Meteora, the main dynamic liquidity protocol on Solana, has entered a “sizzling” part because it introduced plans to carry its Token Era Occasion (TGE) in October, with MET because the core token.

Meteora’s factors system has already attracted a whole lot of 1000’s of wallets. This occasion will doubtless create a brand new wave within the DeFi market alongside the prevailing system. Nevertheless, it additionally carries important dangers from allocation and sell-off pressures. Will probably be a vital take a look at of Meteora’s potential breakthrough in This autumn 2025.

Sponsored

Sponsored

What’s Meteora?

Meteora is a dynamic liquidity protocol throughout the Solana (SOL) ecosystem. It’s well known for its Dynamic Liquidity Market Maker (DLMM) mannequin, which allows optimized capital effectivity and buying and selling charges.

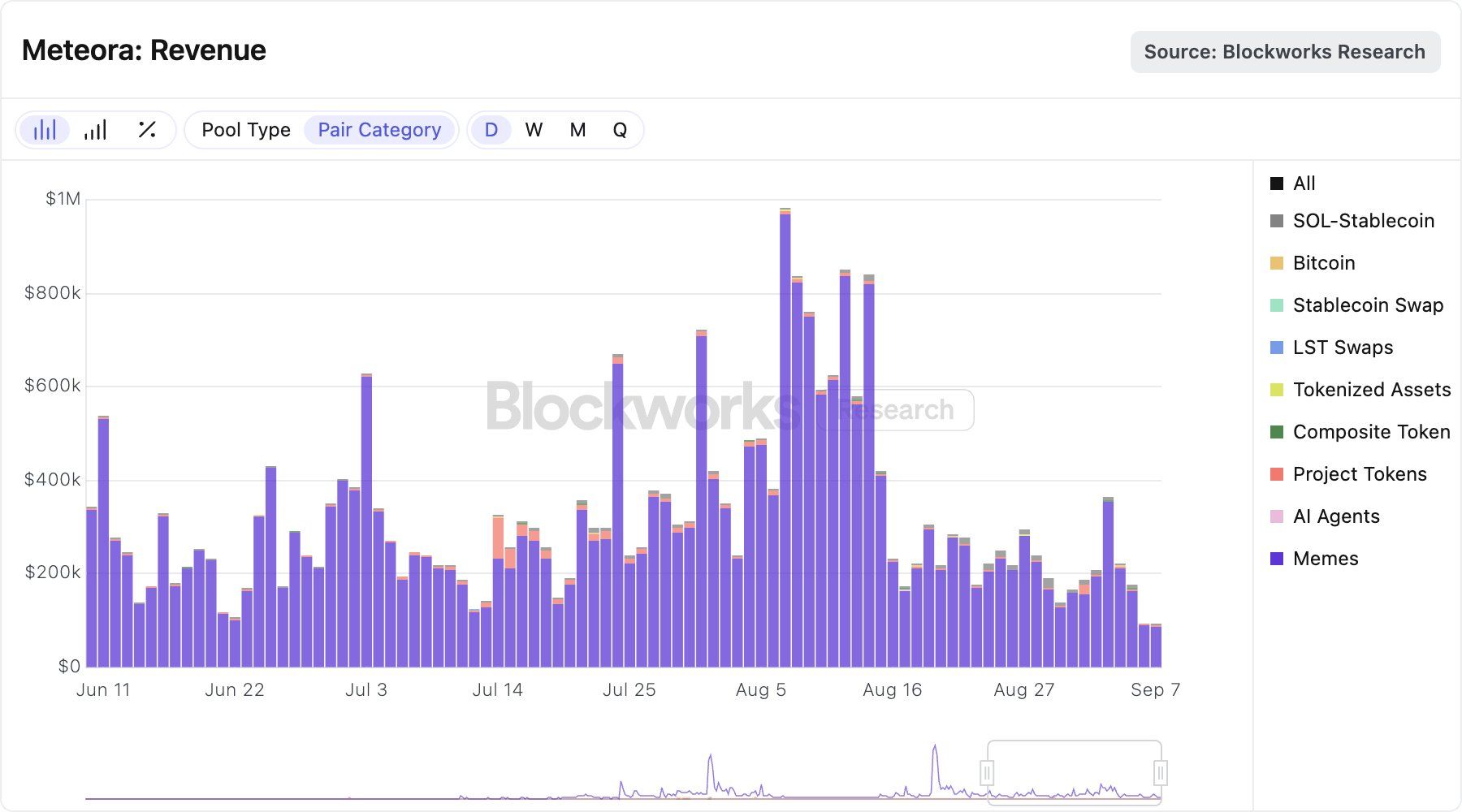

Meteora has made round $10 million in income prior to now 30 days. Nearly all of this income is from memecoin buying and selling exercise. August was Meteora’s second-best month on file for SOL-Stablecoin volumes with $5.5 billion.

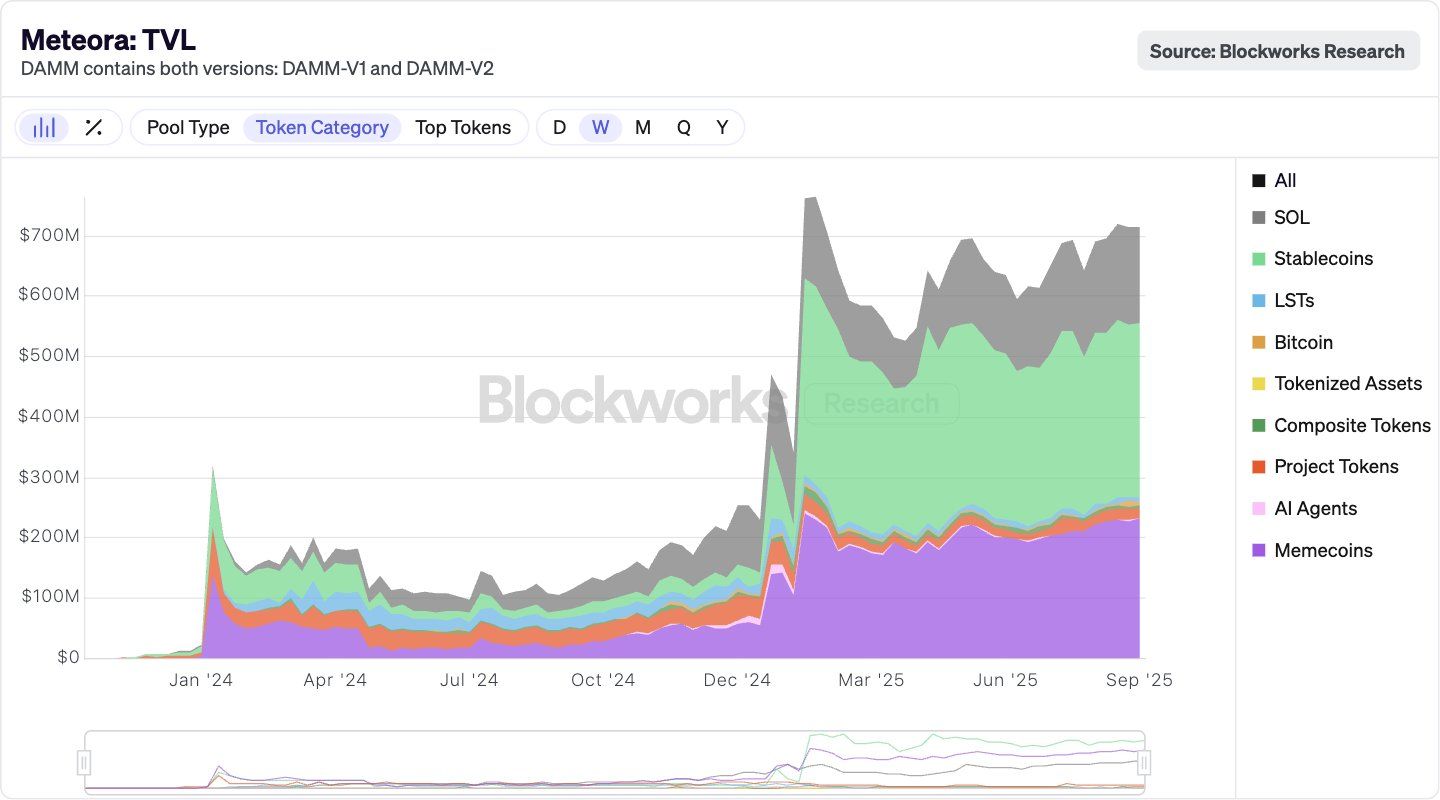

Meteora has over $700 million in TVL, $300 million in stablecoins, and over $150 million in SOL. Jupiter (JUP) is the most well-liked DEX aggregator (80% of DEX aggregator quantity) that Meteora merchants use. Retail/permissionless swimming pools earned over $15 billion final month in LP charges, and meme coin swimming pools have been the most well-liked.

MET Token Era Occasion

Sponsored

Sponsored

The venture has formally confirmed internet hosting a Token Era Occasion (TGE) in October, with MET because the central factor. This represents a pivotal second for Meteora and the broader Solana ecosystem, as MET will change into a direct hyperlink throughout the liquidity mechanisms the venture is constructing. How MET is built-in into liquidity swimming pools, staking applications, or incentive buildings will considerably influence the token’s intrinsic worth and the market’s response instantly after TGE.

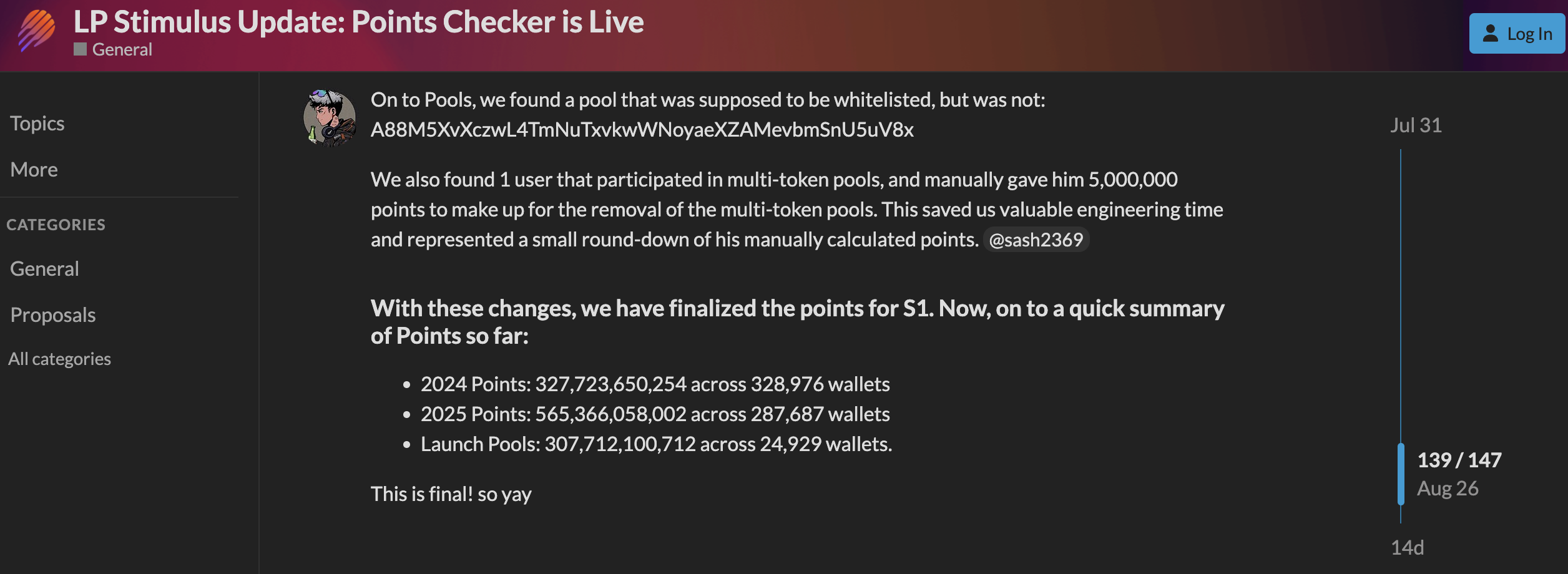

The distribution of MET tokens for Season 1 is predicated on a factors mechanism. The information reveals roughly 327.7 billion factors (2024) have been distributed throughout 328,976 wallets. Moreover, 565.3 billion factors (2025) have been distributed throughout 287,687 wallets. The launch pool distributed 307.7 billion factors throughout 24,929 wallets.

This allocation highlights a major imbalance in focus. Whereas a whole lot of 1000’s of wallets obtained factors from common actions, solely about twenty-five thousand within the launch pool captured a disproportionately massive share.

Particularly, the “Airdrop Declare” mechanism, which permits customers to say tokens straight from the pool, can speed up liquidity however may expose the market to sudden worth fluctuations if not adequately managed. This implies larger reward focus and the danger of great promote stress as quickly as Meteora’s TGE happens.

Nevertheless, MET has not but formally disclosed the complete particulars of its tokenomics. These lacking particulars embrace complete provide distribution, group allocation, and group vesting schedules. The corporate additionally hasn’t revealed DAO vesting or any cliff schedules. Beforehand, Meteora proposed allocating 25% of the MET token provide to Liquidity Rewards and TGE Reserve.

The October TGE is a decisive milestone for Meteora. It marks MET’s official debut and is a real-world take a look at of the protocol’s dynamic liquidity mannequin. Nonetheless, dangers of concentrated allocations, doubtlessly unfavorable vesting phrases, and post-airdrop promote stress stay challenges that buyers should fastidiously navigate.