- Polygon’s POL token dropped 4% to $0.27 after a node bug disrupted RPC companies, forcing validators to resync and inflicting dApp entry points.

- Regardless of the outage, the core blockchain saved producing blocks, and builders say most affected nodes are actually again on-line after restarts.

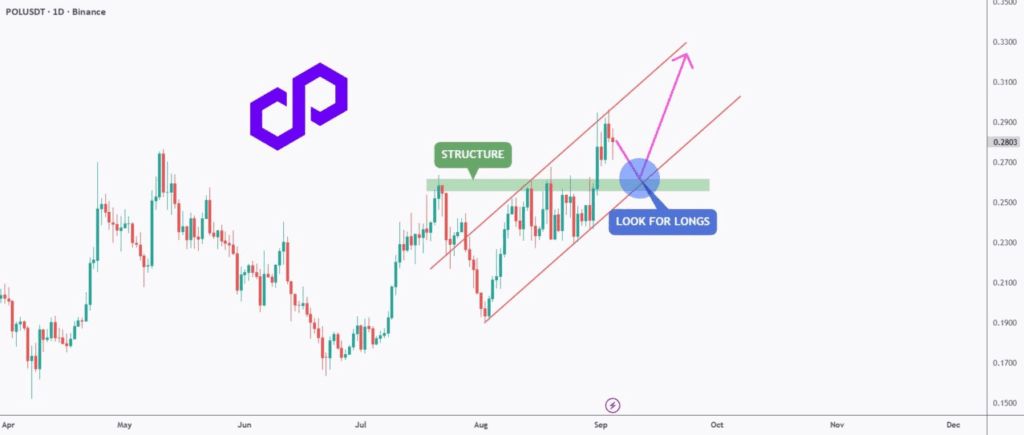

- POL nonetheless trades inside an ascending channel, with analysts eyeing a possible rebound towards $0.32–$0.33 if momentum returns.

Polygon’s new POL token simply hit a velocity bump. After weeks of climbing, the community ran right into a nasty node bug on September 10, triggering outages for RPC suppliers and forcing validators to rewind and resync. That hiccup dragged POL down 4% to $0.27, with buying and selling quantity slipping 17% as merchants grew cautious. Nonetheless, the broader pattern hasn’t flipped bearish—some analysts argue this may very well be nothing greater than a pause earlier than one other leg up.

Node Glitch Places Highlight on Community Stability

The bug didn’t crash Polygon fully—the chain saved producing blocks—however dApps and customers confronted unreliable entry as RPC companies glitched out. It’s the primary notable disruption since July’s Heimdall v2 improve. Polygon devs confirmed the problem was linked to particular node configurations, and restarting the affected methods has already mounted issues for a lot of. Nonetheless, the incident underscored how fragile consumer expertise can really feel when the backend wobbles.

The staff has promised faster fixes and higher communication with node operators going ahead. This comes simply days after Polygon wrapped its migration from MATIC to POL, which launched native staking on Ethereum. For a lot of, this bug is extra of a bump within the street than a derailment—but it surely did rattle some confidence.

Value Outlook: Correction or Only a Reset?

Even with at the moment’s pullback, POL remains to be driving an ascending channel that’s been in place since July. It’s printing larger highs and better lows, a construction merchants like to see. The “construction zone” that capped earlier rallies has now flipped into assist, that means bulls nonetheless have the sting for now.

If momentum returns, projections level towards $0.32–$0.33 within the coming weeks—roughly 20% upside from present ranges. In different phrases, this dip won’t be the top of the rally, only a breather earlier than POL exams contemporary highs.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.