is bullish or bearish for crypto, with the connection proving something however simple.

Martyparty, a macro analyst, instructed that gold and world liquidity act as leaders within the present cycle.

“Gold and International Liquidity main the way in which—Bitcoin follows,” he said.

If historical past rhymes, Bitcoin could possibly be set to profit as soon as gold’s run stabilizes. Analyst MacroScope echoed this view, noting that the final time gold spiked to the $3,400–$3,500 vary earlier this 12 months, Bitcoin retraced sharply earlier than staging a breakout to new highs.

“Gold is screaming to be lengthy BTC as soon as this BTC retracement is finished,” they argued.

Nonetheless, some don’t see gold’s breakout as a optimistic for Bitcoin. Longtime crypto critic Peter Schiff argued that gold’s rise comes at Bitcoin’s expense.

“That is beginning to get fascinating. Gold is now up virtually $30, about to hit $3,480. Silver is up over 70 cents, about to hit $40.50. In the meantime, Bitcoin is again beneath $108,000 and appears poised to go a lot decrease. Gold and silver breaking out could be very bearish for Bitcoin,” wrote Schiff.

Schiff’s perspective means that some analysts see gold and Bitcoin as complementary hedges, whereas others view them as opponents for safe-haven flows.

Elsewhere, former Coinbase government Balaji Srinivasan identified that the greenback’s share of world reserves has fallen to 42%, whereas gold continues to realize. The shift, he suggests, highlights why gold is rising—and why Bitcoin could possibly be subsequent in line.

The gold value breakout has revived one of many market’s most enduring debates: whether or not the yellow metallic and Bitcoin transfer in opposition or concord.

With world liquidity increasing, fiscal dangers mounting, and the greenback’s dominance eroding, each belongings seem set to play bigger roles in a shifting monetary order.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.