Federal Reserve coverage selections have been among the many most influential drivers of crypto efficiency this 12 months. Every minimize to the benchmark fee has left a transparent mark in the marketplace, igniting strikes that ripple throughout digital property virtually immediately. For a number of months, buyers waited with little progress on that entrance, however September has now introduced a turning level.

Market information signifies close to certainty {that a} fee minimize is imminent, creating the strongest backdrop but for crypto merchants in 2025. With the chances priced in at 100%, the stage is ready for a surge of capital into each Bitcoin and choose altcoins. For this reason consideration has returned to figuring out tasks that would ship outsized returns as liquidity improves.

Charge Cuts, Digital Gold, and the Crypto Pump

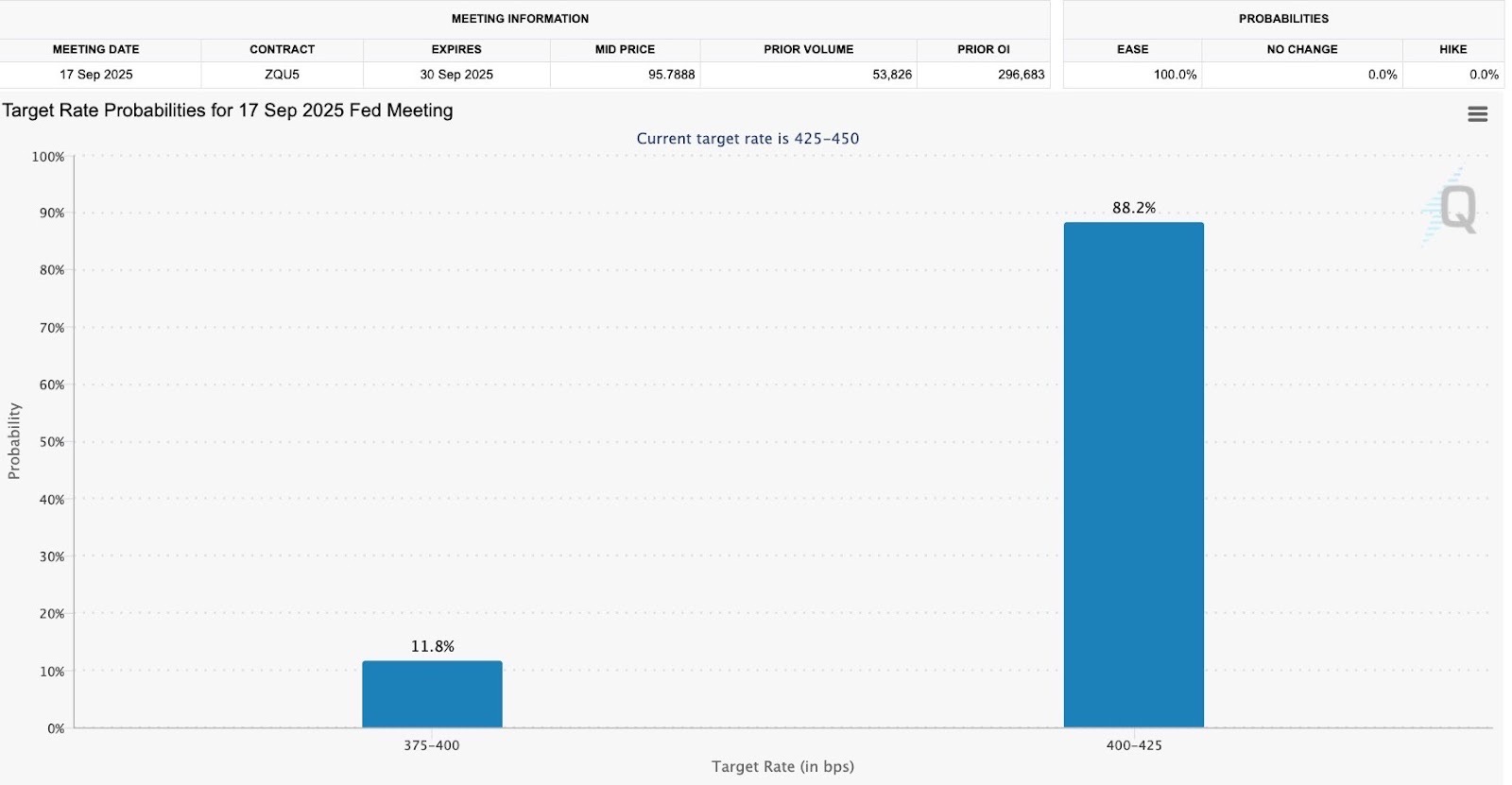

The September assembly has develop into a decisive second for world markets. In keeping with CME’s FedWatch instrument, merchants are actually assigning a 100% probability that the Federal Reserve will minimize charges, with the majority of bets set on a 25 foundation level transfer. A smaller fraction nonetheless leaves open the potential for a bigger 50-point minimize, although that continues to be unlikely with out clearer proof of financial weak spot.

The mushy August jobs report, which confirmed payrolls increasing by solely 22,000 and unemployment rising to 4.3%, helped cement the case for motion. Wall Avenue now views a fee minimize as a close to certainty, with some economists even projecting a string of reductions throughout the subsequent a number of conferences.

Gold has already responded, climbing steadily as buyers hedge in opposition to simpler cash. Bitcoin, usually described as digital gold, has adopted the identical trajectory. Inside a day it moved from simply above $110,000 to greater than $112,000, a rally that illustrates how tightly its valuation tracks financial coverage. In previous cycles, the hyperlink between Fed easing and crypto upside has been instant, as decrease yields push capital towards danger property and different shops of worth.

This backdrop is why buyers are already positioning forward of the official announcement. With odds priced in at full certainty, the search has shifted to the property most definitely to seize inflows.

Bitcoin offers the bottom, however the strongest alternatives usually lie in rising tasks that may trip the identical wave with amplified momentum. For a lot of, this second represents one of many clearest home windows of the 12 months to purchase into high quality crypto earlier than liquidity accelerates.

Finest Crypto to Purchase Now As Market Expectations Flip Bullish

Finest Pockets Token

A bullish flip throughout the market usually pushes merchants to seek for dependable entry factors into tasks that provide day by day relevance and broad participation. Finest Pockets Token sits firmly in that class.

The pockets has developed past a easy storage instrument, presenting itself as a full Web3 suite that features a decentralized trade, staking, token swaps, portfolio administration, and built-in entry to dApps. This versatility means it’s not only a passive holding setting however an lively hub for participation in crypto.

The significance of that function grows as liquidity begins to increase. When markets flip bullish, new contributors arrive and veterans reposition. Each teams require safe, intuitive, and feature-rich infrastructure.

Finest Pockets has designed its ecosystem to fulfill that demand by simplifying entry throughout a number of chains, together with Ethereum and Solana, whereas providing added layers reminiscent of a factors system that rewards exercise.

The presence of those options has helped the token stand out as greater than a utility layer, as an alternative representing direct publicity to the platform’s rising adoption. It has already raised upwards of $15 million, and will quickly make its approach to numerous exchanges post-listing.

🔥 Over $15M Raised! 🔥

Finest Pockets is setting a brand new commonplace for velocity, entry, and management:

✅ Commerce new tokens early, straight in-app

✅ Swap throughout chains seamlessly

✅ Modern design paired with full management📲 Obtain Finest Pockets at present: https://t.co/Ykt3PTrPG0 pic.twitter.com/qIZ8kY96L1

— Finest Pockets (@BestWalletHQ) August 21, 2025

Because the Fed prepares to ease situations, the cycle for capital inflows into crypto is ready to widen. Finest Pockets Token presents a approach to seize this momentum whereas being tied to a product that merchants will use in observe.

The mission advantages from the twin impact of total market optimism and utility-driven engagement, making its native token one of many stronger candidates for positive aspects in a bullish local weather.

Pepenode

Momentum usually favors tasks that merge simplicity with an attractive design, and Pepenode has managed to strike that stability whereas including real utility.

Constructed round a mine-to-earn mannequin, the mission gamifies participation by rewarding customers for mining nodes by a digital dashboard that feels extra like a recreation than a standard interface. This mechanism has already confirmed enticing in presale, drawing in customers who worth each leisure and the possibility to earn.

What makes Pepenode stand out on this setting is how its design aligns with present market sentiment. With fee cuts fueling optimism and capital rotation, merchants usually are not simply established property but additionally scouting for early-stage tokens that may ship exponential returns.

