Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value climbed a fraction of a % within the final 24 hours to commerce at $4,403 as of three:50 a.m. EST on a 3% lower in buying and selling quantity to $35.54 billion.

The bounce within the ETH value comes after information that month-to-month spot buying and selling quantity for ETH overtook Bitcoin on centralised exchanges for the primary time in seven years, sending a powerful sign that investor focus is shifting.

Main institutional gamers like Tom Lee’s BitMine are additionally betting large, with one other $167 million Ethereum buy pushing optimism even larger, its second giant buy in beneath per week.

TOM LEE’S BITMINE (@BitMNR) JUST BOUGHT ANOTHER 28,650 ETH ($130,000,000)$BMNR now holds 1.174M $ETH valued at $5.26 BILLION DOLLARS

Bitmine now holds virtually 1% of the TOTAL ETH SUPPLY

The most important ETH treasury simply received greater, Tom Lee isn’t taking part in round 🔥 pic.twitter.com/xtFWWoDiRw

— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) August 15, 2025

These adjustments put the ETH value forecast within the highlight as merchants and analysts look ahead to the subsequent transfer. New knowledge confirms that in August ETH’s month-to-month spot buying and selling quantity soared to about $480 billion, eclipsing Bitcoin’s $401 billion over the identical interval.

Analysts credit score this increase to extra energetic institutional participation, rising adoption of DeFi, and ETH ETF inflows that reached almost $4 billion whereas Bitcoin spot ETFs noticed web inflows.

May $ETH truly flip $BTC?@ethereumJoseph says Ethereum’s financial base dimension may “eclipse” Bitcoin’s inside a 12 months.

Up to now @SharpLinkGaming has bought 521k+ ETH price $2.2B.

They’re one of many main entities inside the new wave of treasury corporations stacking ETH… pic.twitter.com/Gt4g8SOhwm

— Milk Highway (@MilkRoadDaily) August 10, 2025

Bloomberg analyst James Seyffart says a brand new “Altcoin Season” is now underway, pushed by new treasury allocations and ETF inflows. That exercise helps raise confidence and the ETH value whilst Bitcoin’s value appreciation slows.

Are you prepared for a brand new period in cryptocurrency funding? In response to Bloomberg ETF analyst James Seyffart, the extremely anticipated company altseason is not simply coming—it is already underway.https://t.co/W7ahWROLBe pic.twitter.com/5PNZjOozeK

