Somnia, an EVM-compatible Layer 1 blockchain, has rapidly birthed one of many fastest-rising new tokens. At press time, Somnia (SOMI) trades close to $1.59, after leaping nearly 40% prior to now 24 hours. Since its launch, the Somnia worth has been up greater than 250%. Nonetheless, it has pulled again about 14% from its all-time excessive of $1.84, set only some hours in the past.

On the floor, this appears like a token cooling off. However repeating chart patterns and technical alerts recommend that the worth pullback may simply be a pause earlier than the subsequent rally begins.

Sponsored

Sponsored

Chart Fractals Trace at One other Rally, With Bulls In Management

One of many clearest clues for the Somnia worth comes from repeating momentum alerts. The Relative Power Index (RSI) is a device that measures the power of worth strikes on a scale of 0 to 100. Decrease numbers recommend weak point, whereas greater numbers present power.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

Sponsored

Sponsored

On Somnia’s 1-hour chart, the identical setup that appeared earlier than its final massive rally has surfaced once more. Again when the token traded close to $1.10, the worth made a better low whereas the RSI dipped to a decrease low. This mismatch, referred to as a divergence, confirmed sellers had been fading. What adopted was a surge from $1.10 to $1.84 — practically 70% positive factors.

That very same sign has now returned. The Somnia worth has held a better low, whereas the RSI has continued to slip decrease. This typically suggests hidden power, with consumers quietly taking up.

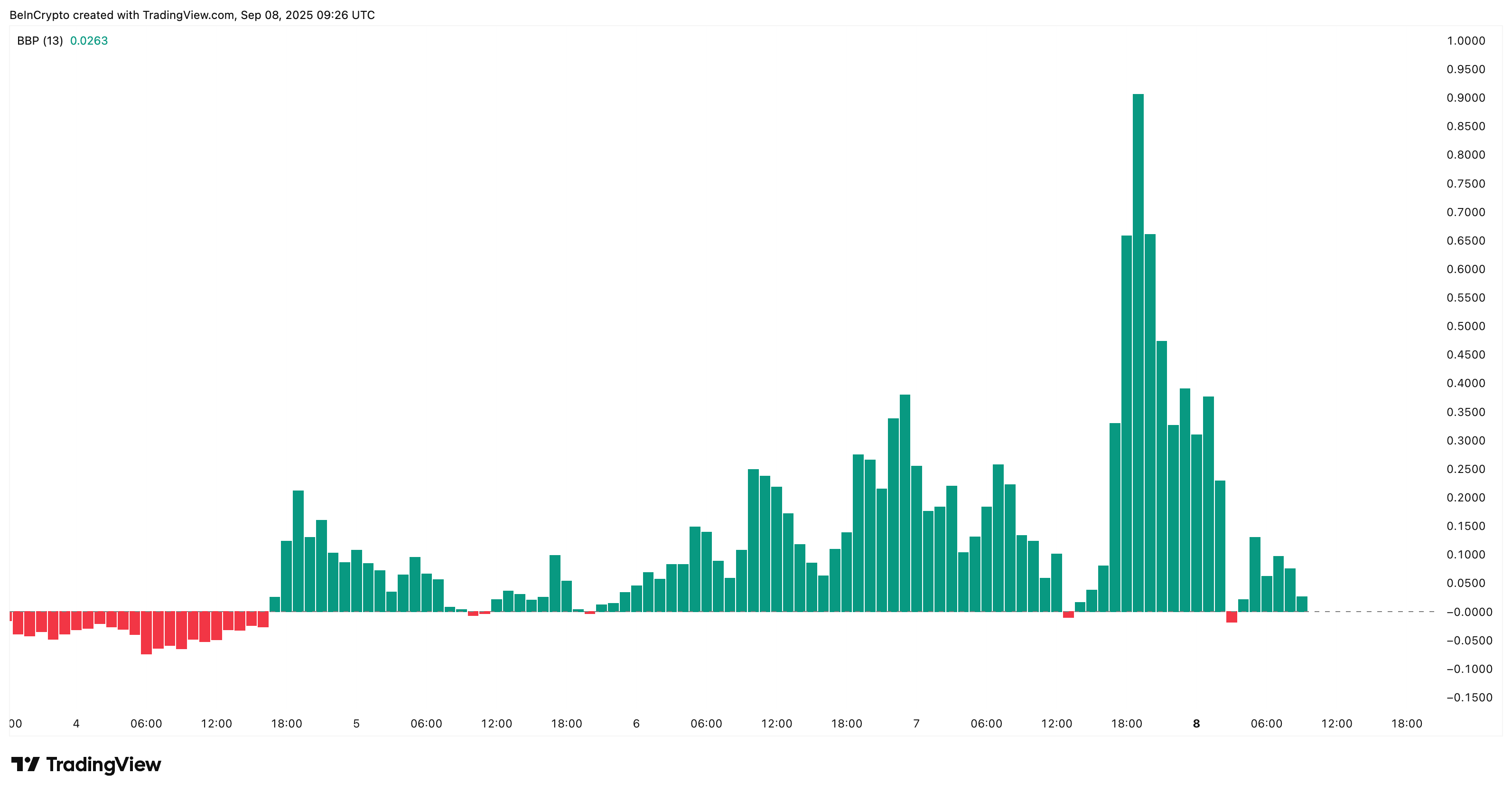

Supporting this case, the bull-bear energy indicator — which compares purchaser strain towards vendor strain — remains to be optimistic. Even with the latest pullback, consumers are stronger than sellers, giving weight to a different potential breakout.

Somnia Worth Ranges And Inflows Line Up For A Breakout

As a result of Somnia is a brand new token, it has little buying and selling historical past. That’s why merchants use Fibonacci extensions of earlier strikes to challenge potential targets. Right here’s how the setup appears now:

Sponsored

Sponsored

- The primary hurdle is $1.62, simply above the present $1.59 stage.

- If cleared, the subsequent take a look at is $1.86, near the final excessive. That may once more put SOMI within the worth discovery class.

- Past that, projections level to $2.12 after which $2.31.

A transfer from $1.59 to $2.32 can be a rally of virtually 46%.

Regular inflows highlighted on the 1-hour chart affirm this worth map. The Chaikin Cash Circulation (CMF) tracks whether or not cash is getting into or leaving a token. So long as CMF stays above zero, it reveals that cash is flowing in. Even in the course of the correction from $1.84 to $1.59, the CMF continued to maneuver greater. Meaning giant wallets continued to purchase in the course of the dip, protecting demand alive.

Nonetheless, a dip underneath $1.41 would invalidate this short-term bullish speculation. If that occurs, the SOMI worth may even appropriate to $1.08 within the absence of robust technical help ranges.

When each worth ranges and inflows level in the identical course, it typically means a pullback shouldn’t be weak point however a reset; a catapult-like setup for the subsequent rally.