- Launch date: Cboe will debut Bitcoin and Ethereum perpetual futures on November 10, 2025.

- Distinctive function: Contracts prolong as much as 10 years, eliminating frequent rollovers.

- Market impression: May shift perpetual buying and selling away from offshore platforms into U.S.-regulated markets.

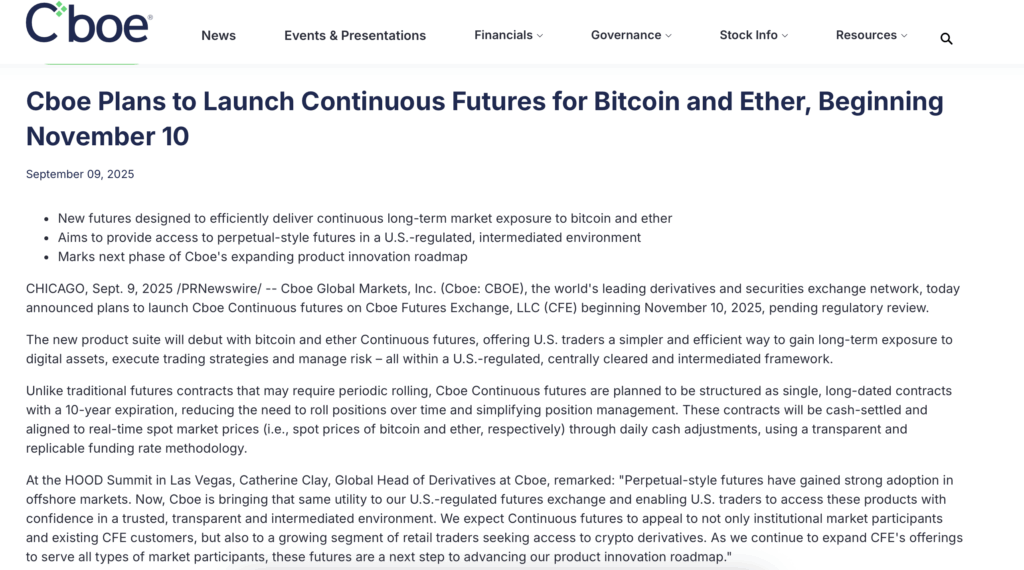

Cboe International Markets is getting ready to roll out perpetual futures for Bitcoin and Ethereum on November 10, 2025. The transfer is being described as a significant milestone in bringing crypto derivatives underneath U.S. regulatory oversight, opening the door for broader adoption of those merchandise by each institutional and retail buyers.

How Cboe’s Crypto Perpetual Futures Work

In contrast to conventional futures that expire and require fixed rollovers, Cboe’s contracts will function maturities of as much as 10 years. This design is aimed toward decreasing buying and selling prices and making long-term publicity to Bitcoin and Ethereum a lot less complicated for buyers. Offshore exchanges have already popularized perpetual contracts, and now Cboe plans to supply a regulated U.S. model that establishments can belief.

Institutional and Retail Demand for Regulated Crypto Derivatives

Catherine Clay, Cboe’s international derivatives chief, emphasised that the demand for perpetual futures has been constructing for years. “We see demand from establishments, current CFE shoppers, and even retail merchants who need entry to crypto derivatives in a clear, centrally cleared surroundings,” she mentioned. The launch is predicted to draw a mixture of institutional buyers and on a regular basis merchants in search of safer, regulated publicity.

Why Cboe’s Perpetual Futures May Reshape U.S. Crypto Markets

The brand new merchandise are designed to attraction to buyers who need environment friendly instruments to hedge threat and execute long-term methods. Extra importantly, the launch indicators a deeper degree of oversight in U.S. crypto markets, the place perpetual contracts have traditionally been dominated by offshore venues. If Cboe succeeds, it might shift a big share of crypto derivatives buying and selling again into the regulated monetary system.

Bitcoin and Ethereum Derivatives Enter a New Period

Cboe’s initiative represents greater than only a new product—it’s a turning level for the U.S. crypto trade. By providing perpetual futures on Bitcoin and Ethereum, Cboe is giving buyers one of the best of each worlds: the safety of regulated markets and the flexibleness of perpetual publicity. This launch might redefine how American merchants and establishments work together with the 2 largest digital belongings.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.