Assessing the correlation between Bitcoin and macroeconomic knowledge is a key step in figuring out long-term developments. A current evaluation means that monitoring central financial institution steadiness sheets can present deeper insights as a substitute of focusing solely on international M2 cash provide.

Nevertheless, the macro image is extra advanced than charts could recommend. The next evaluation highlights intertwined elements from knowledgeable views.

Sponsored

Sponsored

What Does the Correlation Between International Central Financial institution Liquidity and Bitcoin Value Point out?

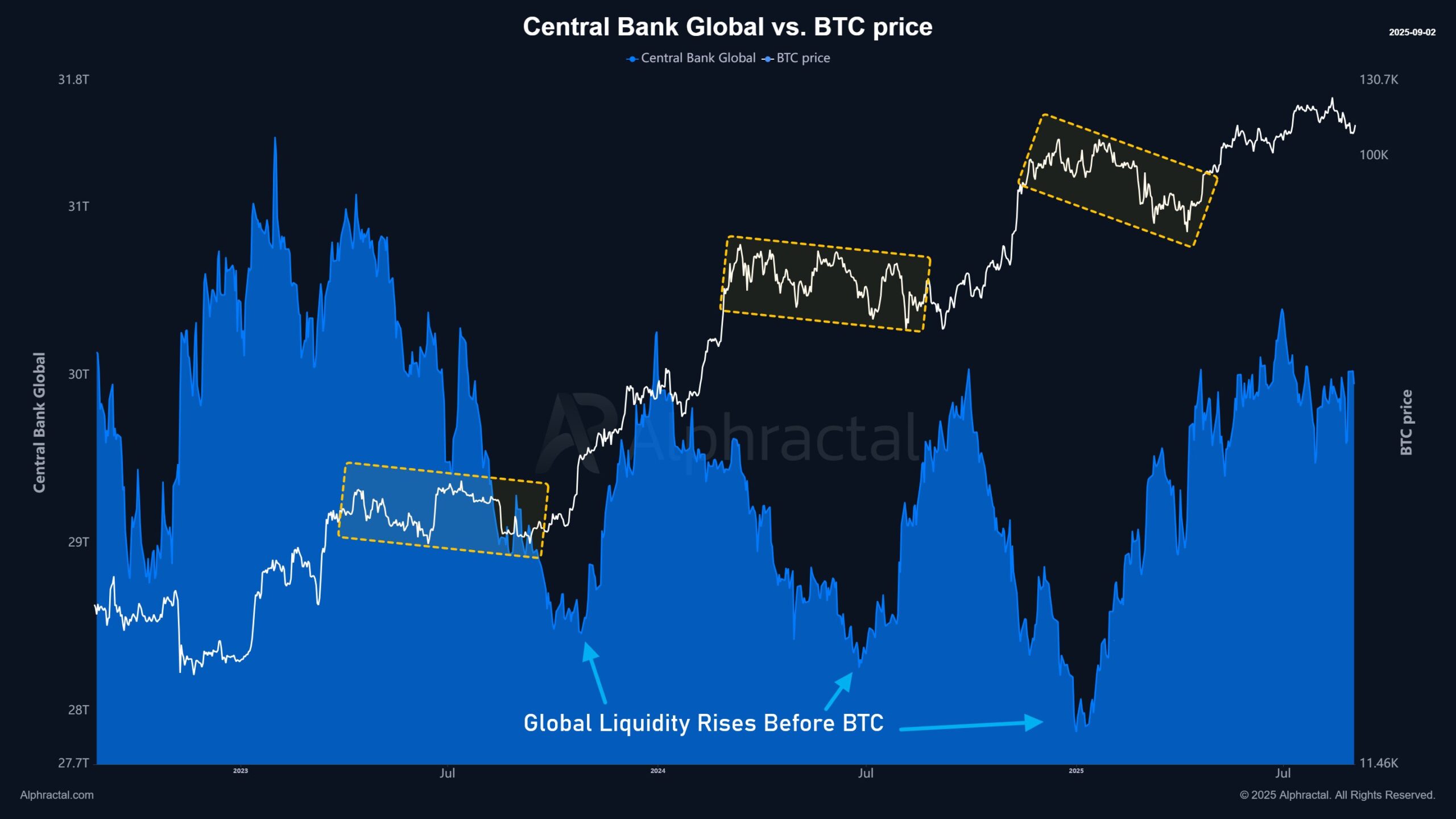

A current examine by Alphractal argues that central financial institution liquidity flows into the financial system—shares, gold, and crypto—a lot sooner than international M2 provide.

Due to this fact, evaluating central financial institution liquidity knowledge with Bitcoin’s worth reveals how the correlation works.

Sponsored

Sponsored

Information exhibits that international central financial institution liquidity fluctuated between $28 trillion and $31 trillion from 2023 to 2025, transferring via 4 expansion-and-contraction cycles. Every time liquidity elevated, Bitcoin rose about two months later.

