After hitting its newest all-time excessive of $4,956 on August 23 on Binance, Ethereum (ETH) has been buying and selling in a decent vary – oscillating between $4,200 to $4,500 – giving little clues about its subsequent potential route. Nonetheless, current change knowledge counsel {that a} provide crunch could also be nearing for ETH.

Ethereum Value Steady Amid Trade Provide Decline

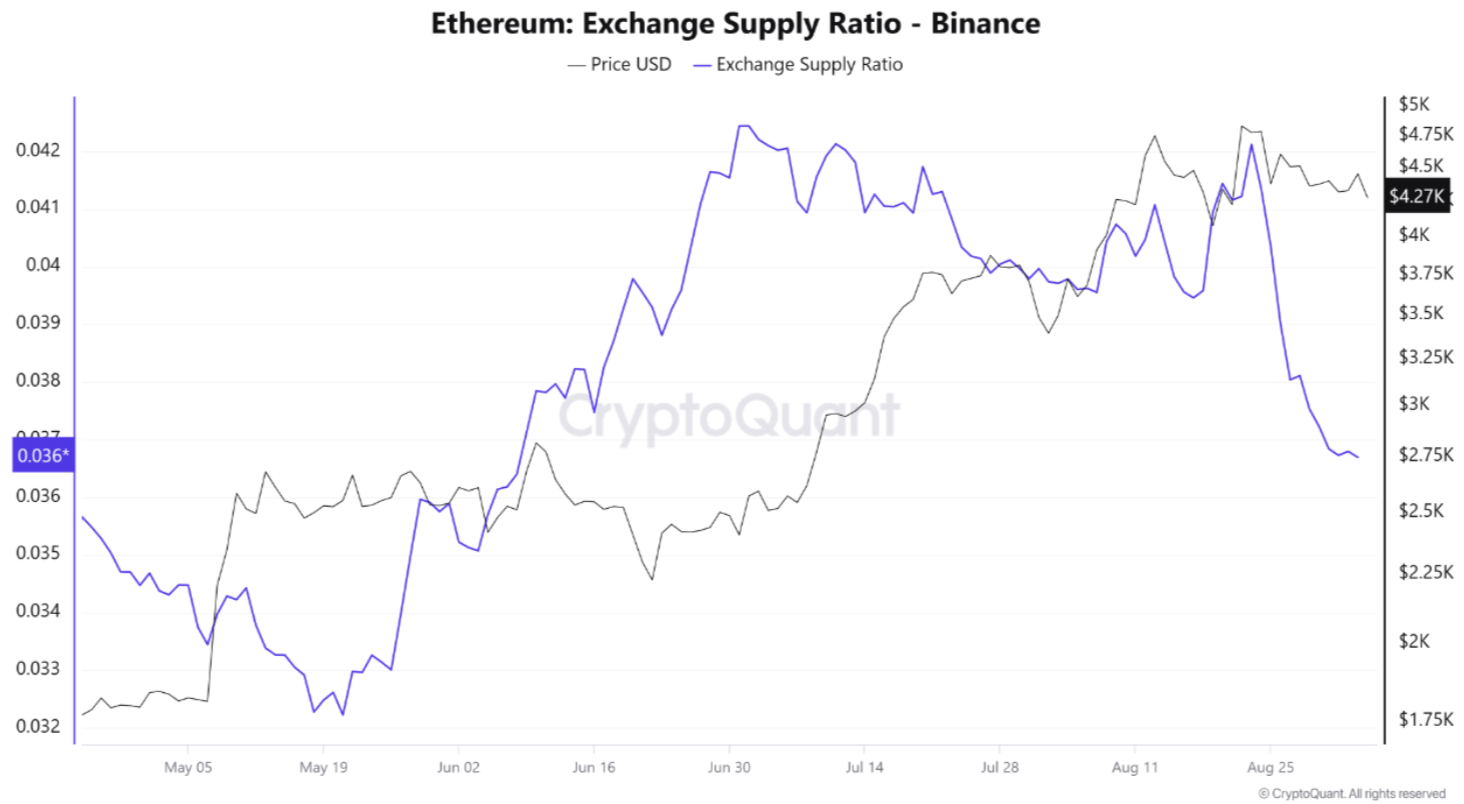

Based on a CryptoQuant Quicktake put up by contributor Arab Chain, in the course of the interval between August 16 to September 3, Ethereum’s Binance Trade Provide Ratio (ESR) noticed a sharp decline.

Associated Studying

Though ETH’s value has remained within the mid $4,000 vary, its ESR tumbled from 0.041 to 0.037 – marking the most important decline throughout the noticed interval – in a matter of simply two weeks.

It’s value highlighting that ETH’s value has remained steady all this time, buying and selling near $4,400 on the finish of the interval. Based on the CryptoQuant analyst, such value conduct can clarify two issues.

First, it indicators that buyers are withdrawing from exchanges – together with Binance – at an accelerated tempo. Additional, it additionally reveals rising confidence amongst ETH holders as they go for self-custody in chilly wallets as a substitute of conserving their holdings on exchanges.

Arab Chain remarked {that a} mixture of steady value, declining change provide, and wholesome exchange-traded fund (ETF) inflows confirms that sellable provide is dwindling whereas the demand for the digital asset stays sturdy. They added:

Declines in ESR have traditionally preceded sturdy upward strikes, as decrease change liquidity limits sellers’ potential to push costs down. The present ESR ranges have fallen again to pre-June figures, suggesting that the market has successfully “flushed out” earlier profit-taking exercise and is now reaccumulating provide into long-term wallets.

ETH Coming into A New Bull Cycle?

The analyst concluded by saying that if ETH’s ESR continues to fall with out a corresponding decline in value, then it could imply that the market is getting into a brand new, institutional investor-led bull cycle. Three metrics particularly assist this prediction.

Associated Studying

The ETH market has seen a current drop in leverage, that means there are fewer merchants with speculative positioning. Additional, most perpetual futures markets present impartial funding charges for ETH contracts. Lastly, the on-chain exercise by ETH whales has additionally subsided, that means long-term holders aren’t promoting.

Additionally value noting is that the Ethereum blockchain’s fundamentals proceed to enhance. Newest knowledge reveals that as a lot as 36 million ETH has been staked on the ETH community, additional elevating the potential for an ensuing provide shock.

Not too long ago, Ethereum day by day transactions additionally hit a 12-month excessive. Amid these bullish developments, seasoned trade specialists aren’t shying away from giving formidable ETH value predictions. At press time, ETH trades at $4,295, down 1.7% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com