- Dogecoin surged 15% this week, backed by Cleancore’s $235M funding and rising institutional demand.

- ETF hypothesis, led by Rex-Osprey’s proposed DOGE ETF, is boosting long-term confidence regardless of decrease retail exercise.

- Technical indicators counsel a attainable breakout towards $0.29, marking a 20% upside goal.

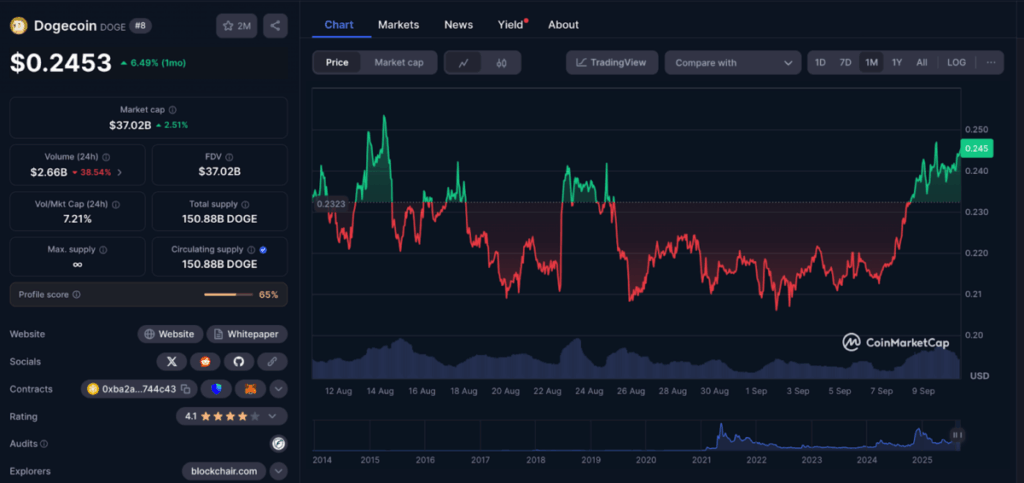

Dogecoin has quietly grow to be one of many week’s shock movers, climbing from $0.20 to $0.25 in just some days. That’s a 15% achieve, and it’s not simply random hype this time—massive cash is beginning to line up behind DOGE. Institutional gamers and chatter round a attainable ETF are fueling the momentum, making DOGE instantly appear to be one of many strongest performers among the many high 10 cash.

Cleancore’s $235M Allocation Provides Company Legitimacy

The primary spark got here when Cleancore, of all corporations—a cleansing options supplier—introduced an enormous $235 million allocation into Dogecoin. The agency set its sights on scooping up a billion DOGE over the subsequent month to diversify its steadiness sheet. That single transfer gave Dogecoin a form of company legitimacy often reserved for Bitcoin or Ethereum, placing it in the identical breath as layer-1 giants like BTC, ETH, SOL, and BNB, all of which have been pulling in institutional treasury inflows this 12 months.

ETF Hypothesis Heats Up as Buying and selling Quantity Shifts

The rally gained much more traction when Bloomberg ETF analyst Eric Balchunas dropped a submit hinting that Rex-Osprey’s DOGE ETF—ticker DOJE—might be hitting the U.S. market quickly. The fund is anticipated to make use of the identical Funding Firm Act construction that was used for the Solana Staking ETF earlier this summer season. Regardless of this bullish backdrop, buying and selling quantity truly slipped 38% midweek whereas DOGE costs nudged up one other 2.4%. That uncommon combo suggests whales and huge gamers are quietly driving the transfer, whereas retail exercise takes a backseat.

Technical Patterns Level Towards a $0.29 Goal

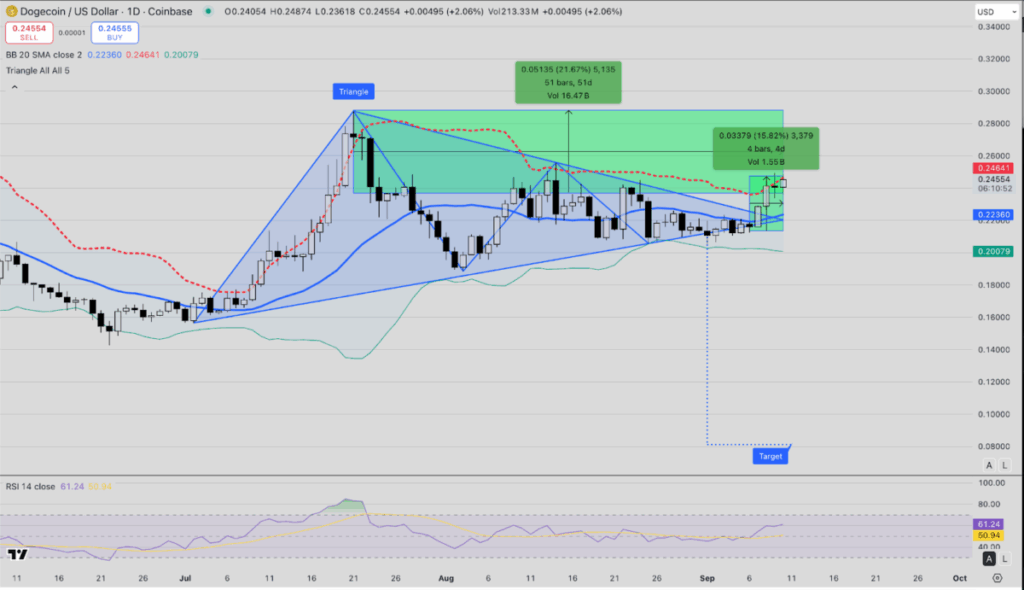

From a technical lens, Dogecoin is exhibiting energy after breaking clear above the 20-day Bollinger midline at $0.223. The RSI is holding close to 61, which indicators bullish momentum with out tipping into overheated ranges. Nonetheless, DOGE faces resistance on the Bollinger higher band round $0.246, which might act like a short-term ceiling except volumes chill in. If consumers handle to maintain stress regular, the 50-day triangle breakout sample units up a possible run towards $0.29—roughly a 20% upside from present ranges.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.