— BitcoinWorld Media (@ItsBitcoinWorld) September 5, 2025

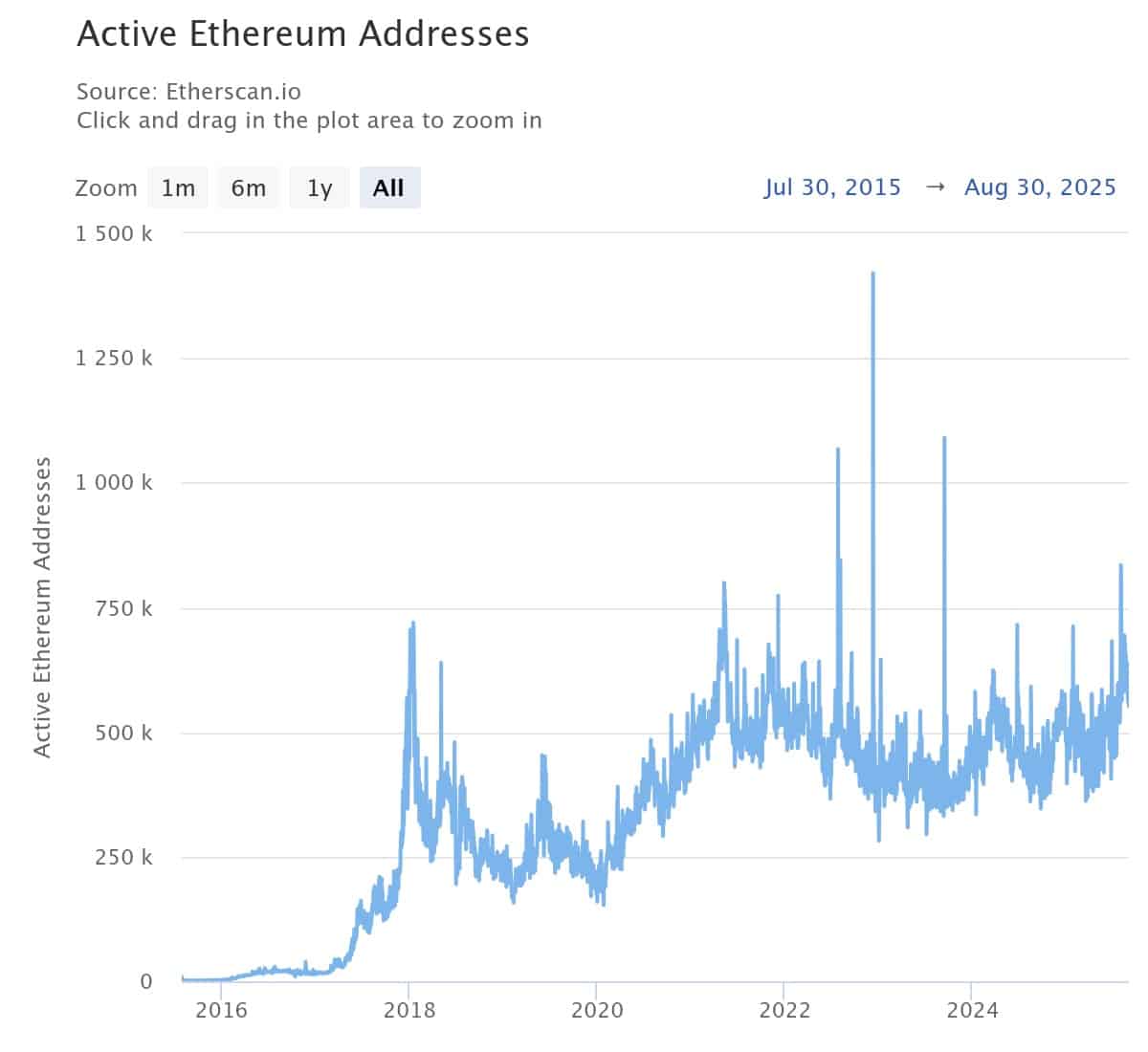

Ethereum On-Chain Exercise

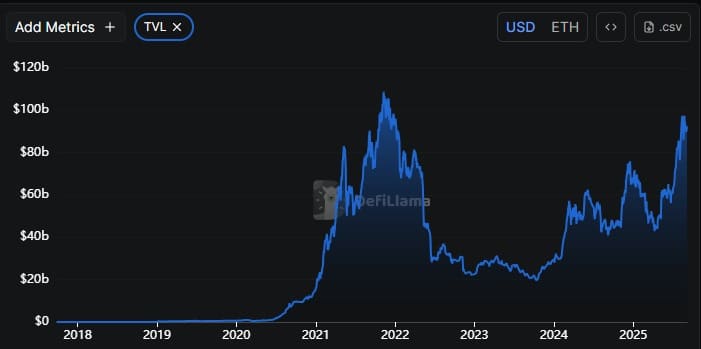

Ethereum on-chain exercise is backing up the bullish information. The full worth locked in Ethereum’s DeFi apps stays above $100 billion, with new wallets and energetic addresses hitting contemporary highs.

Ethereum Lively Addresses Supply: Etherscan

Extra ETH is flowing into staking contracts, and change reserves are at a three-year low, suggesting holders are transferring cash into long-term positions as an alternative of promoting.

Ethereum Whole Worth Locked Supply: DeFiLlama

Massive-scale OTC strikes, just like the current BitMine acquisition, and sizeable fund inflows sign that whales and establishments are driving a lot of this development.

In the meantime, elevated ETF curiosity and new multi-asset funds focusing on Ethereum have lower down provide on exchanges, supporting a wholesome coin value basis. The most recent developments present that consumers usually are not simply speculating, they’re staking and locking up tokens, making fewer cash obtainable for buying and selling.

This dynamic usually results in larger volatility and upward strain when demand kicks in, particularly if new ETF approval or one other wave of institutional buys arrives.

ETH Worth Chart Holds Above Key Help

The ETH value is now buying and selling near $4,408.91, with consumers defending assist at $4,115.73 (the 50-day easy transferring common) and staying comfortably above the 200-day transferring common at $2,721.70.

This bullish setup is obvious on the day by day chart, as ETH continues to make larger highs and better lows inside a large rising channel.

ETHUSD Evaluation. Supply: Tradingview

A essential resistance stays at $4,957.51, the realm that capped the rally earlier in August. If consumers can escape above this stage, ETH value may rapidly advance to $5,200 and even larger. If ETH stalls or dips, sturdy assist is available in round $4,115, adopted by a bigger security web close to $2,721, the place the long-term pattern is anchored.

Key indicators present why merchants stay bullish. The MACD is in constructive territory, signalling consumers are nonetheless energetic, however some short-term momentum loss is seen. RSI is at 55.01, exhibiting ETH just isn’t overbought and nonetheless has room to run.

ADX sits at 21.25, revealing the pattern is agency however not but overheated. Bulls have the higher hand, however there isn’t a signal of loopy hypothesis.

If extra institutional capital enters and ETF inflows maintain regular, a transfer to new all-time highs above $5,000 may come quickly. With spot quantity at new data and massive names like BitMine including to their ETH holdings, the ETH value outlook is powerful.

Analysts now say {that a} breakout above $4,950 may rapidly push the ETH value towards $5,200 or larger, particularly with large ETF and treasury inflows on the horizon.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection