Be part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor’s Technique meets all the standards for inclusion within the S&P 500 index, which may result in $16 billion in inflows for the corporate’s inventory, Bloomberg reported.

That’s after the corporate achieved a $14 billion unrealized achieve the final quarter, delivering the profitability wanted to be included within the index underneath present guidelines.

Along with assembly the profitability necessities, Technique’s shares are essentially the most actively and effectively traded of all the 26 attainable candidates for inclusion within the index on the subsequent quarterly rebalancing, the story stated. Different candidates embrace AppLovin Corp, Robinhood Markets, and Carvana Co.

If Technique (MSTR) had been to be included within the S&P 500, passive funds that observe the index can be pressured to purchase up practically 50 million shares, which is price round $16 billion, in line with evaluation by Stephens Inc that was referenced within the report.

In keeping with Bloomberg, Technique Inc. (previously MicroStrategy) has theoretically met the S&P 500’s profitability standards with a $14 billion unrealized achieve final quarter. Inclusion would set off passive index funds to purchase round 50 million shares, price roughly $16 billion at…

— Wu Blockchain (@WuBlockchain) September 4, 2025

Institutional Validation

The inclusion would additionally convey institutional validation for Saylor’s daring Bitcoin accumulation plan, which has been pilloried by critics over time for being too reckless, the report stated. It might additionally flip pension funds into oblique holders of the king of cryptos.

Whereas Technique has already been added to the Nasdaq 100 in December, inclusion within the S&P 500 will probably be a a lot larger milestone given it’s practically double the scale of the Nasdaq 100 with near $10 trillion in passive capital monitoring it.

Bloomberg’s report stated Technique’s inclusion within the S&P 500 should still be “a protracted shot for now,” however added that MSTR becoming a member of the index is now throughout the realm of chance, noting that it was unthinkable even a 12 months in the past.

Volatility could also be one downside for its inclusion, with Bloomberg highlighting that Technique’s 30-day value swings run at round 96%, considerably greater than Nvidia’s 77% and Tesla’s 74%.

The S&P committee perhaps reluctant to incorporate MSTR on that foundation, in line with the report.

The S&P committee has the ultimate say in the case of which firms are added to the index, which may imply candidates that meet liquidity necessities are nonetheless overlooked.

Expertise shares at the moment dominate the index, however the committee’s current inclusion of US crypto change Coinbase International Inc and Jack Dorsey’s fintech agency Block Inc suggests the committee is beginning to acknowledge the rising footprint of the crypto area, the report stated.

Doubts Over Sustainability Of Technique’s Company Treasury Mannequin

Regardless of the potential for S&P 500 inclusion, there was rising skepticism across the sustainability of Technique’s company treasury mannequin.

The corporate depends on debt financing to build up BTC, a technique that comes with dangers, particularly if the corporate’s inventory value, or Bitcoin, fall steeply.

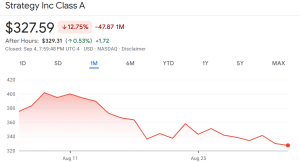

MSTR share value (Supply: Google Finance)

Over the previous month, MSTR’s value has plummeted over 12%. Throughout this identical interval, BTC has slipped 1%, and trades at $112,710.44 as of three:20 a.m. EST, knowledge from CoinMarketCap reveals.

Nevertheless, Technique’s share value continues to be up over 6% on the 6-month timeframe, and MSTR stays greater than 13% within the inexperienced YTD.

Technique BTC holdings (Supply: SaylorTracker)

Technique Is Largest Bitcoin Treasury Agency

Technique is the main Bitcoin treasury firm and is usually seen as a proxy for the worth of BTC given the corporate’s excessive focus within the digital asset.

In keeping with knowledge from Bitcoin Treasuries, Technique holds 636,505 BTC on its stability sheet. The firm is sitting on an unrealized achieve of greater than $25.98 billion, or round 57%, because the agency kicked off its BTC accumulation again in 2020. At present costs, Technique’s Bitcoin stash is valued at $71.45 billion.

The corporate’s most up-to-date Bitcoin buy was on Sept. 2, when it purchased one other 4,084 BTC price round $449.3 million at a mean value of $110,81, in line with an X put up by Saylor.

Technique has acquired 4,048 BTC for ~$449.3 million at ~$110,981 per bitcoin and has achieved BTC Yield of 25.7% YTD 2025. As of 9/1/2025, we hodl 636,505 $BTC acquired for ~$46.95 billion at ~$73,765 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/dxXWygUijS

— Michael Saylor (@saylor) September 2, 2025

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection