- Avalanche surged over 8% in 24 hours following its $1 billion treasury plan.

- U.S. inflation cooling and attainable charge cuts have boosted investor confidence.

- AVAX stays 80% beneath its all-time excessive, with future positive factors tied to treasury adoption and market momentum.

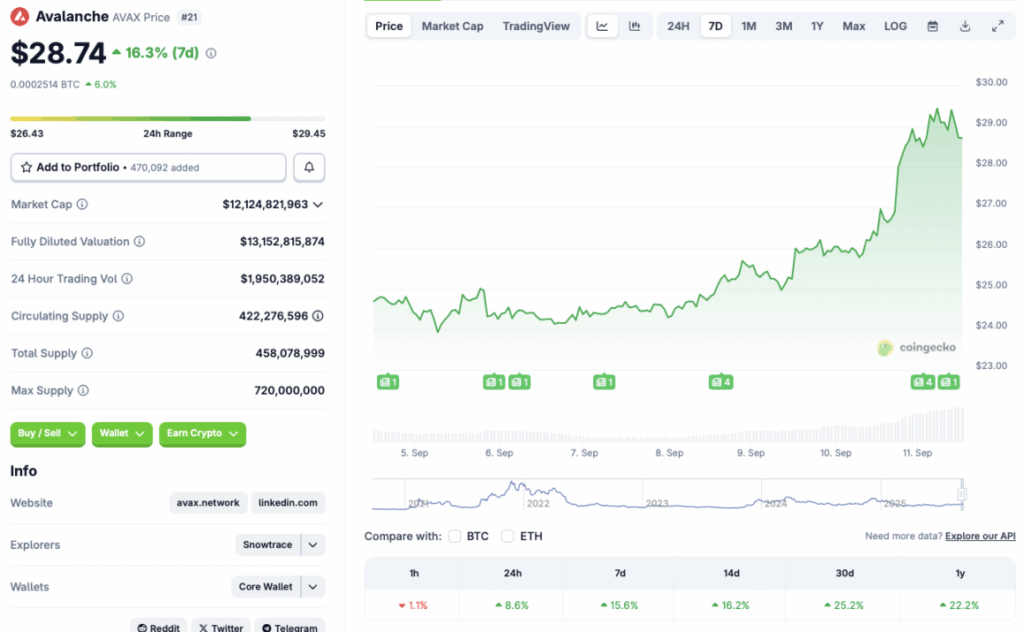

Avalanche (AVAX) has develop into one of many top-performing cryptocurrencies in latest weeks, gaining 8.6% within the final 24 hours and climbing greater than 25% over the previous month. In response to CoinGecko, AVAX has outpaced a lot of the market, making it a standout within the high 100 digital property by market cap.

The $1 Billion Treasury Plan

The most recent spark got here from a Monetary Occasions report revealing Avalanche’s plan to lift $1 billion for 2 new treasury firms. The funds will reportedly be used to buy AVAX at a reduced value, fueling optimism about demand and value stability. This transfer mirrors methods utilized by bigger gamers within the crypto area, the place treasury backing has typically been a catalyst for main rallies.

Macro Tailwinds Increase Investor Sentiment

The rally additionally aligns with cooling U.S. inflation information, which has strengthened expectations of an rate of interest lower later this month. Decrease charges sometimes push buyers towards riskier property, creating a positive atmosphere for cryptocurrencies. Bitcoin’s climb again above $114,000 has additional lifted the broader market, including gasoline to Avalanche’s momentum.

Can AVAX Attain a New All-Time Excessive?

Regardless of the latest rally, Avalanche remains to be buying and selling almost 80% beneath its all-time excessive of $144.96, set in the course of the 2021 bull run. Whereas company treasury exercise has helped Bitcoin and Ethereum reclaim contemporary highs this yr, AVAX nonetheless lacks ETF inflows which have propelled its friends. Whether or not Avalanche can return to its peak relies on sustained demand, treasury execution, and continued bullish momentum within the broader crypto market.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.