Be part of Our Telegram channel to remain updated on breaking information protection

Metaplanet gained shareholder approval to boost as a lot as $3.7 billion for extra BTC buys, paving the best way for an additional growth of its huge Bitcoin treasury.

The shareholder vote at a rare basic assembly that was attended by Eric Trump clears the best way for Metaplanet to problem as much as 2.7 billion new shares and introduce a dual-class most well-liked inventory system, giving it new fundraising choices whereas limiting dilution for present buyers.

Whereas the approvals transfer Metaplanet nearer to its aim, the corporate should nonetheless finalize issuance phrases, safe regulatory clearance, and persuade buyers to again its shopping for plan in a difficult market.

The Japan-based agency, already Asia’s largest company BTC holder, has its sights set on accumulating 210,000 BTC by 2027. It at present holds 20,000 BTC, rating sixth globally and forward of corporations like Tesla and Coinbase.

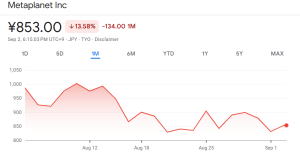

Metaplanet Shares Tick Up After 13% Plunge In A Month

The approvals from the corporate’s shareholders noticed Metaplanet’s share worth climb 2.6% previously 24 hours, based on Google Finance. That’s after a grim month wherein its shares tumbled greater than 13%.

Metaplanet’s share worth over the previous month (Supply: Google Finance)

Three Key Amendments Authorised By Metaplanet Shareholders

The primary decision by the corporate’s shareholders was to extend the variety of approved shares to 2.7 billion. This provides Metaplanet the power to boost extra capital to purchase extra Bitcoin sooner or later.

A brand new dual-class most well-liked inventory system was additionally launched and accredited, formally establishing each Class A and Class B shares. This may make it doable for the corporate to draw various kinds of buyers with out impacting present buyers’ management.

The Class A shares will include a hard and fast dividend, which can cater to buyers which are extra income-focused and are in search of comparatively secure returns. In the meantime, the Class B shares could be a riskier wager, however give buyers the choice to transform their shares into widespread inventory.

The twin-class most well-liked inventory system offers buyers with potential upside if the corporate’s Bitcoin technique succeeds.

In accordance with Metaplanet, the brand new lessons of shares additionally present a type of “defensive mechanism” that shields widespread shareholders from extreme dilution, whereas nonetheless giving the corporate the power to probably increase $3.7 billion in funding.

The remaining decision launched new guidelines enabling virtual-only shareholder conferences.

Metaplanet Is Nearer To Reaching Its Bitcoin Accumulation Objectives

The recently-approved amendments follows Metaplanet’s Aug. 1 announcement of plans to boost $3.7 billion to purchase extra Bitcoin. That is a part of the corporate’s aim of buying 210K BTC by the top of 2027.

Final week, Metaplanet’s board of administrators resolved to problem new shares abroad, which then led to the newest shareholder assembly.

Though shareholders have accredited the brand new framework, Metaplanet’s board of administrators nonetheless must authorize the precise issuance phrases. The corporate should additionally submit detailed registration statements to native regulators.

What’s extra, Metaplanet may also have to exit and discover buyers that may really assist it obtain the $3.7 billion increase. With the current drop in crypto costs and the corporate’s share worth down greater than 13% within the final month, elevating the capital might show difficult.

$3.7 Billion Elevate Might See Metaplanet Climb The Bitcoin Treasury Rankings

Metaplanet just lately overtook Bitcoin miner Riot Platforms when it comes to the variety of BTC held in its reserves.

The corporate at present holds 20K BTC after it purchased 1,009 BTC yesterday for roughly $112.2 million. This ranks Metaplanet because the sixth-largest Bitcoin treasury firm globally, based on information from Bitcoin Treasuries. Metaplanet can be the most important company BTC holder in Asia.

*Metaplanet Acquires Extra 1,009 $BTC, Complete Holdings Attain 20,000 BTC* pic.twitter.com/kwvUkQaFth

— Metaplanet Inc. (@Metaplanet_JP) September 1, 2025

Metaplanet additionally holds extra BTC than US crypto change Coinbase, Elon Musk’s electrical automotive producer Tesla, and the Hut 8 mining agency.

In accordance with Metaplanet’s CEO Simon Gerovich, the common buy worth for the newest acquisition was $111,162 per BTC.

The corporate has additionally achieved a year-to-date (YTD) BTC yield of 486.7%. Total, Metaplanet’s Bitcoin holdings value round $2.06 billion to accumulate, with the common worth for all the buys at round $103,138 per BTC.

Metaplanet is now simply 4K BTC away from overtaking the Peter Thiel-backed crypto change platform Bullish because the fifth-largest Bitcoin treasury globally. With the decision to let Metaplanet problem extra shares to probably increase extra capital, the corporate might quickly surpass Bullish as effectively.

Including to the corporate’s momentum is the FTSE Russell’s improve of Metaplanet’s inventory from small-cap to mid-cap in its September 2025 Semi-Annual Overview. This has bumped the corporate up for inclusion within the flagship FTSE Japan Index.

Metaplanet’s inclusion within the FTSE Japan Index means it’s routinely added to the FTSE All-World Index, which provides it higher publicity amongst international index buyers and will bolster its fundraising efforts.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection