Bitcoin produced generational returns for traders who bought into the digital asset a decade in the past, and it appears to be like like Bitcoin miners are subsequent.

The infrastructure Bitcoin mining corporations use to mine Bitcoin is uniquely positioned to capitalize on synthetic intelligence.

Buyers Are Beginning To View Bitcoin Miners As AI Corporations

Hive Digital Applied sciences Government Chairman and Co-founder Frank Holmes informed BeInCrypto that it takes three years to construct an information middle from scratch. That’s as a result of it’s important to think about particulars like allowing, logistics, and constructing the information middle.

Sponsored

Sponsored

Nonetheless, the trail to changing a Bitcoin mining information middle into an AI information middle takes much less time.

“If you have already got the infrastructure constructed from Bitcoin mining, it’s 9 months to enhance the information middle,” Holmes stated.

Hive has a market cap of greater than $600 million. However the firm doesn’t view itself simply as a Bitcoin miner. The corporate is a vertically built-in, renewable-powered AI infrastructure firm, and Wall Road analysts agree.

Analysts have aggressive worth targets of $6 to $12. Hive inventory presently trades at round $3 per share, which suggests greater than 300% upside from present ranges.

Some institutional traders are beginning to discover as nicely.

Citadel Securities not too long ago disclosed a 5.4% stake in Hive, and with Hive not too long ago establishing its headquarters in america, will probably be one other 12 months earlier than the inventory is eligible for the Russell 2000.

Holmes talked about that retail traders have fueled a lot of the preliminary momentum for Hive inventory.

These kind of shares have a tendency to attain large features as soon as institutional traders get entangled, and investing in indices just like the Russell 2000 attracts extra capital from these traders.

Investing in Bitcoin miners has turn into a preferred development for big traders. Shark Tank’s well-known investor, Mr. Great’ Kevin O’Leary, additionally invested in Bitcoin mining and energy infrastructure firm Bitzero.

Sponsored

Sponsored

In an unique podcast with BeInCrypto, O’Leary defined his technique.

“If I needed to begin investing in gold 300 years in the past, I’d have invested in gold, gold miners, corporations that made denims, picks, and shovels. And I’d have completed significantly better than simply proudly owning gold. So the rationale I personal Bitzero is that they mine Bitcoin they usually’re really an influence firm,” he informed BeInCrypto.

The AI Alternative For Bitcoin Miners

Most traders know in regards to the alternative in synthetic intelligence, however not as many understand how large it may well turn into.

Massive tech corporations are the large leaders, and a single contract with certainly one of these corporations can ship a Bitcoin miner hovering.

As an example, TeraWulf inventory soared by virtually 60% in a single day after touchdown a $3.2 billion cope with Alphabet. Shortly after the deal was introduced, Alphabet upped its stake in TeraWulf.

Sponsored

Sponsored

The restricted provide of electrical energy and information facilities positions crypto miners to signal extra offers like this one sooner or later.

Nonetheless, the most important alternative for Bitcoin miners sitting on AI infrastructure could not even be the large tech corporations that dominate the headlines.

Holmes believes militaries and governments will turn into giant AI information middle clients on account of improvements on the battlefield.

Drones, autonomous robots, and autonomous autos are a number of the superior tech that use AI information facilities as their spine.

“More cash goes to AI. If you will have all of those drones, you’re going to wish information facilities and satellites. The intersection goes to be sovereign information facilities,” Holmes informed BeInCrypto.

Bitcoin Miners Stay Undervalued In contrast To Knowledge Heart Shares

Though Bitcoin miners are key gamers within the AI information middle increase, not many traders acknowledge this chance.

Sponsored

Sponsored

The chance continues to be in its early innings, particularly whenever you have a look at the valuations of Bitcoin miners in comparison with typical information middle shares.

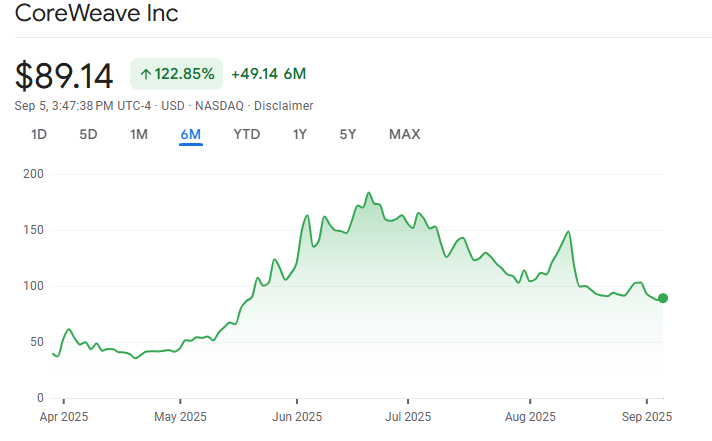

“After we have a look at the everyday information middle ETF that’s on the market, you’ll see that it’s buying and selling at 20 instances EBITDA, however Bitcoin miners like Hive are buying and selling at lower than 2 instances EBITDA,” Holmes informed BeInCrypto. “I believe you will see this re-rating, and also you noticed Core Scientific get [acquired] at 14 instances as a result of CoreWeave was buying and selling at 40 instances EBITDA. We’re going to see re-ratings, however in 5 years, I imagine our information facilities are going to turn into very helpful property.”

CoreWeave began as a crypto mining firm referred to as Atlantic Crypto in 2017. It now has a valuation that’s hovering at round $50 billion ever because it absolutely embraced AI information facilities.

With loads of capital flowing into the trade, valuations and monetary development charges can transfer shortly.

Sponsored

Sponsored

Not like the dotcom bubble, which was stuffed with eyeballs however no money circulate, AI is already producing tangible leads to record-breaking time.

Holmes talked about that OpenAI went from making $0 to $1 billion in month-to-month income in lower than two years.

Hive inventory has greater than doubled from its 2025 lows, however it’s not the one crypto mining inventory to carry out nicely. IREN has greater than doubled year-to-date, whereas Cipher Mining has greater than tripled from its 2025 lows.

All three shares loved sturdy rallies within the again half of August, and if Bitcoin mining consultants like Holmes are appropriate about the way it performs out over the subsequent few years, these large features could be the start.