- HBAR bounced 2.6% in 24 hours however stays down 7% month-to-month.

- Brief-term charts present dip shopping for and fading bearish strain.

- Holding $0.210 help is essential — reclaiming $0.235–$0.249 might set off an even bigger rally.

HBAR is lastly waking up once more, climbing about 2.6% within the final 24 hours to commerce close to $0.219. Even with that little bounce, the token continues to be down roughly 7% over the month. Step again although, and the story modifications — HBAR is up greater than 330% up to now yr, which retains the larger pattern leaning bullish. The day by day setup nonetheless feels fragile, however a couple of early indicators trace that bears is likely to be beginning to lose their grip.

Brief-Time period Consumers Step In

On the 4-hour chart, the Cash Move Index (MFI) has quietly been pushing larger. What’s fascinating is that it’s been printing larger highs even whereas HBAR’s value was drifting decrease. Often, this type of divergence exhibits up first on decrease timeframes as dip consumers creep in earlier than the day by day charts affirm it. If MFI can push above its current excessive round 35.90, that might be a stronger signal that accumulation is already in movement.

On the similar time, the Bull–Bear Energy (BBP) indicator has been sliding since early September, exhibiting that sellers are shedding steam whereas consumers decide up the slack. Put collectively, these indicators don’t imply the rally is locked in but, however they do counsel that sentiment is slowly shifting in favor of the bulls.

Day by day Chart Paints a Larger Image

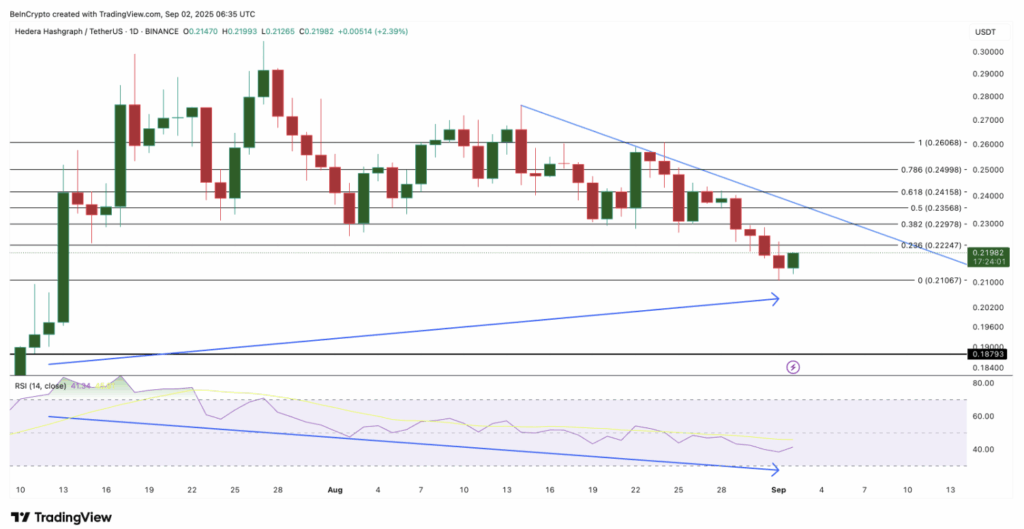

Wanting on the day by day timeframe, HBAR continues to be caught inside a descending triangle sample. Key help rests at $0.210 — lose that, and value might tumble towards $0.187 fairly rapidly. On the flip facet, if bulls can reclaim the $0.235–$0.249 space, it might be the primary actual clue that bearish management is breaking down.

Including some weight to the bullish case is a hidden divergence on the RSI. Between July 13 and September 2, HBAR set a better low in value whereas RSI carved out a decrease low. That’s usually learn as a continuation sign — principally saying the broader uptrend hasn’t gone wherever, even when short-term momentum seems tough.

What to Watch Subsequent

For now, it’s all about whether or not consumers can defend that $0.210 flooring after which push again towards the $0.235–$0.249 pocket. In the event that they succeed, the divergence plus the yearly uptrend could possibly be sufficient to spark a extra sustained rebound. Fail to carry $0.210 although, and sellers might drag HBAR again into deeper correction territory earlier than bulls get one other shot.

The put up HBAR Bulls Present Indicators of Life however Key Take a look at Nonetheless Forward first appeared on BlockNews.