August’s Client Worth Index (CPI) got here in step with market expectations, giving the US Federal Reserve the ultimate inexperienced gentle to chop its goal price at subsequent week’s FOMC assembly.

Actually, with the labour market quickly deteriorating, there’s a rising hypothesis about whether or not the Fed will proceed with a extra aggressive 50 foundation level price reduce.

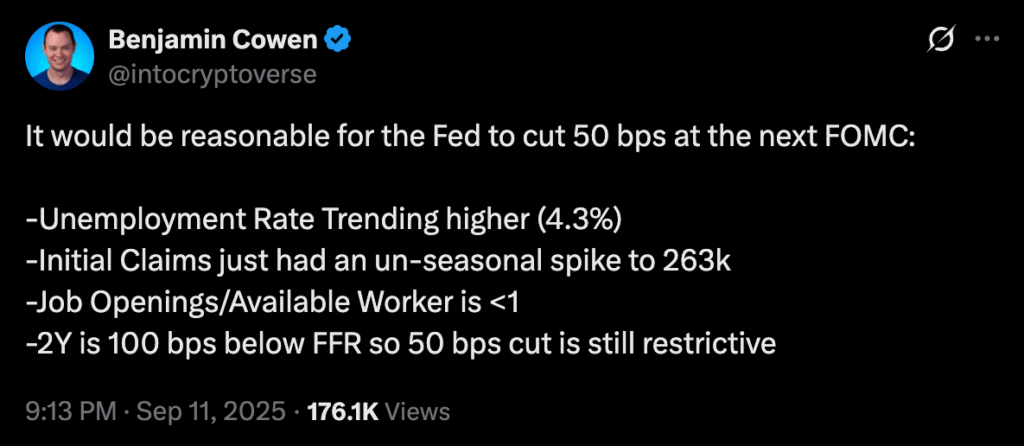

Outstanding analyst and Into The Cryptoverse co-founder Benjamin Cowen believes it will be “affordable” for the central financial institution to resolve on a 50 bps reduce, pointing to the rising unemployment price, the spike in jobless claims, the weakening job-openings-to-workers ratio, and the truth that the 2-year yield is already 100 foundation factors under the Fed funds price.

Notably, a 50 bps reduce isn’t priced in, and would lead to an explosive crypto market rally.

The Bitcoin value is already displaying important bullish energy, climbing to $114,600 following the CPI launch. Regardless of the Rektember fears, BTC is now up by almost 7% over the previous week.

August CPI Exhibits Inflation Stays Elevated, However In Examine

August’s Client Worth Index was largely in step with market expectations.

The headline CPI rose 2.9% year-over-year, its highest degree since January 2025. In the meantime, core CPI, which excludes meals and vitality costs, climbed 3.1%.

Client costs elevated by 0.4% in August, above the 0.2% forecast.

Whereas inflation within the US financial system stays elevated, this week’s CPI and PPI gained’t deter the US Federal Reserve from slicing charges in August.

Will The Fed Reduce Curiosity Charges By 50 BPS In Subsequent Week’s FOMC?

Into The Cryptoverse’s Benjamin Cowen makes a powerful case for a 50 bps reduce within the Federal goal price at subsequent week’s FOMC.

The unemployment price has climbed as much as 4.3%, its highest degree since October 2021. In the meantime, the US labour market is quickly deteriorating. Even this week’s jobless claims knowledge got here out at 263k, a lot greater than the anticipated 236k and the very best in over 4 years.

Cowen argues that even with a 50 bps reduce, the Federal funds price would stay restrictive, since it will nonetheless sit nicely above the 2-year yield.

The largest argument for an aggressive reduce is the huge downward revisions in jobs knowledge: June payrolls, initially reported at 144,000, had been later reduce to 14,000 and in the end revised to a lack of 13,000. On prime of that, the annual benchmark revision diminished job development over the previous 12 months by one other 911,000.

A robust case could be made that the Fed would have already reduce charges if it had seen the revised knowledge earlier. To make up for misplaced time, a 50 bps reduce now seems justified.

As beforehand talked about, a 50-basis-point easing isn’t priced in, and would lead to an explosive market rally.

Bitcoin Worth Hits $114,600, Specialists Name HYPER The Subsequent 10x Crypto

Regardless of Rektember fears, the Bitcoin value has climbed up by almost 7% to commerce as excessive as $114,600 on Wednesday.

With a day by day shut above $113,000 on Tuesday, BTC is poised for a rally to $118,000 and subsequently to new all-time highs.

Notably, the bulls stay assured that Bitcoin will hit $150,000, and a bullish divergence within the weekly timeframe confirms their thesis.

In the meantime, low-cap hunters have recognized Bitcoin Hyper (HYPER) as a beta wager on BTC.

Bitcoin Hyper is the most recent BTC layer-2 mission, which goals to make use of zero-knowledge structure and Solana Digital Machine to sort out the gradual transaction velocity and excessive charges on Bitcoin.

It goals to carry the scalability, efficiency and programmability of contemporary blockchains to Bitcoin, paving the way in which for cost apps, DeFi apps and even meme cash.

HYPER has emerged as one of many hottest presale cash in the marketplace. Behind a string of six-figure investments from whales, it has now raised over $15 million in its ICO.

Contemplating it’s a beta wager on BTC, which is predicted to achieve $150,000 this 12 months, many analysts anticipate that Bitcoin Hyper would be the subsequent 10x crypto.

Go to Bitcoin Hyper Presale

This text has been supplied by certainly one of our industrial companions and doesn’t replicate Cryptonomist’s opinion. Please remember that our industrial companions could use affiliate packages to generate income by the hyperlinks in this text.