Pepenode’s mannequin provides contributors a tangible means of progress. Every mined node contributes to deflationary tokenomics, tightening provide whereas constructing loyalty. This mix of gamification and shortage has already sparked a rising neighborhood, an element that usually performs a decisive function in meme-aligned tasks.

The timing couldn’t be extra favorable. With Bitcoin rising and altcoin sentiment warming, Pepenode presents the sort of recent narrative that buyers search in early cycles. It’s playful sufficient to catch consideration but structured sufficient to construct sustainability.

For merchants getting ready to reap the benefits of looser financial coverage, Pepenode offers a approach to diversify right into a mission that displays the speculative power of the market whereas carrying mechanics that assist long-term participation. This mixture of narrative, design, and timing makes it a critical contender for sturdy efficiency.

Snorter

Telegram bots have develop into one of the adopted sectors of crypto over the previous 12 months, and Snorter has rapidly emerged as a pacesetter inside that house. The mission delivers an AI-powered toolkit that permits buying and selling, sniping, and analysis capabilities straight inside Telegram, reducing down the steps required to behave in fast-moving markets.

This direct integration with the app that a lot of the crypto neighborhood already makes use of day by day offers Snorter with an edge in accessibility and adoption.

What distinguishes Snorter from the various bots which have surfaced not too long ago is its depth. The toolkit contains superior capabilities that attraction not solely to informal merchants but additionally to these looking for extra precision.

Automated buying and selling flows, fast execution, and built-in analytics imply that Snorter positions itself as greater than a gimmick. Its mascot-driven branding provides a lighthearted layer, retaining it aligned with the meme coin tradition, however beneath that design sits a mission that has sensible endurance.

Creators like Borch Crypto and lots of others have already featured the mission of their posts and movies, highlighting its progress potential within the coming weeks.

Within the context of a market charged by Fed easing, velocity and effectivity develop into much more worthwhile. Bullish sentiment results in crowded entry factors, and instruments that permit customers to maneuver quicker can seize important worth.

As buyers look to tasks that mix utility with narrative attraction, Snorter stands out. Its token is not only speculative publicity however a key to unlocking premium options inside the bot, tying demand straight to make use of. With liquidity set to rise and buying and selling exercise anticipated to accentuate, Snorter seems properly positioned to learn.

Bitcoin Hyper

Bitcoin Hyper has develop into one of the intently adopted Bitcoin-based tasks as a result of it takes essentially the most established asset and pushes it into new territory. Designed as a Layer 2 resolution, it focuses on velocity, scalability, and transaction finality whereas retaining the safety of the Bitcoin base layer.

Which means customers can switch and work together with Bitcoin in a manner that’s quicker and cheaper with out sacrificing belief. At a time when community congestion and costs stay obstacles, this enchancment has clear attraction.

The utility goes past easy scaling. Bitcoin Hyper’s structure permits for purposes and integrations that increase Bitcoin’s attain into areas often reserved for different chains.

From DeFi parts to dApp connections, it opens the door for Bitcoin to function as greater than a retailer of worth, whereas its Layer 2 place ensures that liquidity continues to anchor again to the core chain. That twin construction of effectivity and safety is why the mission has gained recognition as greater than a passing experiment.

Within the present macro setting, the timing might be important. With Fed odds absolutely backing a fee minimize and gold already climbing, Bitcoin itself has superior from the $110,000 vary to above $112,000. As buyers equate Bitcoin to digital gold, any mission that enhances its utility turns into extra worthwhile.

Bitcoin Hyper ties straight into that narrative, offering a sensible framework for scaling adoption. If looser financial coverage fuels a recent surge in inflows, Bitcoin Hyper sits as one of many clearest methods to seize that momentum whereas reinforcing Bitcoin’s long-term function.

Conclusion

With the Federal Reserve set to ship its most anticipated fee minimize in years, the situations for a broad market carry are falling into place. Every cycle of easing has drawn liquidity into crypto, and this time the chances are priced in at full certainty.

Bitcoin has already proven the early influence, and historical past means that selective tasks with clear use circumstances usually seize even stronger upside. For buyers positioning forward of the announcement, the very best alternatives might lie in property that pair utility with timing, providing each sensible worth and important potential in a bullish market setting.