Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

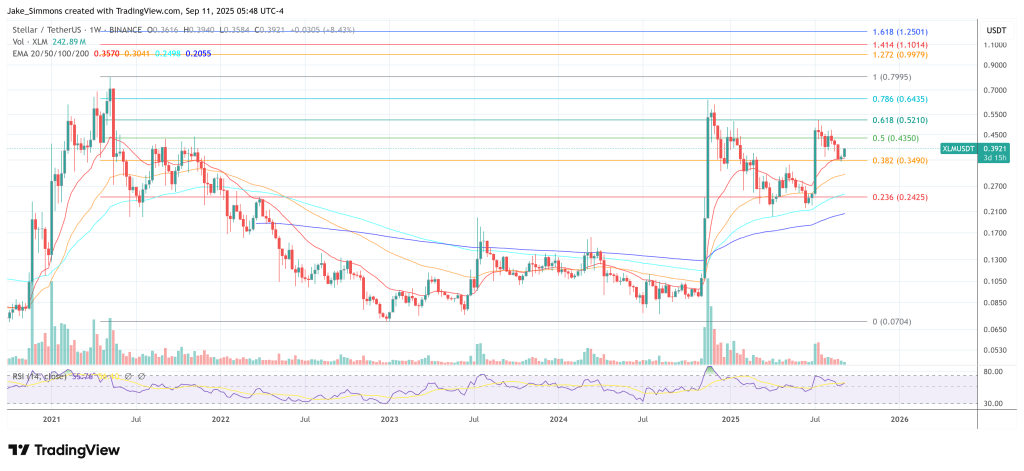

A brand new market-cap–primarily based Elliott Wave examine from impartial chartist Quantum Ascend (@quantum_ascend) argues that Stellar’s native token XLM is positioned for a fifth-wave advance that would raise its valuation roughly 5x from right here. In a video printed on September 10, the analyst says he prefers to mannequin market cap relatively than the greenback value as a result of XLM’s provide dynamics have periodically distorted spot-price returns.

Stellar (XLM) Set To Explode 400%

“ this… the USD value is just up 12,000% whereas the market cap chart [is] up 52,000%. So… there’s some type of inflationary stress on the asset… Stellar, we now have to make use of the market cap chart to measure out precisely the place the value is gonna go,” he stated, earlier than mapping Fibonacci extensions on the month-to-month and weekly time frames.

Associated Studying

From a cycle that he dates to Could 2016, the analyst counts 5 waves up into the January 2018 peak, 5 down into March 2020, after which a brand new, ongoing motive construction that has already printed waves one by 4, with wave 4 “completed in April of this yr.”

He highlights an “88% week” in July that he interprets as a part of the transition into the terminal wave. The crux of his name comes from overlapping Fibonacci projections: measuring the third-to-fourth-wave drawdown and the bigger 2021 vary, he finds confluence close to the three.618 extension, which locations XLM’s totally diluted valuation zone between roughly $60 billion and $71 billion. “My major there’s going to be $60 billion available on the market cap… may see a throw over there to that $71 [billion] as effectively,” he stated.

Translating capitalization right into a notional value path, Quantum Ascend frames a major value goal round $1.96 per XLM—with a extra aggressive extension close to $2.28—whereas emphasizing adherence to Elliott Wave proportionality: “We’re 400% or a 5X… everybody’s going to be screaming for $2; it’s going to finish up at like $1.96… one more reason that is sensible is that the third wave can’t be the shortest… I really feel actually good about that concentrate on proper there.” The analyst additionally notes {that a} fast, internally impulsive sub-structure is believable for the fifth wave (“may see 5 waves on this fifth wave right here fairly fast”), given the asset’s historical past of condensed strikes.

As of September 11, 2025, XLM modifications arms round $0.386 with a market capitalization close to $12.28 billion, per CoinMarketCap. A transfer to the analyst’s $60 billion major goal would suggest an appreciation on the order of ~4.9x from right now’s valuation, with the exact greenback value contingent on circulating-supply situations on the time of arrival.

Associated Studying

Provide mechanics are a key backdrop to his market-cap emphasis. In November 2019, the Stellar Growth Basis (SDF) diminished complete XLM provide to ~50 billion by way of a 55 billion token burn; since then, no new lumens are created on the protocol stage, though circulating provide has continued to evolve as SDF distributes treasury holdings over time. This helps clarify why long-horizon market-cap curves can diverge from easy value charts, notably when evaluating epochs with totally different circulating float.

If realized, a major goal close to $1.96 would set a brand new all-time excessive for XLM, exceeding the $0.938 peak recorded on January 4, 2018. That historic marker is related as a result of, in Elliott phrases, structurally new highs typically validate the completion of a cycle’s terminal wave—although the analyst himself ties affirmation to the unfolding of the interior wave construction relatively than to a single value print.

To make sure, Elliott counting and Fibonacci confluence are interpretive frameworks, not certainties. Macro liquidity, the trail of Bitcoin dominance, and idiosyncratic issuance/distribution by giant holders can all alter trajectories and timing. Nonetheless, for believers in cycle symmetry, Quantum Ascend’s case is simple: a high-time-timeframe fifth wave for XLM, projected at roughly $60 billion in market cap, equating to a few 400% rally from present ranges—“simply shy of $2” on value.

Featured picture created with DALL.E, chart from TradingView.com