Stellar (XLM) value has surged over 400% within the final 30 days, marking one of the crucial vital rallies in November. After reaching $0.63, its highest value since 2021, XLM now faces potential consolidation as its pattern indicators present indicators of weakening.

Regardless of this, the uptrend stays intact, supported by sturdy market curiosity and bullish sentiment. If XLM can regain its momentum, it might goal $0.70 subsequent, persevering with its exceptional ascent.

XLM Present Development Is Dropping Its Power

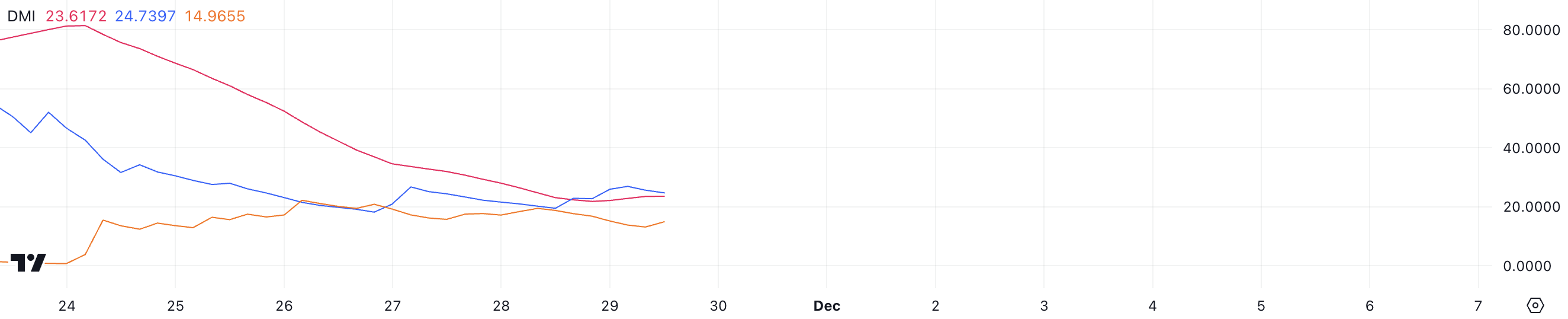

Stellar DMI chart signifies an ADX of 23.6, down considerably from over 40 simply two days in the past, suggesting weakening pattern momentum. The ADX, or Common Directional Index, measures the energy of a pattern on a scale of 0 to 100 with out indicating its course. Values above 25 sign a powerful pattern, whereas values beneath 20 counsel a weak or no pattern.

Though XLM value stays in an uptrend, the declining ADX displays diminishing momentum, hinting at potential consolidation or a slowdown within the bullish motion.

With the constructive directional indicator (D+) at 24.7 and the detrimental directional indicator (D-) at 14.9, XLM’s uptrend nonetheless reveals a transparent bullish bias. The upper D+ worth highlights that purchasing strain is at the moment outpacing promoting strain, supporting the continuation of the uptrend.

Nonetheless, for the pattern to regain energy, the ADX would want to climb again above 25, signaling stronger momentum. Till then, Stellar value may even see extra modest good points or a interval of consolidation.

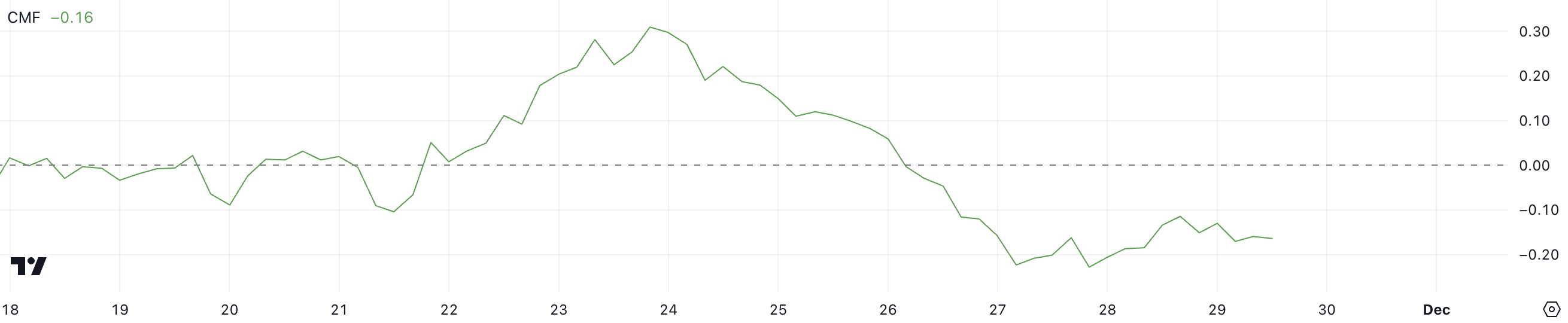

Stellar CMF Has Been Adverse for 3 Days

XLM’s CMF at the moment stands at -0.16, marking a sustained detrimental pattern since November 26 after being constructive for 4 consecutive days. The CMF, or Chaikin Cash Circulate, measures capital inflows and outflows over a given interval, with values above 0 signaling shopping for strain and values beneath 0 indicating promoting dominance.

A detrimental CMF worth means that promoting exercise has outweighed shopping for, which may gradual the present uptrend.

At -0.16, Stellar CMF signifies reasonable promoting strain, doubtlessly limiting its current bullish momentum. Whereas this worth displays a shift in sentiment, it stays much less extreme than extra excessive detrimental ranges seen throughout stronger corrections.

If the CMF developments additional downward, it may sign a weakening uptrend and improve the chance of a value pullback. Conversely, if it returns to constructive territory, it could reaffirm rising shopping for strain and assist continued value good points.

XLM Worth Prediction: Can It Attain $0.7 In December?

Stellar value not too long ago achieved $0.63, its highest value since 2021, showcasing spectacular bullish momentum. XLM is up 433.84% within the final 30 days.

If the present uptrend regains energy, XLM value may retest this resistance stage and doubtlessly rise to $0.70, representing a 37% improve from present ranges.

Nonetheless, if the uptrend fails to maintain and promoting strain will increase, XLM value may face a reversal. On this state of affairs, the token could check its key assist at $0.41, a big stage to take care of its medium-term bullish outlook.

A failure to carry this assist may sign a deeper correction and diminish the current constructive momentum.

The put up Stellar (XLM) Worth Return to $0.70 May Be Postponed for Now appeared first on BeInCrypto.