The Solana Value has cooled after a powerful August. Over the previous seven days, it has traded flat, and within the final 24 hours, it slipped 1.1%. Against this, month-to-month positive factors nonetheless stand close to 26%, and three-month positive factors are about 35.8%.

For merchants studying this to see if the SOL Value can repeat these August-style positive factors, the reply could also be disappointing. On-chain knowledge exhibits revenue reserving is heavy, and one other metric has quietly turned bearish. Collectively, these increase doubts over how briskly Solana can transfer larger from right here.

Sponsored

Sponsored

Two Metrics Trace At Lively Promoting

On-chain knowledge exhibits that the proportion of provide in revenue continues to be very excessive for Solana. As of September 3, almost 95% of Solana holders had been in revenue, near the six-month peak of 96.59% on August 8. Even at press time, the studying sits round 87%, nonetheless an overheated degree. When such a excessive share sits on positive factors, the temptation to promote rises.

Sponsored

Sponsored

Historical past backs this. The final time revenue provide dropped exhausting, falling below 54% on August 2, Solana Value was about $158.53. From there, SOL Value climbed all the best way to $214.51 by August 28 — a achieve of roughly 35%. This means that Solana largely rallies when fewer holders maintain onto their earnings. In any other case, each transfer larger tends to get bought into energy.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

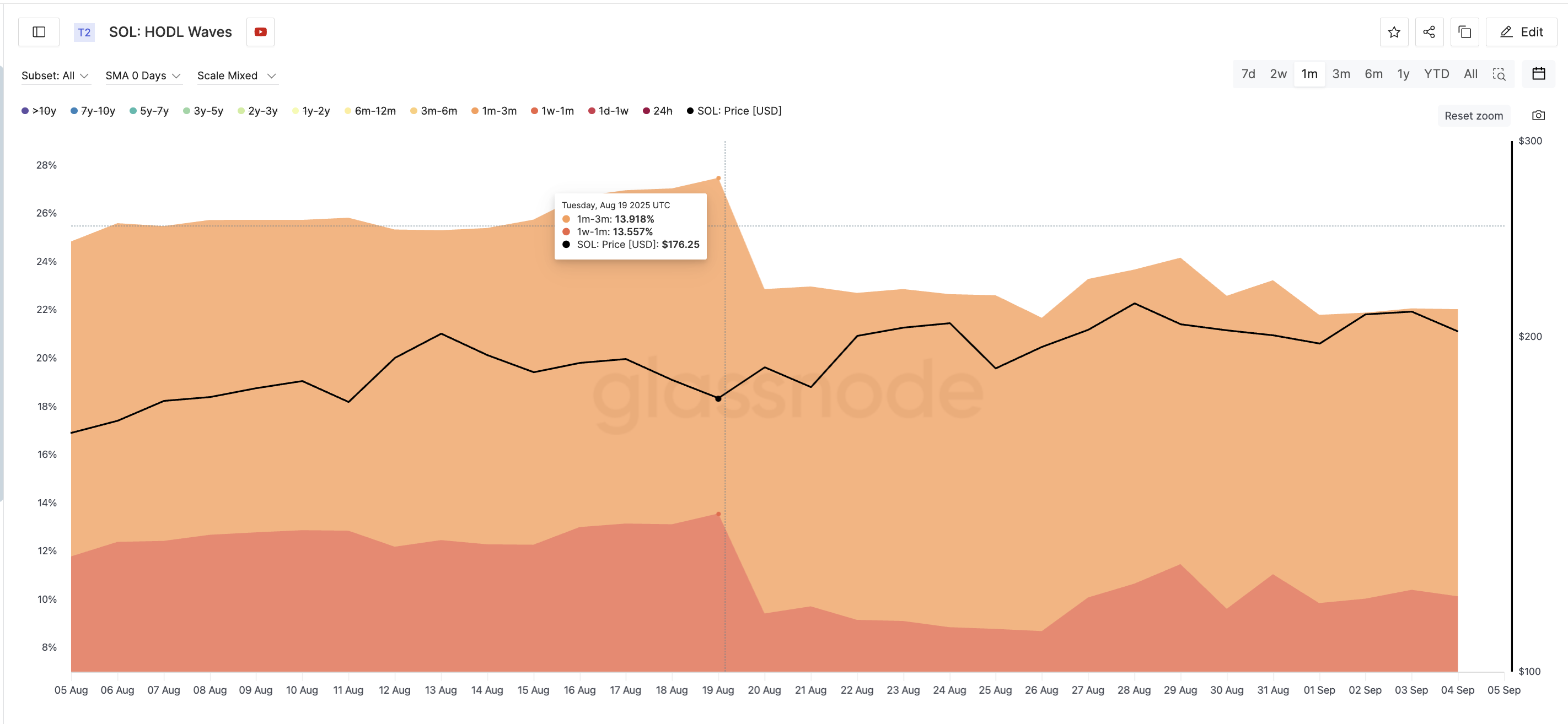

The HODL Waves metric, which tracks how lengthy cash are held earlier than shifting, confirms this. Quick-term holders — those that held between 1 week–1 month and 1–3 months — peaked on August 19, when Solana Value traded close to $176.

Collectively, they managed about 27% of the provision. Since then, their share has dropped to round 22%. These cohorts are promoting into energy, displaying profit-taking is energetic in actual time.

Weak Cash Inflows Reveal the Solana Value Fragility

Sponsored

Sponsored

On the value chart, the SOL Value faces heavy resistance at $218. A clear candle shut above the latter would verify a breakout and mark a brand new excessive, invalidating the bearish view.

Nevertheless, the issue of cash move retains the optimism low. The Chaikin Cash Circulation (CMF), which measures whether or not shopping for strain or promoting strain dominates, has weakened sharply. On July 22, when the Solana Value hit an area excessive, CMF stood at 0.31, displaying robust inflows. Since then, worth has made larger highs, however CMF has dropped to –0.01.

This divergence means whales and establishments aren’t including recent cash into SOL. With out these massive inflows, profit-takers face little resistance when promoting. The shortage of offsetting demand leaves rallies fragile and makes a deeper pullback extra possible than a respite if key helps fail.

On the draw back, robust help sits at $194, with additional ranges at $186 and $173 if promoting deepens. At current, the Solana Value is holding regular, however until CMF improves, any respite appears far off.