XRP pulled again sharply after failing to maintain momentum above the $2.88–$2.89 resistance zone, whilst ETF hypothesis continues to construct forward of October SEC deadlines.

The selloff highlights a pivotal inflection level as institutional flows battle in opposition to long-term consolidation patterns that many analysts consider may precede a bigger transfer.

Information Background

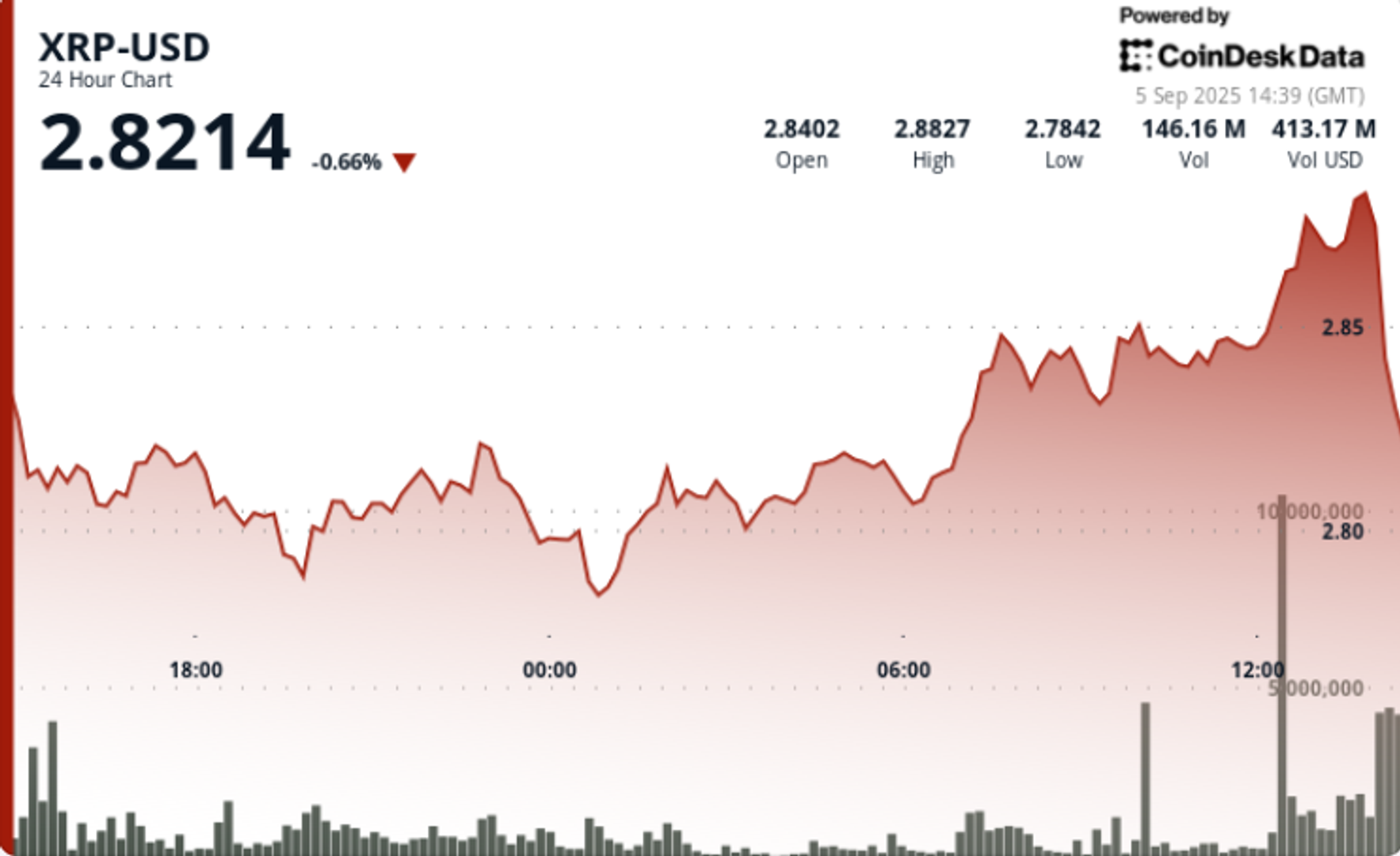

• XRP fell 4% from $2.88 to $2.84 on September 5 after hitting an intraday excessive of $2.89, as institutional promoting strain emerged.

• Buying and selling quantity exploded to 227.75 million throughout the 12:00 hour, almost 4x the 24-hour common of 58.40 million.

• Six asset managers, together with Grayscale and Bitwise, have filed for spot XRP ETFs, with SEC selections anticipated in October.

• Ripple’s authorized settlement with the SEC has improved regulatory readability, boosting trade estimates to an 87% likelihood of ETF approval.

• Technical strategists are evaluating the present 47-day consolidation vary to XRP’s 2017 construction, which preceded a parabolic rally.

Value Motion Abstract

• XRP traded in a $0.10 vary (3.47%) between $2.78 and $2.89 throughout the 24-hour session from Sept. 4 15:00 to Sept. 5 14:00.

• The asset superior from $2.84 to $2.89 on huge quantity at 12:00 and 13:00 earlier than rejecting resistance.

• A concentrated 60-minute transfer from 13:26 to 14:25 noticed a 4% slide from $2.88 to $2.84 on 10.6M quantity, breaching intraday helps at $2.86 and $2.85.

• XRP closed the session at $2.84, simply above major help ranges close to $2.77.

Technical Evaluation

• Resistance: $2.88–$2.89 zone validated after a number of failed breakouts.

• Help: Rapid ranges at $2.84–$2.85, with stronger backing at $2.77.

• Sample: 47-day consolidation suggests potential breakout setup; $4.63–$13 targets flagged if construction resolves greater.

• Momentum: RSI in mid-50s, exhibiting impartial bias; MACD histogram converging towards bullish crossover.

• Quantity: 227.75M at peak vs 58.40M common confirms institutional distribution.

What Merchants Are Watching

• Whether or not $2.77 holds as decisive help into September.

• SEC’s October spot XRP ETF rulings — seen as a possible bullish set off.

• Continuation of whale accumulation (340M tokens not too long ago added) regardless of short-term distribution strain.

• Indicators of breakout above $3.30, which analysts argue may open pathways towards $4+.