“International central financial institution liquidity tends to rise earlier than BTC. Normally, when liquidity is in its remaining stage of decline, BTC enters a interval of sideways motion. In different phrases, central banks inject cash first, and a part of that liquidity later migrates into threat belongings—like BTC,” Alphractal defined.

This commentary helps clarify Bitcoin’s fluctuations between $100,000 and $120,000 in Q3, as liquidity has stabilized beneath $30 trillion.

Zooming out the chart since 2020, analyst Quinten famous that Bitcoin’s four-year cycle aligns intently with the four-year liquidity cycle.

These findings reinforce the vital function of central financial institution liquidity injections in shaping asset efficiency, together with Bitcoin. In addition they recommend the potential of a brand new liquidity cycle rising within the subsequent 4 years.

US Debt Progress Outpacing Liquidity Alerts

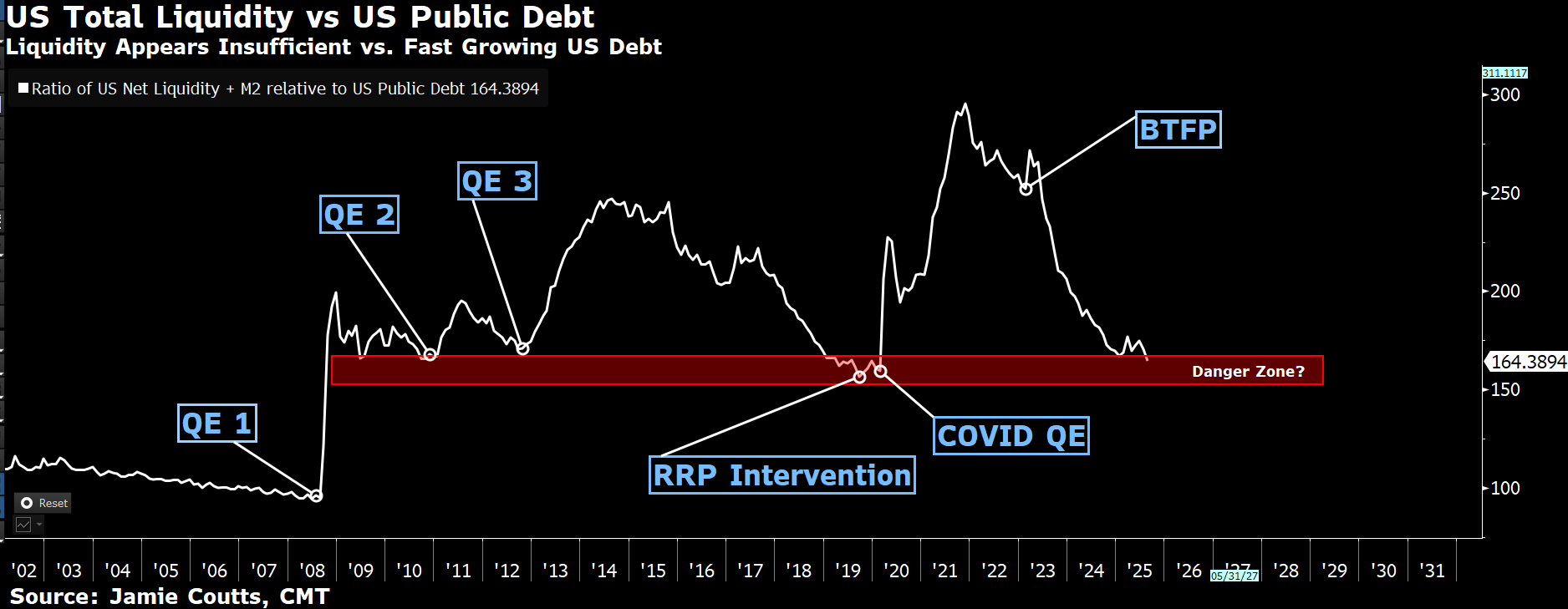

Jamie Coutts, Chief Crypto Analyst at Realvision, added one other layer to the dialogue. Monetary stress may emerge if debt continues to rise sooner than liquidity, making markets extra fragile.

Sponsored

Sponsored

He described international liquidity as a always refinancing machine through which debt expands sooner than financial progress. Liquidity should preserve tempo to keep away from collapse.

Within the US, debt progress outpacing liquidity already alerts systemic threat. His chart exhibits the ratio between liquidity and US debt has fallen to low ranges.

“When the ratio is excessive, extra liquidity feeds inflation. When it’s low, funding pressures emerge and threat belongings grow to be weak…So what? This doesn’t imply the cycle has ended. But it surely does sign fragility,” Jamie Coutts stated.

Billionaire Ray Dalio additionally sees this fragility. He warned that the US public debt has reached harmful ranges and will set off an “financial coronary heart assault” inside three years. He predicted that cryptocurrencies with restricted provide could grow to be enticing options if the US greenback depreciates.

Whereas Alphractal’s observations focus primarily on recurring historic patterns, Jamie Coutts and Ray Dalio emphasize present-day variations. Regardless of these contrasting views, Bitcoin stays in a singular place. Consultants nonetheless argue that the affect of those forces may very well be optimistic for BTC.