Ethereum is as soon as once more within the highlight as merchants level to historic patterns and on-chain indicators that recommend a serious rally may very well be brewing.

Two extensively shared charts this week spotlight each the technical setup and investor conduct shaping ETH’s outlook.

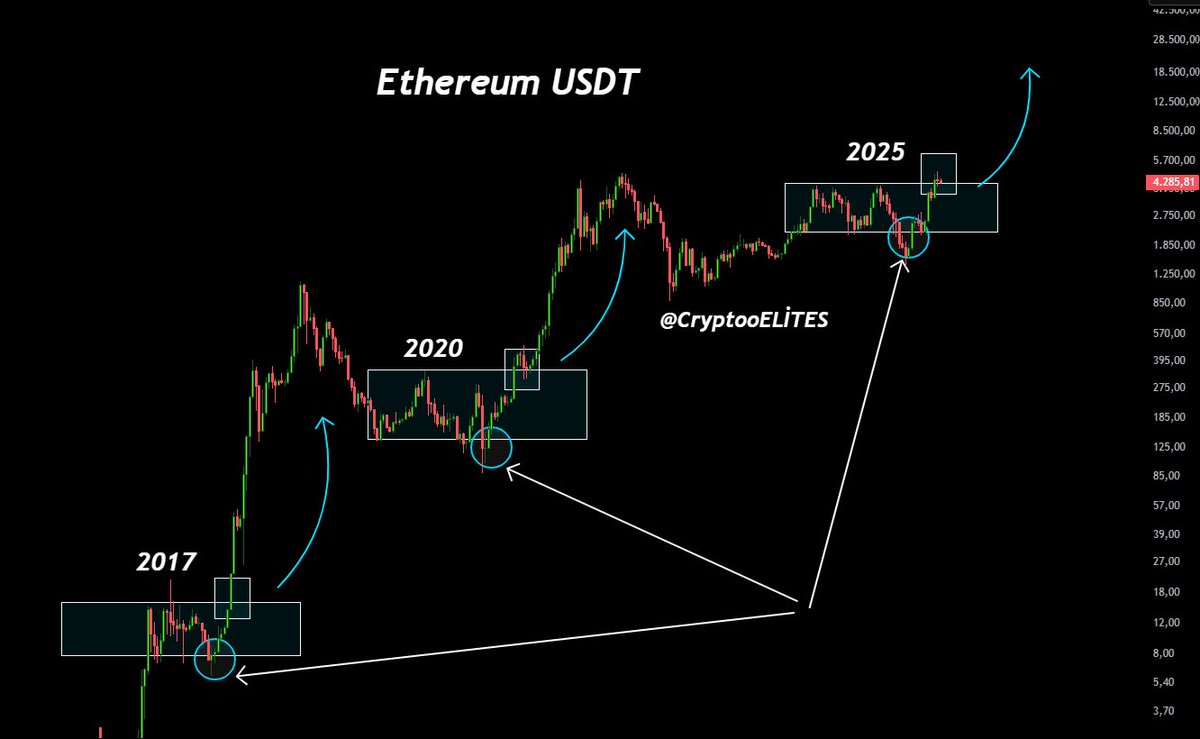

Historic Rhyme: 2017, 2020… and Now 2025

A chart from Crypto Gems exhibits Ethereum repeating a well-known cycle seen in 2017 and 2020—prolonged accumulation phases adopted by explosive upward runs. In line with this mannequin, the present consolidation may very well be the final pause earlier than ETH begins a push towards $10,000, a milestone analysts say could arrive “before you assume.”

Every earlier breakout got here after lengthy sideways intervals the place sentiment turned quiet, solely to be adopted by surging retail inflows and worth discovery. Merchants argue 2025 may very well be organising for the same trajectory.

Whales Accumulate in Silence

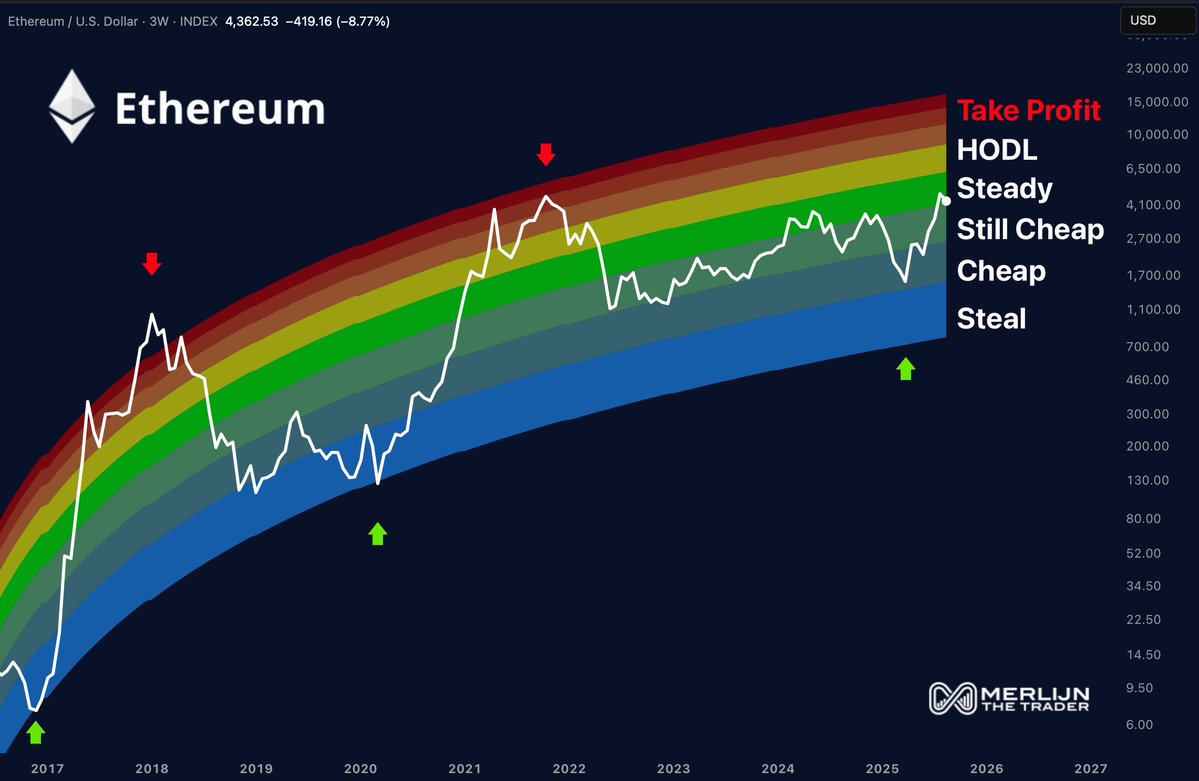

In the meantime, Merlijn The Dealer shared an “Ethereum Accumulation Map” that frames market psychology by way of coloured bands. Retail traders, he argues, sometimes panic within the blue zone, whereas whales purchase aggressively within the inexperienced bands. The present worth motion locations ETH squarely in what he calls the “legendary accumulation zone.”

“The map is obvious: accumulate when it’s quiet, not when it’s crowded,” Merlijn wrote. He cautioned that the pink zone, close to the higher ranges, is traditionally the place vacationers FOMO in and whales take income.

The Greater Image

With ETH consolidating round mid-cycle ranges, merchants consider whales are positioning forward of the subsequent leg larger. If historical past repeats, Ethereum may very well be making ready for one among its strongest rallies yet-potentially taking purpose at five-digit costs.