Ripple’s XRP has been buying and selling underneath persistent sell-side strain, trending inside a descending parallel channel since August 2.

Whereas the altcoin has tried a number of breakouts from this bearish construction, sentiment has remained overwhelmingly destructive, stopping any sustained transfer greater. With trade balances climbing and promoting exercise intensifying, XRP could possibly be poised for additional losses this month.

XRP Struggles to Break Free as Bears Maintain Worth Trapped in a Decline

Sponsored

A descending parallel channel types when an asset persistently posts decrease highs and decrease lows inside two parallel trendlines. This setup displays a sustained decline in buy-side strain, as sellers repeatedly overpower bullish makes an attempt to push costs greater.

Readings from the XRP/USD one-day chart present that the altcoin has trended inside this channel since August 2, reflecting the persistent selloffs which have weighed on its worth.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Over the previous few weeks, the token has made a number of makes an attempt to interrupt above this bearish construction. Nonetheless, every retest has been met with robust selloffs, stopping any profitable breakout and maintaining XRP confined throughout the downtrend.

Sponsored

XRP Faces Bearish Outlook as Alternate Holdings Swell

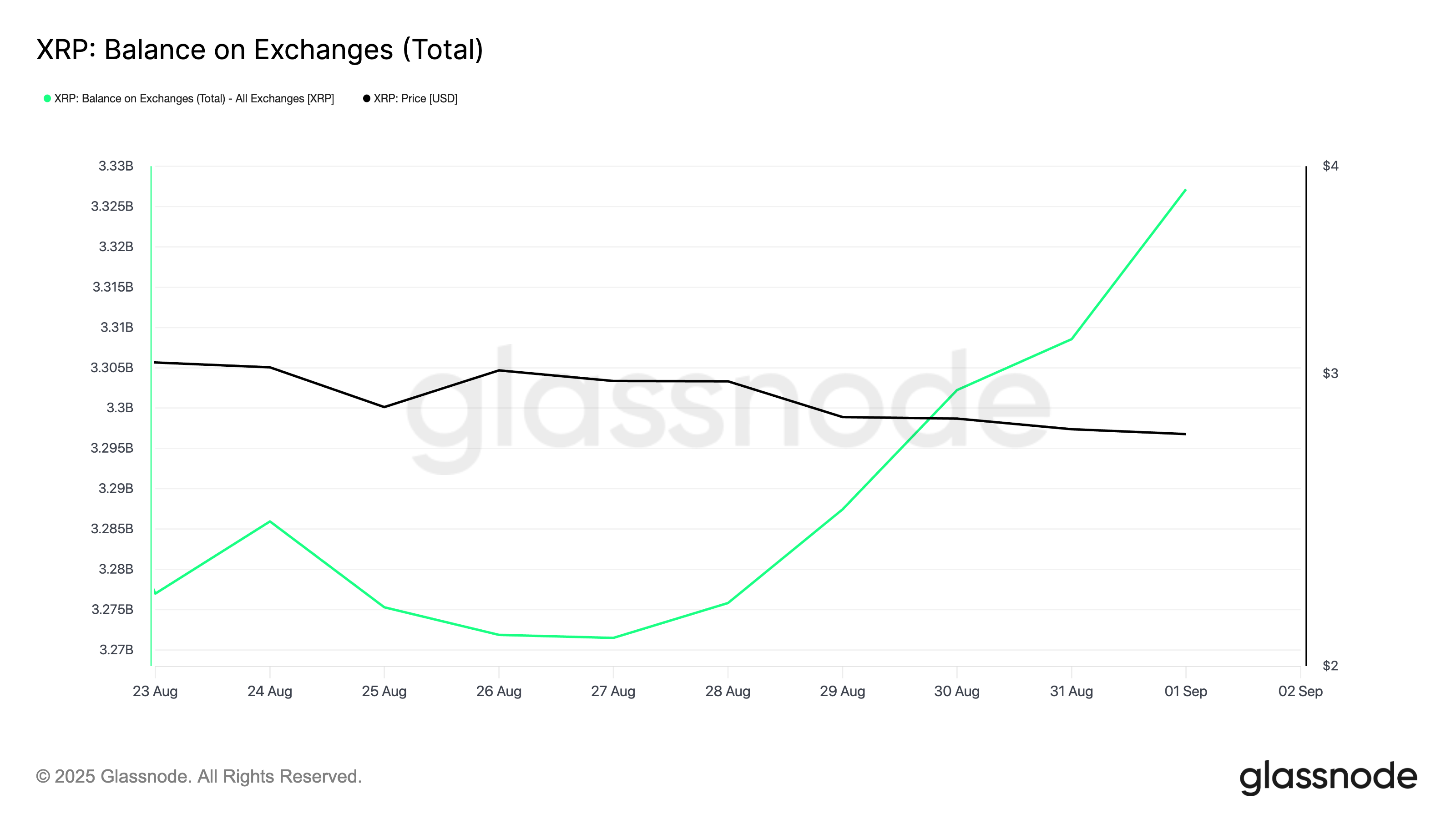

On-chain, XRP’s climbing steadiness on exchanges confirms the rising distribution amongst market individuals. Per Glassnode, XRP’s trade reserves have risen 2% since August 27, indicating an uptick in profit-taking amongst token holders.

