The crypto market is bracing for heightened volatility as greater than $4.6 billion in Bitcoin and Ethereum choices expire at this time. This pivotal occasion may dictate short-term worth motion for each main belongings.

Analysts warning that the September expiry carries added weight, traditionally related to weaker efficiency and decrease liquidity throughout digital belongings.

Bitcoin, Ethereum Choices Expiry Looms With $14.6 Billion at Stake

Sponsored

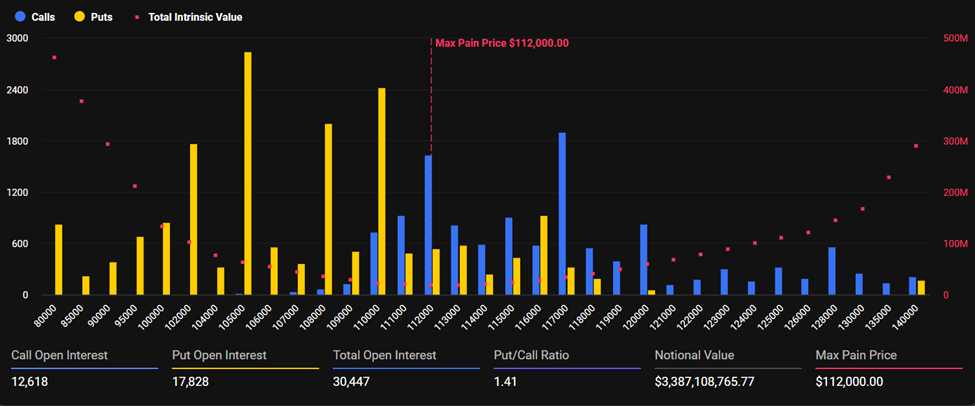

Bitcoin (BTC) dominates this spherical of expiring choices, with a notional worth of $3.38 billion. Based on Deribit, whole open curiosity stands at 30,447 contracts.

The max ache level, the place the best variety of choices expire nugatory, is $112,000. In the meantime, the put-call ratio is 1.41, suggesting an edge for bearish positions and a market leaning towards warning.

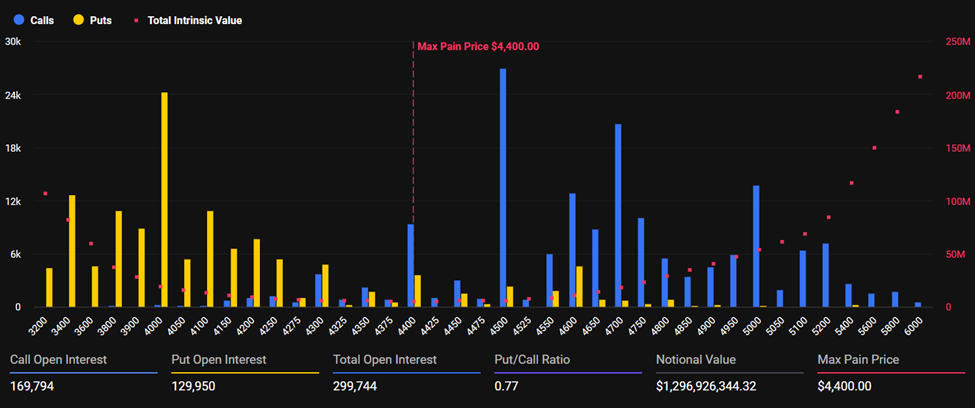

Ethereum faces a equally essential expiry with $1.29 billion in notional worth. Open curiosity is 299,744 contracts, with the max ache stage at $4,400.

The put-call ratio of 0.77 signifies stronger demand for calls (purchases), although analysts observe a major build-up above the $4,500 strike. Deribit highlighted this skew.

“…flows lean extra balanced, however calls construct up above $4.5K, leaving upside optionality,” Deribit famous.

Sponsored

Analysts at Greeks.stay highlighted Ethereum’s implied volatility (IV), indicating that short-term IV has surged towards 70%. This means heightened expectations for worth swings after the Ethereum worth corrected over 10% from its latest peak.

“Weak point in US equities and the WLFI index has intensified market skepticism,” Greeks.stay analysts wrote.

In the identical manner, IV throughout Bitcoin maturities has rebounded to round 40% after a month-long correction. Notably, this pullback noticed the Bitcoin worth drop greater than 10% from its all-time excessive.

Nevertheless, analysts see a defensive stance amongst merchants. Proof of that is accelerating block buying and selling in places, which account for almost 30% of at this time’s choices quantity.

Sponsored

Analysts Warn of September Weak point

Nonetheless, market sentiment is shifting shortly. Greeks.stay pressured that September has traditionally been a difficult month for crypto. Institutional rollovers and quarterly settlements usually subdue capital flows.

“The choices market, generally, lacks confidence in September’s efficiency,” the analysts added.

The prevailing downtrend and declining crypto-related equities make threat aversion the first theme.

As choices close to expiry, Bitcoin and Ethereum costs have a tendency to tug towards their max ache ranges. For Bitcoin, buying and selling at $111,391 as of this writing means a modest uptick to $112,000. The identical goes for Ethereum, which traded for $4,326 at press time.

Sponsored

With at this time’s third-quarter supply month, liquidity patterns and rollover exercise may amplify volatility in each instructions.

Subsequently, defensive sentiment might dominate as merchants brace for extended weak spot or a possible breakout as soon as expiry clears. Nevertheless, the market tends to stabilize after 8:00 UTC when the choices expire on Deribit.

Sponsored

The important query stays whether or not expiry will pin Bitcoin and Ethereum close to their present ranges or act as a catalyst for a restoration.

Possibility dynamics may exert magnetic stress within the close to time period, with max ache sitting simply above present costs for each BTC and ETH.

If historical past holds, September might proceed to problem bulls, however the market’s rising defensive posture suggests any shock upside might be met with equally aggressive repositioning.