Ethereum has gained greater than 68% over the previous three months, placing most near-term holders firmly in revenue. But over the previous week, the asset has stalled — shedding 4.7% and buying and selling flat within the final 24 hours.

This consolidation has pushed the Ethereum worth inside a sample of indecision the place bulls and bears battle for management. Whereas such setups can resolve in both route, two on-chain metrics counsel the following transfer could favor the upside.

Sponsored

Sponsored

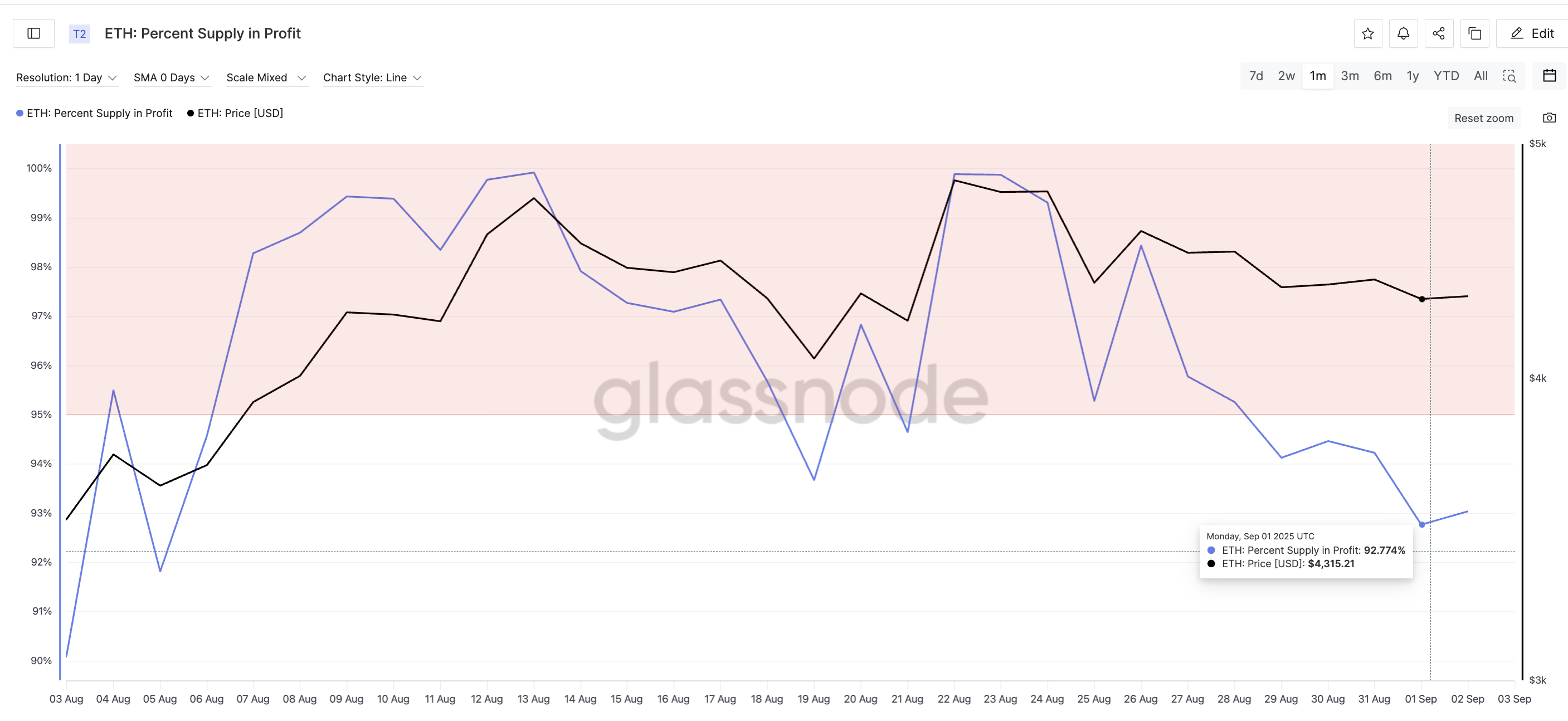

Metric 1: Revenue Provide Drop Factors To Vendor Exhaustion

The proportion of ETH provide in revenue dropped from 98.4% on August 26 to an area backside of 92.7% on September 1 — its second-lowest studying in a month. Usually, such declines mirror heavy profit-taking. However as soon as revenue provide hits native bottoms, ETH has traditionally rallied. For instance, when the ratio fell to 91.8% earlier in August, ETH surged from $3,612 to $4,748 (over 31%) in simply eight days.

This drop means a wave of sellers could already be out of the market, leaving ETH with fewer profit-sensitive holders who would possibly panic-sell. In different phrases, promoting depth has doubtless weakened at a time when the Ethereum worth is already consolidating at a breakout zone. And that’s a bullish signal.

Sponsored

Sponsored

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

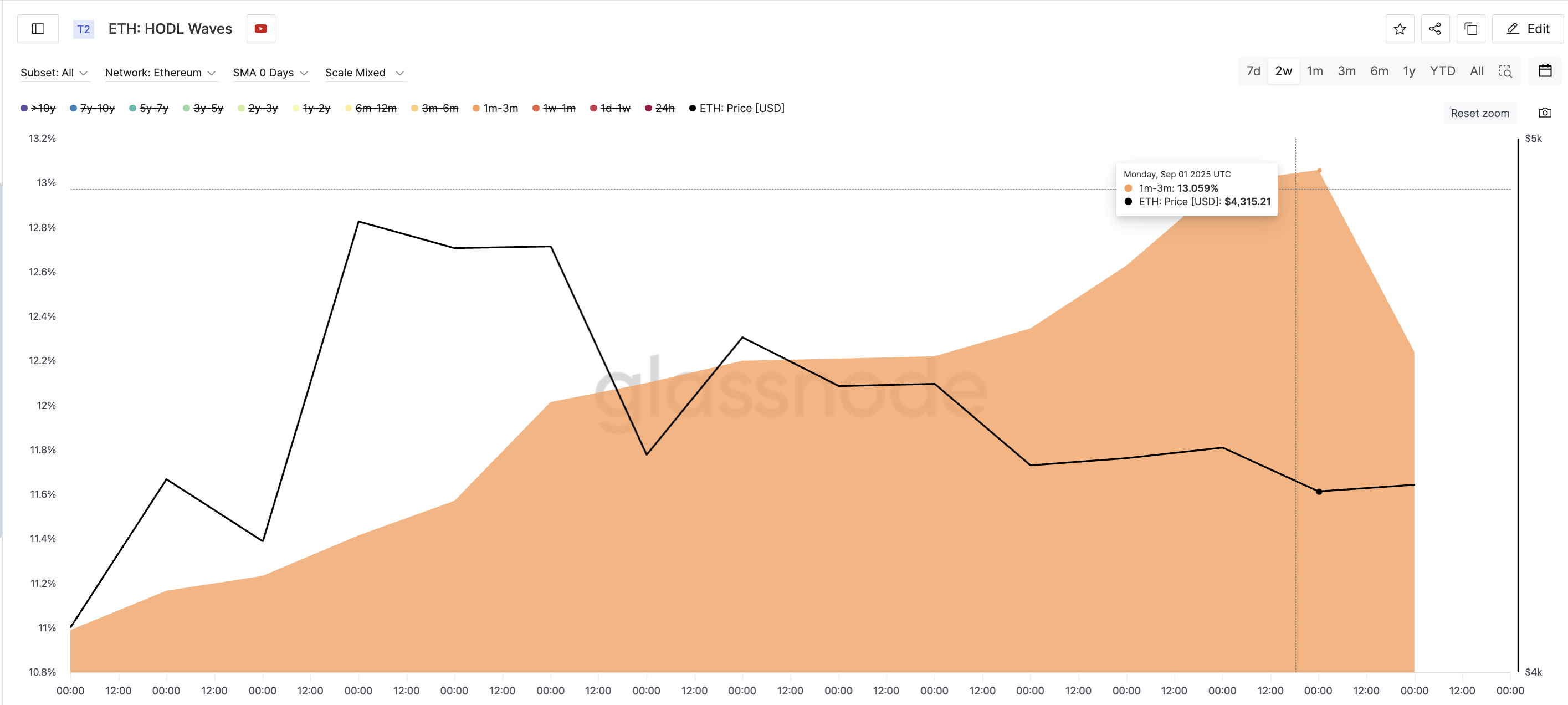

Metric 2: Quick-Time period Holders Accumulate Regardless of Beneficial properties

The extra shocking element is that the group most vulnerable to profit-taking — one- to three-month holders — has been including provide. Their share rose from 10.9% to 13% in simply two weeks, though ETH delivered over 20% month-to-month positive factors and greater than 68% in three months.

This exhibits that merchants who often flip positions rapidly are as a substitute accumulating, signaling confidence in additional upside. Mixed with the low profit-supply studying, this HODL Waves discovering paints an image of lowered promote stress and hidden demand build up behind ETH’s consolidation.

HODL Waves measure the distribution of a cryptocurrency’s provide by the age of cash held in wallets.

Sponsored

Sponsored

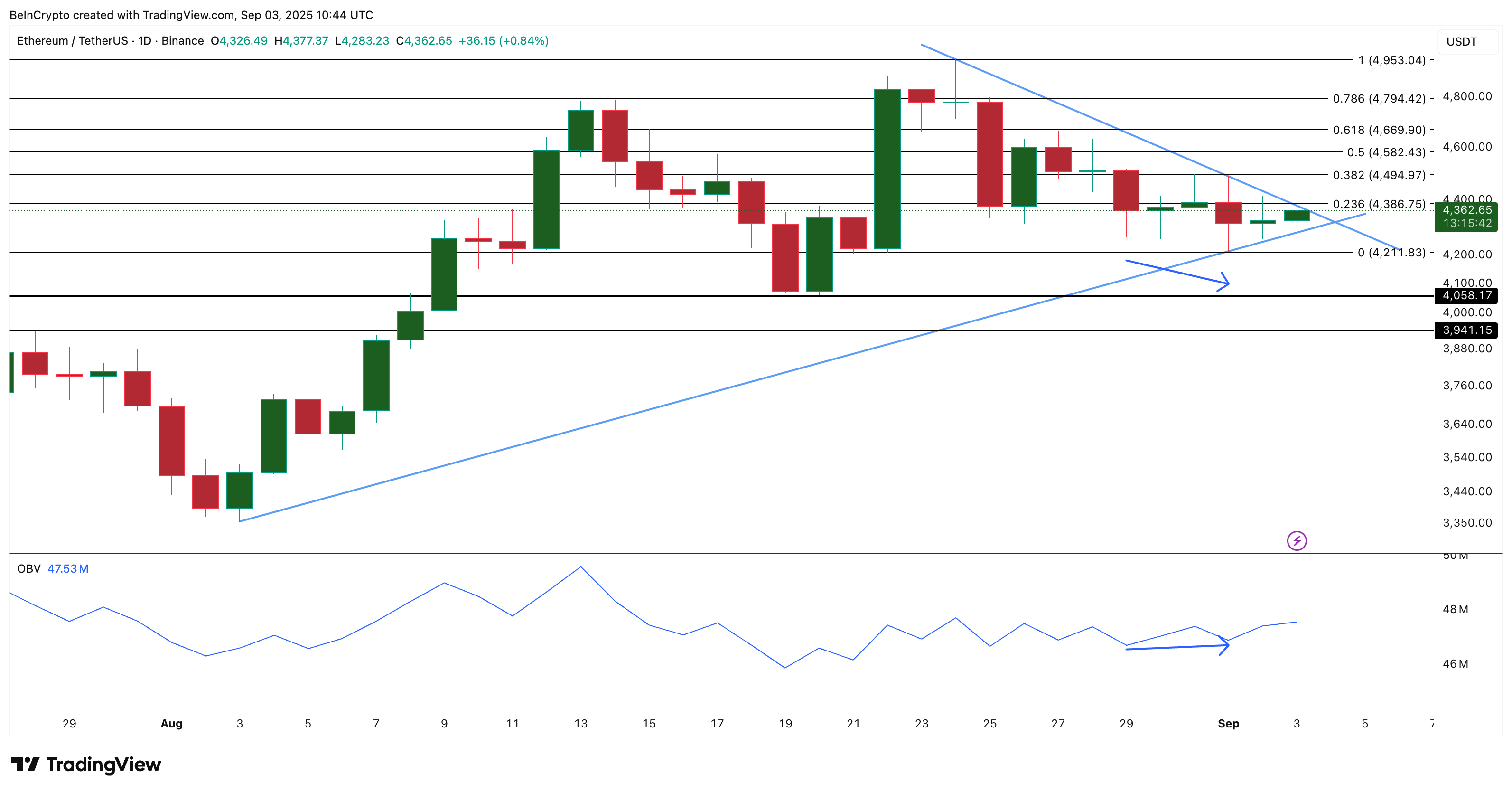

Ethereum Worth Motion And OBV Affirm Accumulation

On the chart, the ETH worth trades inside a symmetrical triangle with assist close to $4,211 and resistance at $4,386. Whereas worth has made decrease lows throughout this consolidation, On-Steadiness Quantity (OBV) has made larger lows. OBV tracks whether or not buying and selling quantity is dominated by patrons or sellers, and this divergence suggests accumulation continues beneath the floor.

The OBV metric confirms what we noticed earlier, whereas dicussing HODL waves.

The alignment of Ethereum worth motion and quantity indicators strengthens the case for a bullish breakout.

An in depth above $4,494 would unlock $4,669 as the following hurdle and $4,794 because the prolonged goal. A drop beneath $4,211 would weaken the setup, whereas $4,058 stays the deeper assist if bears take over.