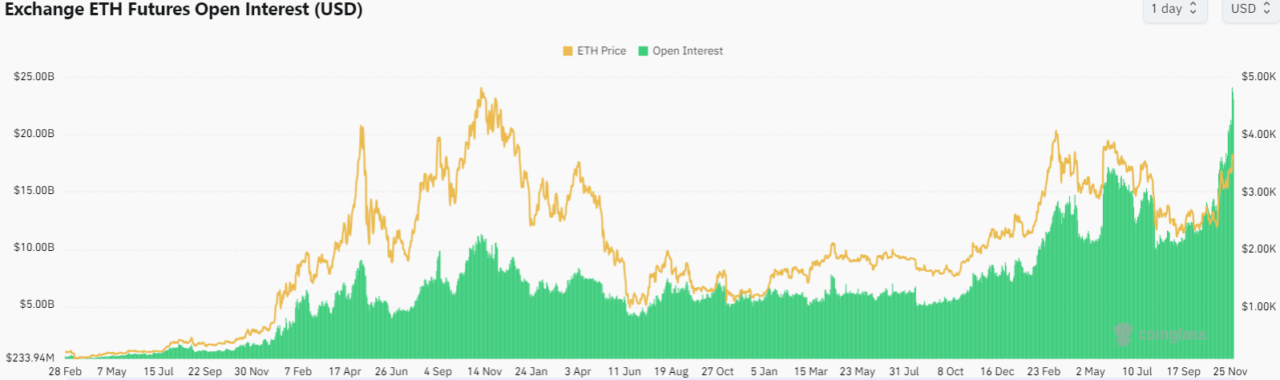

Information exhibits that open curiosity on Ethereum derivatives contracts has lately exploded upward to a brand new all-time excessive of $23 billion, up from round $7 billion at first of the yr, in an upward transfer that one analyst recommend is “assured for heavy fireworks.”

Based on knowledge from CoinGlass, there are actually $23 billion value of ETH futures open curiosity, suggesting a rising quantity of positions are being created on the cryptocurrency as contemporary capital flows into the market.

The inflow of capital could result in rising volatility within the close to future by amplifying potential value actions, therefore its potential to result in “heavy fireworks,” in line with CryptoQuant analyst Maartunn.

The rise in open curiosity comes at a time by which the value of Ethereum has been considerably underperforming that of Bitcoin, with knowledge from CryptoCompare displaying that whereas the flagship cryptocurrency is up greater than 156% during the last 12-motnh interval, ETH solely rose 77%.

As CryptoGlobe reported, an enormous Ethereum whale that amassed almost 400,000 ETH when the second-largest cryptocurrency by market capitalization was buying and selling at round $6 per token has lately restarted promoting.

Based on knowledge shared by on-chain evaluation agency Lookonchain, the whale amassed a complete of 398,889 ETH for round $2.4 million between January and March 2016, with the tokens now being value over $1.34 billion after Ethereum’s value exploded within the final eight years.

The cryptocurrency is now buying and selling at $3,600 per token and has a $433 billion market capitalization. Per Lookonchain, the large Ethereum whale remained dormant for over eight years, earlier than it restarted promoting on November 7.

Whereas Bitcoin is buying and selling close to a report, Ethereum remains to be removed from its all-time excessive close to $4,600 seen again in 2021. As CryptoGlobe reported, late final month the quantity of ETH being held on cryptocurrency exchanges has plunged by round $750 million after large withdrawals of the second-largest cryptocurrency by market capitalization from these platforms.

Featured picture through Unsplash.