Este artículo también está disponible en español.

A current report from analysis agency Messari offered an outline of the NEAR (NEAR) protocol’s efficiency in the course of the turbulent third quarter (Q3) of 2024, when the broader cryptocurrency market skilled important volatility.

NEAR Protocol Q3 Efficiency

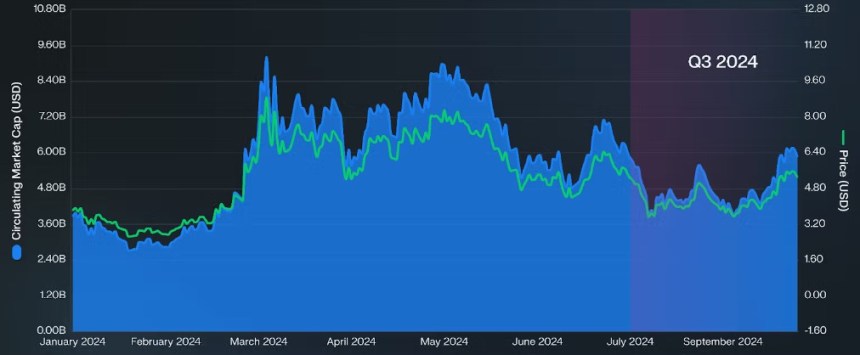

All through Q2 2024, the crypto market noticed a downturn that continued into Q3 for NEAR. The protocol’s circulating market cap fell to roughly $5.16 billion, reflecting a major quarter-over-quarter (QoQ) lower of about 27.52%.

NEAR’s token value additionally retraced barely, closing the quarter at round $5.29, a marginal decline of 0.21% QoQ. Regardless of these challenges, NEAR managed to keep up its place because the seventeenth largest crypto by market cap, indicating relative stability amongst main digital belongings.

Nonetheless, over the previous three weeks, it has gained 54% by way of market capitalization, rising to $7.99 billion amid the broader market rally led by Bitcoin (BTC) and the catalyst that was Donald Trump’s election.

Associated Studying

One of many notable elements of NEAR’s Q3 efficiency was its income, which measures community transaction charges whereas excluding storage staking. Income dropped to roughly $1.64 million, marking a 30.13% decline QoQ.

This dip is especially important because it represents the primary quarter prior to now 12 months the place income ended decrease than it started. The report attributes this to a decline in transaction quantity, which resulted in lowered transaction charges—down by roughly 10.48% QoQ and 34.23% year-over-year.

As of the tip of Q3 2024, about 93.46% of NEAR’s whole token provide was in circulation, with 52.36% of that provide staked. The annualized nominal yield from staking stood at roughly 8.60%, whereas the annualized actual yield was 4.09%.

Regardless of the challenges in transaction quantity, NEAR skilled an uptick in handle exercise. The common day by day energetic returning addresses elevated by 7.27% QoQ, and the common day by day new addresses rose by 11.06%.

TVL Rises, Liquid Staking Sees Enhance

The report additionally highlighted a regarding pattern in developer engagement. NEAR noticed a major drop in its weekly energetic core builders, reducing by 41.28% from 177 to 104. Equally, the variety of weekly energetic ecosystem builders fell by 19.70%, from 286 to 230.

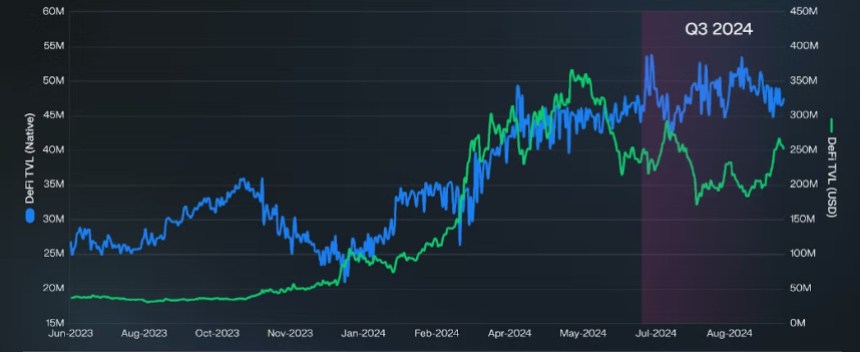

When it comes to decentralized finance (DeFi), NEAR’s Whole Worth Locked (TVL) recorded a modest enhance, ending Q3 at roughly $251.44 million, which is a 7.63% rise from the earlier quarter.

Associated Studying

Notably, NEAR’s liquid staking TVL additionally grew by 9.85% QoQ, reaching round $279.66 million. The LiNEAR Protocol accounted for a TVL of roughly $145.14 million, whereas the Meta Pool noticed a 12.70% enhance, totaling round $126.61 million.

On the time of writing, the NEAR token is buying and selling at $6.745 and has seen substantial positive factors of 27% and 46% within the fourteen and thirty day time frames respectively, whereas on a year-to-date foundation it has seen a large 266% surge.

Featured picture from DALL-E, chart from TradingView.com