The cryptocurrency market recovered fairly properly on Sept. 11, pushing new boundaries of the bearish market additional and doubtlessly making much more progress than anticipated. The surge in RLUSD quantity might counsel extra cautious positioning, although. In our most up-to-date market prediction, we broke down how bulls began coming again.

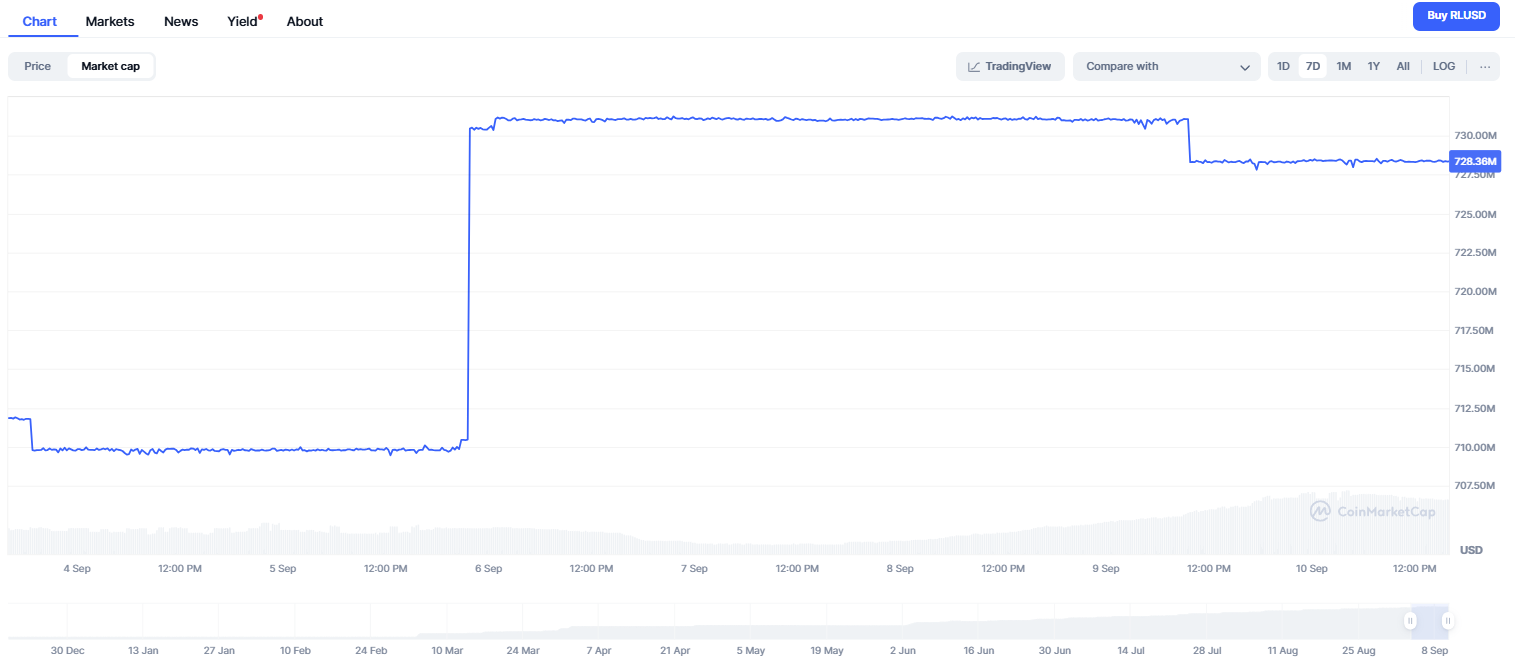

RLUSDT quantity spike

Round $200 million have moved by means of Ripple’s stablecoin, RLUSD, up to now day, marking an enormous spike in buying and selling quantity. This spike is garnering consideration all through the cryptocurrency market, for a token that usually retains a low-key, steady profile as a USD-pegged stablecoin.

There may very well be various causes for this sort of motion. With a purpose to shield themselves from the volatility of extra dangerous belongings like Bitcoin or Ethereum, institutional gamers could also be shifting their cash into RLUSD. Stablecoins are most likely getting used as a protected haven by some merchants because of latest volatility in altcoins and vital inflows into exchanges.

