The marketplace for tokenized Pokémon playing cards is experiencing speedy development, with Collector Crypt’s launch drawing traders and collectors into on-chain buying and selling. Its CARDS token surged tenfold in lower than every week, hitting a completely diluted valuation (FDV) of $360 million.

The token’s worth alerts $38 million in projected annualized income, fueled by intense demand for its “Gacha machine,” which produced $16.6 million in gross sales final week.

Collector Crypt’s Breakout Launch

Sponsored

Sponsored

The broader buying and selling card RWA (real-world asset) sector has additionally gained traction. In line with CoinGecko, buying and selling card RWA platforms reached an $87.2 million market capitalization this week, rising 32% in 24 hours.

Collector Crypt reported $44 million in month-to-month quantity, a 124% improve month-over-month, whereas rival Phygitals posted $2 million, up 245%.

Danny Nelson, a analysis analyst at Bitwise Asset Administration, in contrast the pattern to a pivotal second in prediction markets.

“Pokémon and different TCGs are about to have their ‘Polymarket second,’” Nelson wrote in an X submit.

Collector Crypt stands out by addressing inefficiencies in Pokémon’s multi-billion-dollar buying and selling ecosystem. Regardless of its measurement, most offers nonetheless contain delivery bodily playing cards and verifying situation by intermediaries.

By tokenizing property on Solana, Collector Crypt permits immediate buying and selling, NFT-backed deposits, and world liquidity.

Sponsored

Sponsored

The CARDS token’s surge displays investor expectations that income from market charges and buybacks will maintain long-term worth. Its Gacha characteristic, which dispenses randomized digital card packs, has been so standard that the staff is struggling to maintain stock out there.

The Solana Basis, which highlighted a PSA 10 Charizard card shifting seamlessly on-chain, framed the shift as a structural change.

“Startups like Collector Crypt and Phygitals are cracking the code: tokenize it, make it redeemable, rip packs digitally, zero friction,” the inspiration reported.

Underlying market dynamics help the pattern. In fiscal 2024, The Pokémon Firm produced 9.7 billion playing cards, almost triple the output of two years prior, in keeping with a report. That yr alone accounted for 18.3% of all Pokémon playing cards ever produced, fueling liquidity in secondary markets.

Sponsored

Sponsored

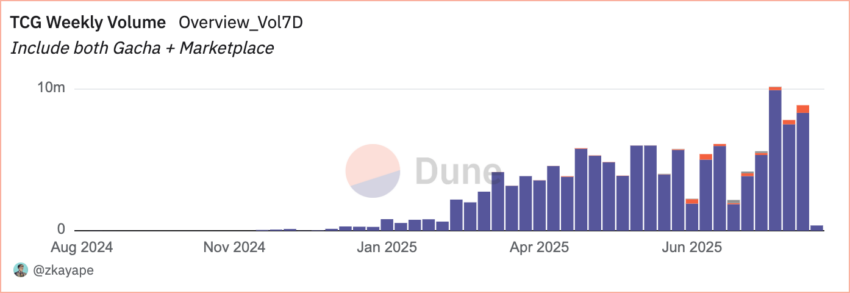

On-chain knowledge reinforces the expansion. In line with Raydium Protocol, tokenized Pokémon packs have already surpassed $70 million in gross sales, together with a report $5 million in 24 hours. A Dune Analytics dashboard exhibits greater than 17,000 tokenized playing cards circulating throughout marketplaces.

RWAs Achieve Floor in Buying and selling Card Markets

The momentum displays a broader RWA narrative. Conventional efforts have targeted on treasuries, gold, and actual property, the place blockchain improves settlement velocity however doesn’t rework market construction. Buying and selling playing cards, nevertheless, stay largely offline regardless of huge retail demand.

Nelson famous that Whatnot, a social public sale platform, generated $3 billion in gross sales final yr, a lot of it from Pokémon playing cards. But no exchange-traded funds or institutional merchandise exist for the pastime. Tokenization offers digital rails for a market nonetheless underserved by finance.

Different platforms are testing related fashions. In line with CryptoRank, Courtyard.io raised $37 million, together with a $30 million Sequence A in July 2025 led by Y Combinator, ParaFi Capital, and NEA.

Sponsored

Sponsored

Courtyard points NFTs on Polygon tied to playing cards saved and insured by Brink’s, with redemption rights for bodily property. A Delphi Digital report stated the strategy blends NFTs with tangible RWAs.

Skepticism stays. Critics argue that tokenization may fragment liquidity throughout protocols, whereas established marketplaces like eBay and PSA already supply vault and escrow companies.

simple_peanut3, a builder at Grvt and longtime Pokémon TCG collector, cautioned that speculative hype may hurt each communities.

Sponsored

Sponsored

“Ultimately, this may occasionally not finish effectively for each side — whether or not you’re a crypto native or a pure Pokémon collector,” he wrote.

Regardless of considerations, proponents argue tokenized playing cards can function collateral for loans and unlock monetary utilities past conventional markets. The Solana Basis has emphasised that the phenomenon is a part of a broader business pattern.

“The longer term shall be tokenized,” Solana declared.