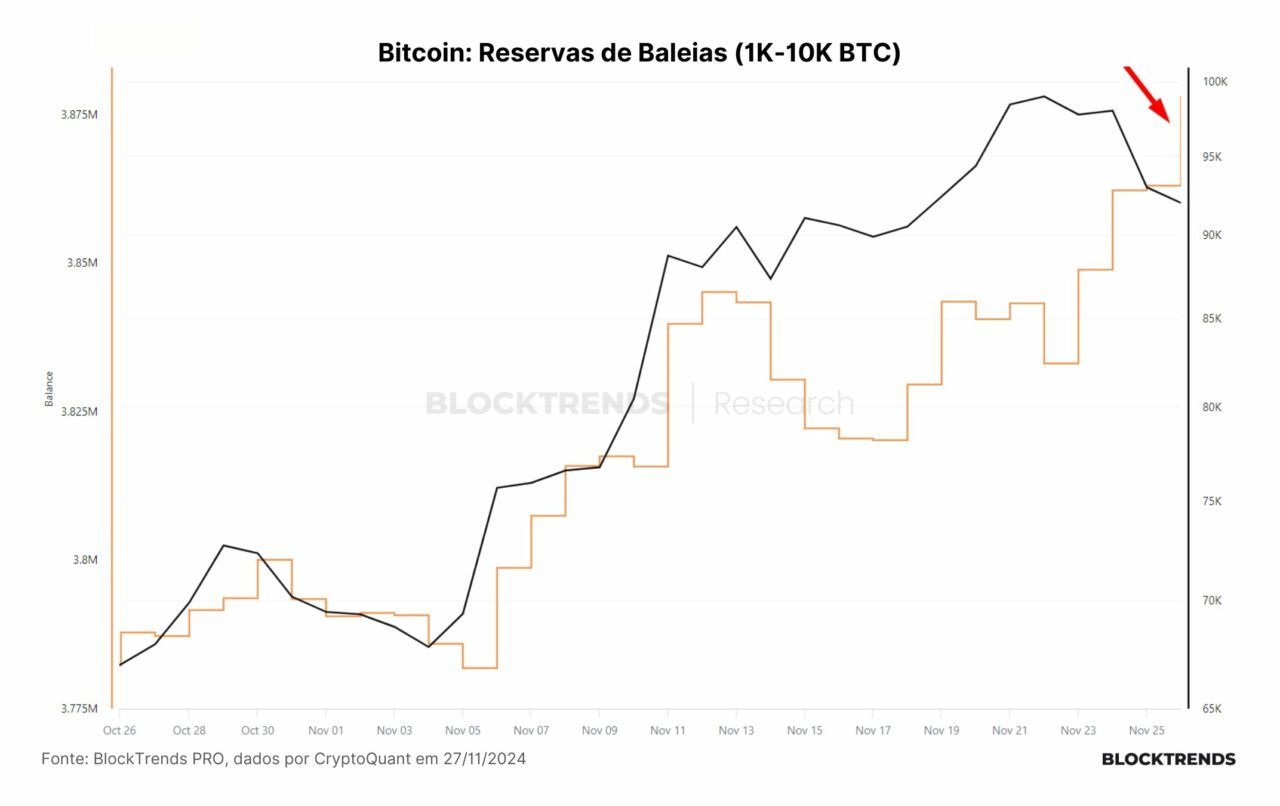

Bitcoin whales have been making the most of the flagship cryptocurrency’s latest worth dip to maintain on accumulating BTC after short-term holders moved practically $4 billion within the cryptocurrency to exchanges.

In accordance with CryptoQuant analyst Cauê Oliveira, Bitcoin whales took benefit of the “panic promoting” to build up, with 16,000 BTC price practically $1.5 billion entered whale reserves in a single day after short-term holders’ gross sales.

In a publish, the analyst famous that the determine was “mirrored in institutional addresses on the community” however steered extra BTC was gathered, because the funds that weren’t withdrawn from cryptocurrency exchanges and stay in customers’ accounts aren’t counted.

Per his phrases, the whale accumulation hasn’t been adequate to show a “extra widespread buy-the-dip” sample,” which he stated stays concentrated amongst institutional buyers.

The value of Bitcoin has surged by greater than 35% over the previous month to now commerce close to the $97,000 mark, but over the previous week it dipped from a close to $100,000 all-time excessive to a low simply above the $91,000 degree.

As reported, BTC’s worth rise got here after Republican candidate Donald Trump received the US presidential elections, and helped cryptocurrency hedge fund Pantera Capital’s Bitcoin fund obtain a lifetime return of over 131,000%.

Within the publish, Pantera Capital’s CEO Dan Morehead shared an e mail forecasting again in July 2013, when Bitcoin was buying and selling at $65, that the “bitcoin washout occurred” and predicting the value of the cryptocurrency would surge over time.

The e-mail notes he was going to “purchase 30,000 bitcoins” together with his personal private cash at a time by which the cryptocurrency’s market capitalization was round $740 million. Given the small measurement of the cryptocurrency market on the time, Morehead famous that in 2013-15, the fund “purchased 2% of the world’s bitcoins.”

To Morehead, shopping for Bitcoin on the time was like “shopping for gold in 1000 B.C.” as then “99% of the monetary wealth has but to handle bitcoin.” He famous that the trade has made progress and now believes 95% of the monetary wealth “has but to place their full-sized place on.”

Featured picture by way of Unsplash.