XRP’s steadiness on exchanges measures the entire quantity of tokens held in trade wallets at any given time. When it rises, it indicators that buyers are transferring tokens from non-public wallets to exchanges, typically with the intention of promoting.

Sponsored

As of this writing, 3.32 billion XRP valued at $9.3 billion are held on trade pockets addresses. A excessive trade steadiness like this implies extra liquidity is available for buying and selling, which might drive costs decrease if XRP demand fails to maintain up.

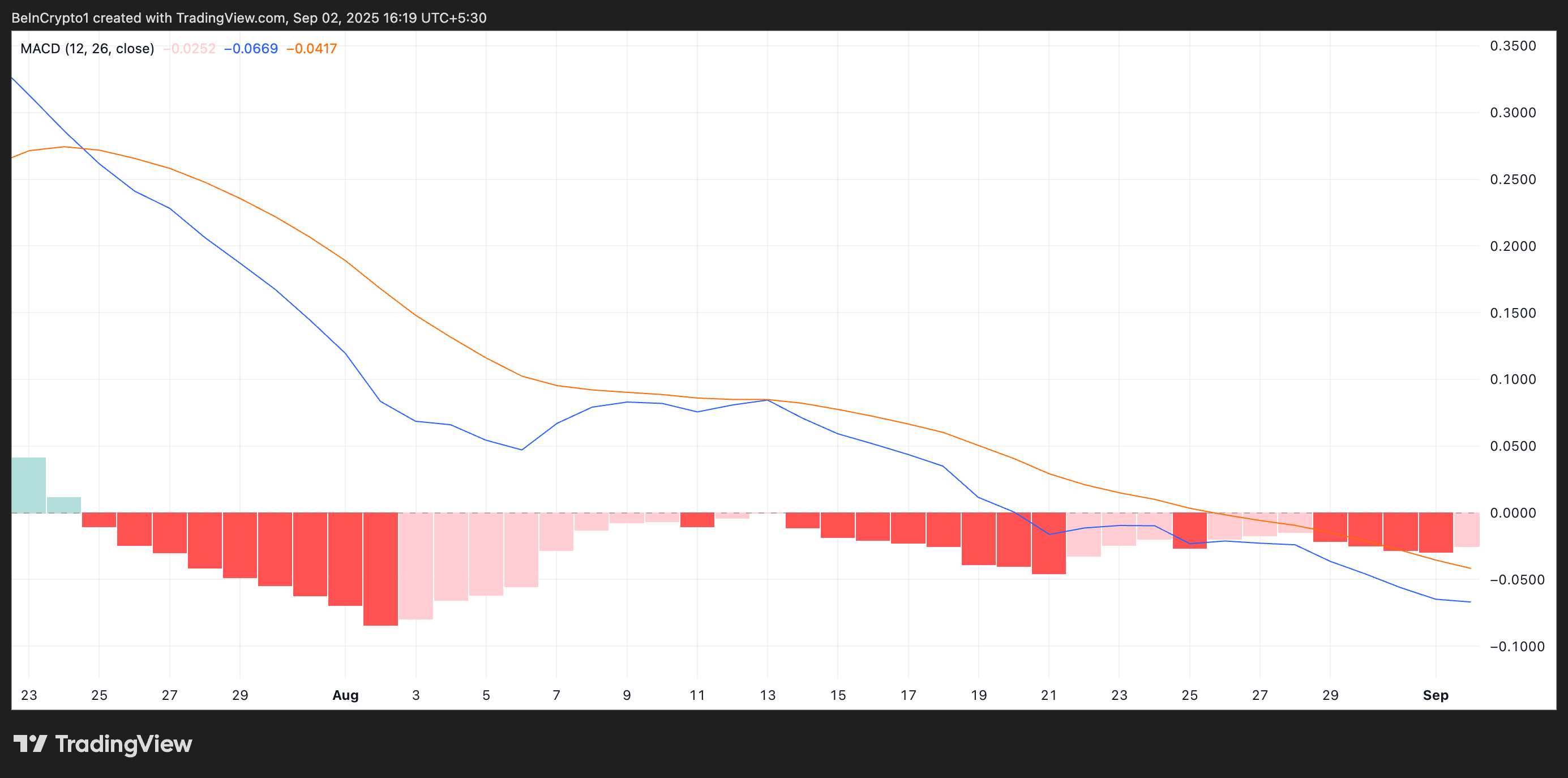

Moreover, the setup of the altcoin’s Shifting Common Convergence Divergence (MACD) indicator helps this bearish outlook. At press time, XRP’s MACD line (blue) rests beneath the sign line (orange), and has been so positioned since July 25.

The MACD indicator identifies traits and momentum in its worth motion. It helps merchants spot potential purchase or promote indicators by way of crossovers between the MACD and sign strains.

Sponsored

When an asset’s MACD line rests beneath the sign line, shopping for strain has declined, additional supporting the case for continued XRP decline within the brief time period.

$2.63 Assist in Focus as Bears Dominate

Sponsored

XRP dangers falling to $2.63 if the sell-side strain strengthens. If the bulls are unable to defend that help flooring, it may give strategy to a deeper decline towards $2.39.

Nonetheless, XRP may witness a rebound and climb above $2.87 if shopping for returns to the market.