Technique, previously often known as MicroStrategy, has constructed its fame because the world’s largest company Bitcoin holder, but the corporate was not noted of the S&P 500 in the course of the newest rebalancing.

The choice shocked many within the crypto neighborhood, who anticipated the Michael Saylor–led agency to hitch the ranks of America’s Most worthy corporations. Notably, crypto buying and selling platform Robinhood was included within the index.

Sponsored

Sponsored

Why Did Technique Miss Out on S&P 500 Inclusion?

The S&P Dow Jones Indices doesn’t disclose why particular companies are excluded, however its standards require that corporations submit optimistic earnings over the past 4 quarters, together with the most recent quarter. Technique’s monetary document doesn’t meet that bar.

Since pivoting to Bitcoin in 2020, the corporate’s outcomes have swung sharply relying on BTC’s value.

Sponsored

Sponsored

Within the second quarter of this yr, rising Bitcoin valuations pushed Technique’s internet revenue above $10 billion. Nonetheless, only one quarter earlier, a BTC hunch compelled the agency to document a $4.2 billion internet loss.

This inconsistency seemingly factored into the choice to exclude the inventory regardless of its market capitalization and buying and selling quantity.

“MicroStrategy’s financials are dominated by unrealized beneficial properties/losses on Bitcoin holdings, which swing its earnings from massive income to massive losses quarter by quarter,” crypto analyst Vincent Van Code mentioned on X.

Certainly, Technique’s potential addition to the S&P 500 carries weight past status. The index anchors trillions of {dollars} in institutional funds and ETFs, which means inclusion usually sparks further shopping for stress.

Technique, which at the moment holds 636,505 BTC in its company treasury, may use that recognition to draw extra mainstream buyers to the rising trade.

Contemplating this, some crypto neighborhood members argue that the index ought to adapt to the brand new monetary actuality Bitcoin represents.

Sponsored

Sponsored

“S&P 500 wants MSTR, MSTR doesn’t want S&P 500. Bitcoin deserves a spot in each retirement account,” Jeff Walton, the Vice President of Bitcoin Technique at Try, said.

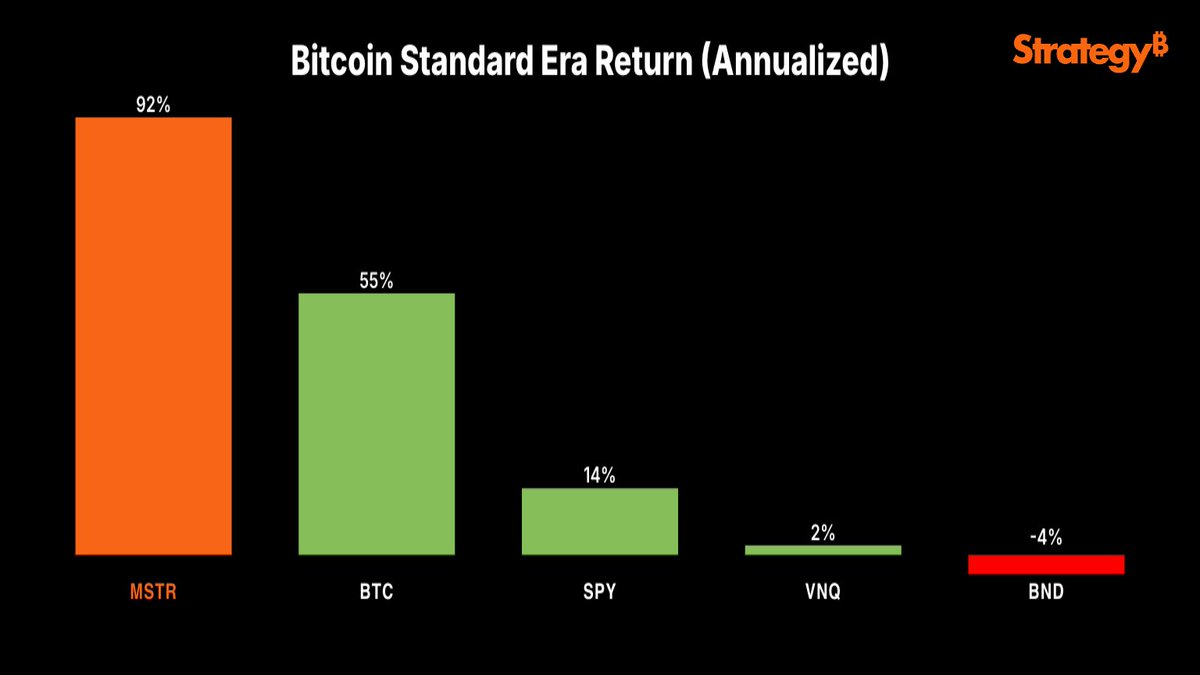

To corroborate this level, Saylor identified that the agency’s inventory has delivered almost double the return of Bitcoin itself. He added that it has outclassed conventional property such because the S&P 500.

In the meantime, the following alternative for inclusion will are available in December, when S&P will announce its new quarterly changes.

Till then, Technique’s exclusion highlights the stress between conventional monetary metrics and digital property’ unstable however rising affect.