Ethereum’s restoration rally has stalled over the previous few days, with ETH buying and selling sideways as promoting stress mounts.

The hesitation stems from long-term holders (LTHs) transferring to safe income, a pattern traditionally tied to main value reversals. Whereas this conduct shouldn’t be new, its reappearance threatens additional draw back.

Sponsored

Sponsored

Key Ethereum Holders Promote

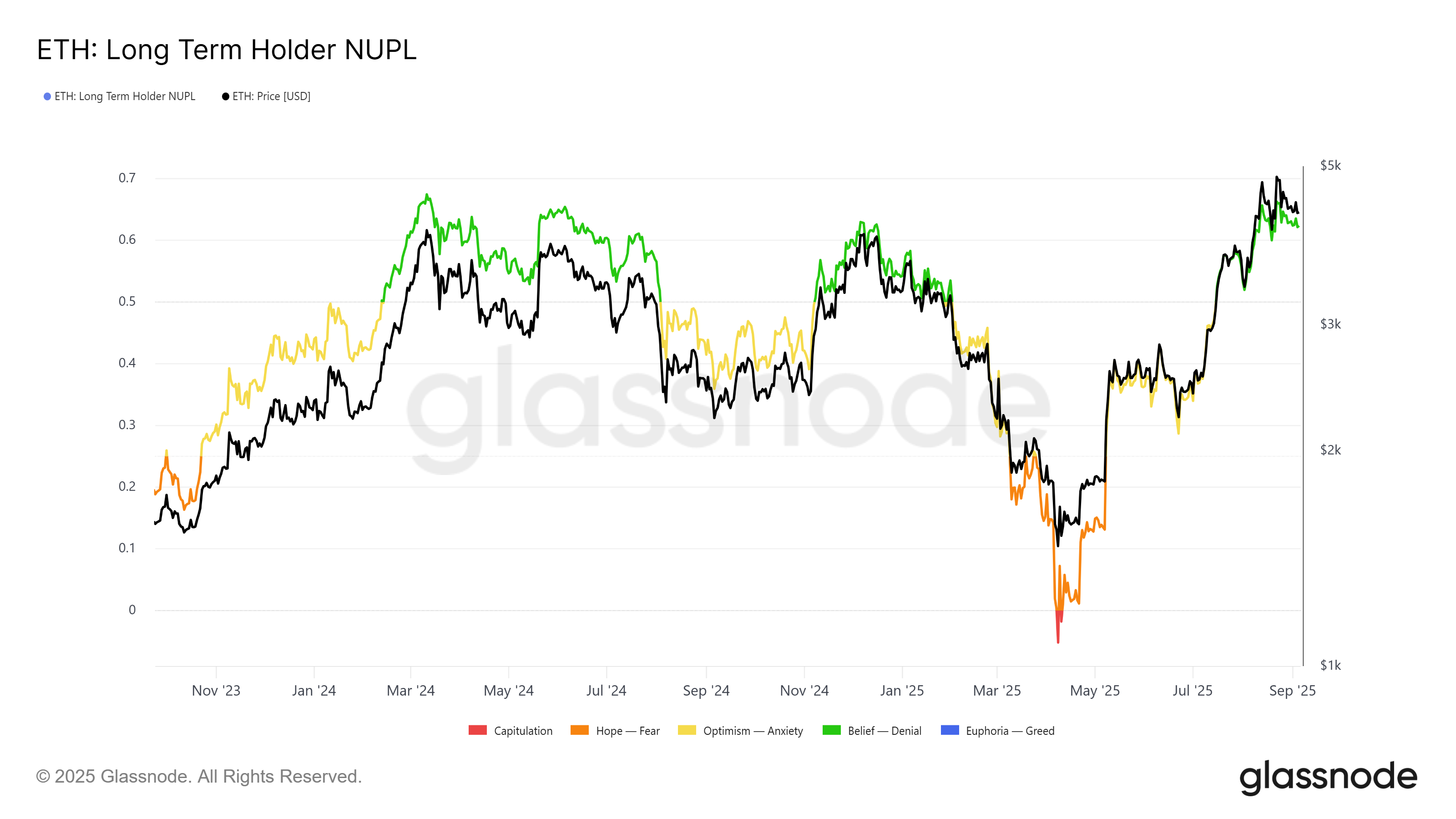

The LTH Web Unrealized Revenue and Loss (NUPL) metric reveals that every time the indicator crosses the 0.65 mark, Ethereum’s value struggles.

It’s because revenue ranges attain a saturation level the place seasoned traders choose to promote moderately than maintain, leading to value stagnation or corrections.

