- Polygon’s POL token dropped 4% to $0.27 after a node bug disrupted RPC companies, forcing validators to resync and inflicting dApp entry points.

- Regardless of the outage, the core blockchain stored producing blocks, and builders say most affected nodes are actually again on-line after restarts.

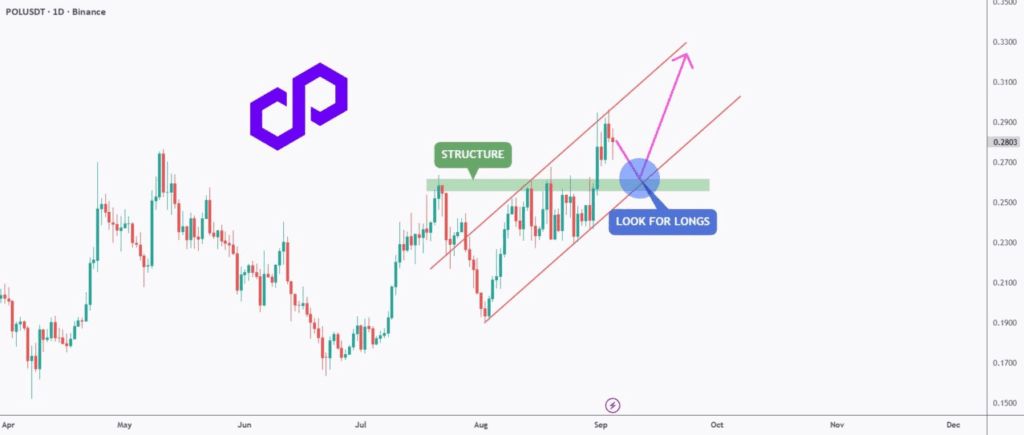

- POL nonetheless trades inside an ascending channel, with analysts eyeing a possible rebound towards $0.32–$0.33 if momentum returns.

Polygon’s new POL token simply hit a pace bump. After weeks of climbing, the community ran right into a nasty node bug on September 10, triggering outages for RPC suppliers and forcing validators to rewind and resync. That hiccup dragged POL down 4% to $0.27, with buying and selling quantity slipping 17% as merchants grew cautious. Nonetheless, the broader development hasn’t flipped bearish—some analysts argue this might be nothing greater than a pause earlier than one other leg up.

Node Glitch Places Highlight on Community Stability

The bug didn’t crash Polygon utterly—the chain stored producing blocks—however dApps and customers confronted unreliable entry as RPC companies glitched out. It’s the primary notable disruption since July’s Heimdall v2 improve. Polygon devs confirmed the difficulty was linked to particular node configurations, and restarting the affected methods has already fastened issues for a lot of. Nonetheless, the incident underscored how fragile person expertise can really feel when the backend wobbles.

The group has promised faster fixes and higher communication with node operators going ahead. This comes simply days after Polygon wrapped its migration from MATIC to POL, which launched native staking on Ethereum. For a lot of, this bug is extra of a bump within the highway than a derailment—however it did rattle some confidence.

Worth Outlook: Correction or Only a Reset?

Even with in the present day’s pullback, POL continues to be driving an ascending channel that’s been in place since July. It’s printing increased highs and better lows, a construction merchants like to see. The “construction zone” that capped earlier rallies has now flipped into assist, that means bulls nonetheless have the sting for now.

If momentum returns, projections level towards $0.32–$0.33 within the coming weeks—roughly 20% upside from present ranges. In different phrases, this dip may not be the top of the rally, only a breather earlier than POL exams contemporary highs.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.