- XRP is shifting from its unique “financial institution rail” imaginative and prescient to new roles like retail remittances, SME funds, and IoT micropayments.

- Platforms like goLance and SBI Japan already use XRP for quick, low-cost cross-border transfers.

- The XRPL ecosystem and XRP’s provide burn place it as each a utility asset and a possible hedge in a CBDC-driven world.

When XRP launched, its pitch was daring—turn out to be the digital rail for banks, the SWIFT killer for cross-border settlements. Greater than a decade later although, the banking world hasn’t fairly signed on. As a substitute, giants are tinkering with central financial institution digital currencies (CBDCs) and constructing their very own inside rails. Some critics, particularly of us from the Chainlink neighborhood, have even referred to as this a loss for XRP. However that’s not the entire story. The token has carved out new paths—smaller possibly, however significant—that hold it related and rising.

XRP because the Folks’s Rail

One in every of XRP’s strongest lanes now could be retail remittances. In international locations like Mexico, the Philippines, Nigeria, and India, tens of millions of employees depend on cross-border transfers to assist households. Each second saved and each charge lower issues. Platforms like goLance, led by Michael Brooks, are already utilizing XRP to pay freelancers immediately and cheaply. For employees incomes round $50 per week, ready days or dropping 10% to financial institution charges isn’t an possibility. XRP fixes that. With the worldwide remittance market close to $860 billion, this “individuals’s rail” narrative might quietly turn out to be XRP’s new spine.

Company Funds With out Financial institution Approval

Small and mid-sized companies are one other alternative. They don’t have to overthrow banks—they only need quicker, cheaper methods to pay suppliers, freelancers, or groups overseas. XRP gives that. Take SBI Japan in 2023: they launched an XRP-based service for remittances into the Philippines, Vietnam, and Indonesia. Utilizing XRP as a bridge foreign money, funds transfer rapidly and land in native foreign money with minimal price. This exhibits adoption can develop steadily outdoors conventional finance, particularly in high-volume corridors throughout Asia.

Fueling the Web Economic system

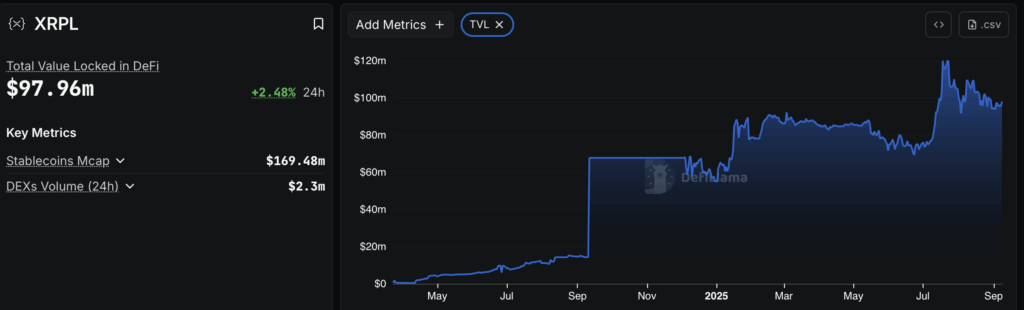

The longer term isn’t solely about remittances or payrolls. XRP might play a task within the on-line economic system too. Assume micropayments for gaming, streaming, IoT gadgets, and even automated API calls. Bitcoin’s Lightning Community and stablecoins are standard right here, however XRP’s pace and low charges make it a pure contender. On high of that, the XRP Ledger itself is increasing—decentralized exchanges, tokenized belongings, automated market makers, even NFT initiatives are bobbing up. As stablecoin issuers be part of the XRPL, XRP’s worth as a bridge and liquidity asset grows stronger.

XRP in a CBDC World

Wanting additional forward, XRP may additionally discover a area of interest as a reserve-like asset. With transaction charges regularly burning XRP provide, shortage might make it engaging as a hedge in a CBDC-heavy world. It doesn’t want to interchange the greenback or euro. Simply being another allocation in portfolios might assist long-term worth.

Ultimate Phrase

The concept XRP’s success relies upon completely on banks is outdated. As a substitute, XRP has discovered new legs—from remittances and SME funds to IoT micropayments and tokenized belongings. Every use case could also be smaller than the unique “financial institution rail” dream, however collectively they create a various basis that retains XRP alive and kicking. Banks could hesitate, however XRP nonetheless has loads of methods to win.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.