At present, Ethereum displays the identical conduct as its previous cycles. With LTHs realizing substantial income, the sell-off is undermining ETH’s upward trajectory. Consumers hesitate to soak up the promoting stress, leaving ETH susceptible to prolonged consolidation.

Sponsored

Sponsored

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

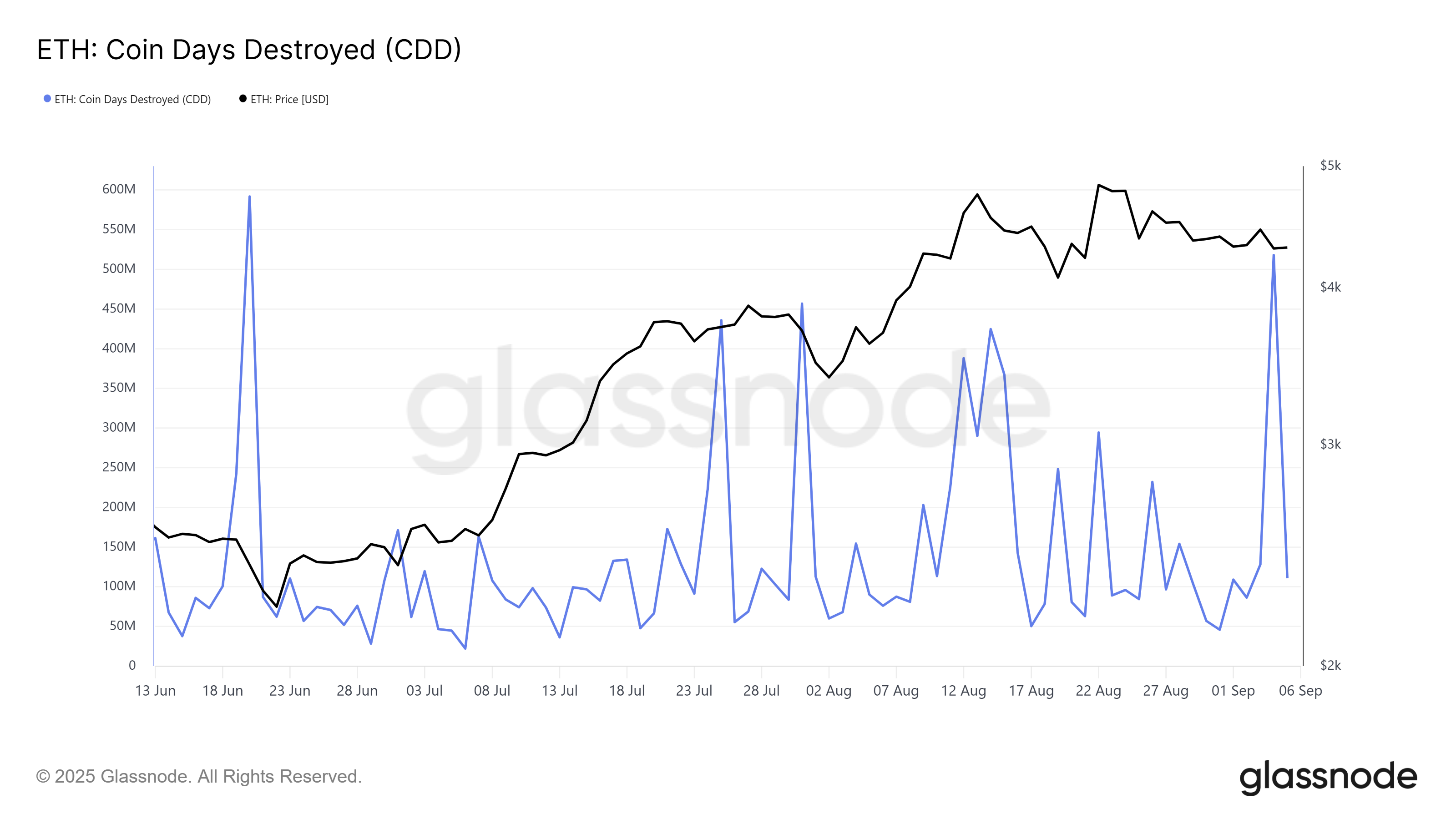

The Coin Days Destroyed (CDD) metric helps this pattern, exhibiting LTHs are actively liquidating holdings. Up to now 24 hours, CDD registered its sharpest spike in two months, highlighting elevated promoting.

Such exercise typically indicators additional draw back danger. LTH promoting at elevated ranges signifies a insecurity in quick restoration. Except offset by robust inflows from different investor teams, ETH’s macro momentum suggests a cooling interval.