-

The amount would possibly point out early exercise from fee corridors opening up behind the scenes, given Ripple’s steady push for adoption in cross-border funds and settlements. The principle lesson discovered from the spike is that RLUSD stays regular, bolstering belief in its peg mechanism.

-

If the quantity rise continues, it could sign the beginning of a bigger uptake of Ripple’s stablecoin on fee and buying and selling platforms. Buyers ought to monitor whether or not the upper demand ends in deeper liquidity throughout exchanges within the close to future, as this is able to make the RLUSD a extra reliable buying and selling pair.

Normally, hypothesis is much less necessary than the general positioning of the cryptocurrency market on the subject of RLUSD’s $200 million quantity surge. In a method, it attracts consideration to the rising want for stability on an unpredictable market and means that Ripple’s stablecoin would possibly develop into extra vital in future world liquidity flows.

How good can DOGE be?

Dogecoin has carried out surprisingly properly, breaking by means of the $0.24 mark, which few had predicted given its gradual efficiency in latest months. DOGE — which was as soon as regarded as a meme-driven asset susceptible to hype cycles — is now exhibiting resilience, defying normal market uncertainty and proving its capability to shock each ardent supporters and doubters.

The 100-day and 200-day EMAs of Dogecoin have been a strong base for consumers, and the cryptocurrency has repeatedly revered necessary assist zones within the $0.21-$0.22 vary in latest weeks. With bulls intervening at pivotal factors, the restoration from these ranges and the break above short-term shifting averages counsel that momentum is enhancing.

Moreover, there was a slight improve in buying and selling quantity, which might point out that recent market curiosity is rising. The RSI, which is near 59, signifies that bullish strain is rising with out being overbought. This permits for extra upside earlier than reaching harsh circumstances.

If DOGE stays above $0.24, the subsequent logical resistance is positioned between $0.27 and $0.28, the place earlier rallies this summer season had been capped. A run towards $0.30, which might characterize a serious psychological milestone, may be doable if that zone is efficiently damaged. The truth that this rally coincides with a decline within the enthusiasm surrounding meme cash is what makes it so intriguing.

It seems that technical power and accumulation somewhat than speculative mania had been the driving forces behind DOGE’s transfer. Dogecoin might begin to set up a status as a dependable mid-cap cryptocurrency with regular investor assist if this pattern retains up. In abstract, Dogecoin has resurfaced as a contender within the present market cycle after its sudden breakout above $0.24 has dispelled bearish expectations.

Ethereum too quiet

With value motion settling within the $4,300 vary and volatility at all-time lows, Ethereum is exhibiting an uncommon calm. The second-largest cryptocurrency believes that this quiet time is deceptive and may very well be a dangerous prelude to a storm.

With tight candles and little quantity, ETH has been buying and selling sideways on the charts for greater than per week. The market appears to be shedding liquidity, which means that merchants are holding off till one thing clear occurs. Previously, these intervals of inaction often got here earlier than violent outbursts.

Ethereum is holding at excessive ranges with out both consumers or sellers controlling the market, which is extra regarding than simply the dearth of motion. This suggests that it’d launch a surge sturdy sufficient to destroy every thing in its path when momentum ultimately returns.

The thesis is supported by technical indicators. There’s nonetheless loads of alternative for development because the RSI is impartial however balanced at 51. Ethereum, in the meantime, remains to be buying and selling above its 50-day EMA, indicating that the bullish construction remains to be in place even within the absence of any quick motion.

Failure to carry present ranges might end in a retest of $4,100 and even $3,800, whereas a clear breakout above $4,500 might pave the way in which to the eagerly anticipated $5,000 mark. As a result of there’s much less liquidity, there’s a better probability {that a} sudden surge in shopping for strain will result in a collection of brief liquidations, which might ship ETH skyrocketing.

Then again, if bears reap the benefits of the state of affairs, the identical lack of liquidity might speed up a pointy decline. Though Ethereum’s silence is unsettling, it additionally prepares the marketplace for the subsequent pivotal motion.

The storm has the potential to propel ETH to new heights with $5,000 as the primary goal if bulls make a robust comeback. The calm ought to be interpreted as a warning somewhat than an indication of security till that point.

The final state of the market is cautiously optimistic. With the comeback of Bitcoin, Ethereum and different grands, smaller belongings are gaining extra traction and would possibly present us long-awaited recoveries. Sadly, if stablecoin volumes carry on rising, it might be an indication of a bearish shift.