ETH Worth To Stay Stagnant

Sponsored

Sponsored

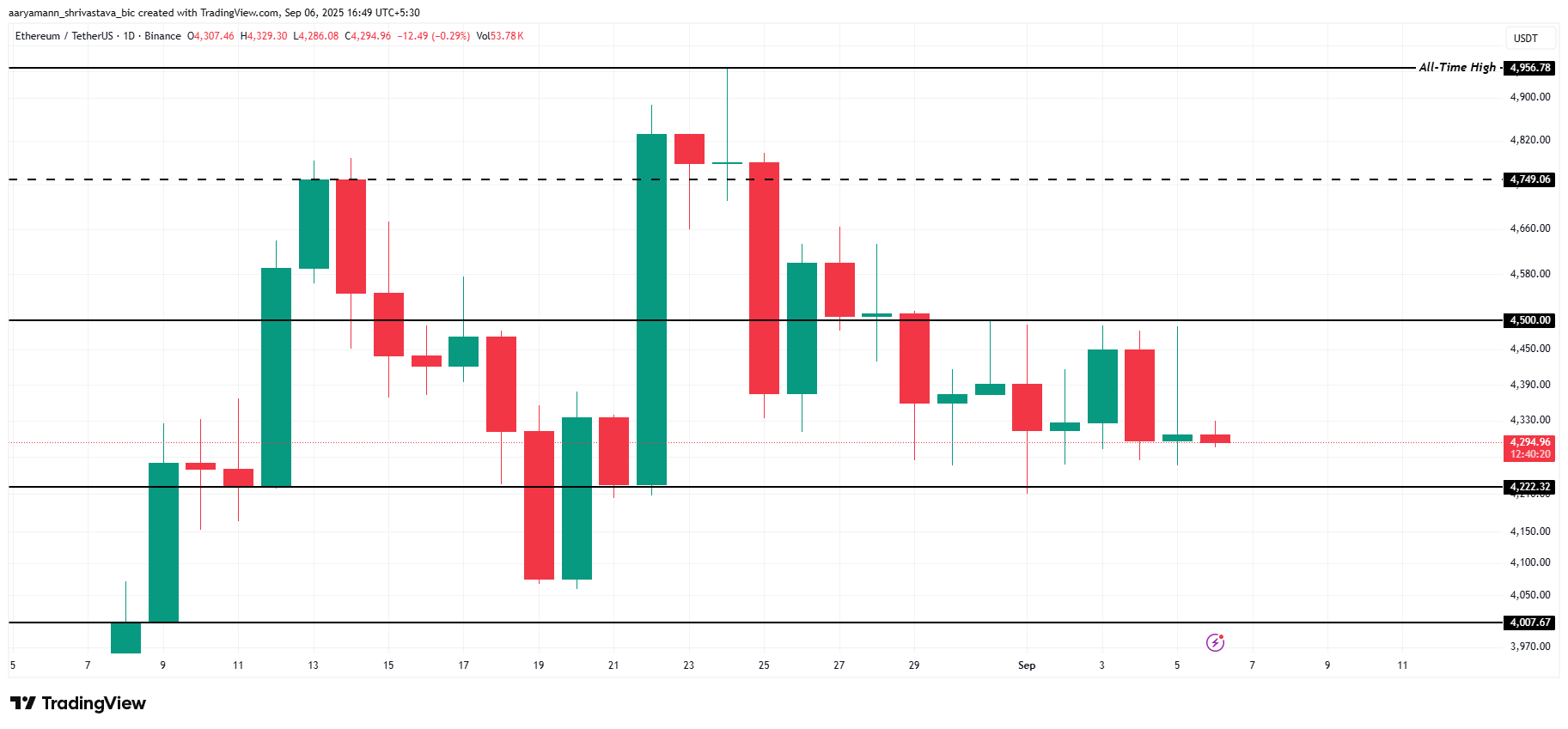

Ethereum’s value is at present at $4,294, holding above the $4,222 help stage. The problem stays ETH’s repeated failure to breach $4,500 over the previous few days, a ceiling that now acts as a important resistance barrier for the altcoin king.

This implies ETH might stay rangebound within the close to time period. With LTHs reserving income, upside potential is capped, leaving ETH oscillating between $4,222 and $4,500 till market circumstances enhance or demand absorbs the continuing promote stress.

If different traders step in to purchase ETH offloaded by LTHs, restoration may nonetheless materialize. A profitable breach and flip of $4,500 into help would open the trail for ETH to retest $4,749.

This could mark a possible resumption of its broader bullish trajectory.