Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value jumped 3% within the final 24 hours to commerce at $4,436 as of three:33 a.m. EST after BitMine purchased $200 million ETH and because the US Securities and Alternate Fee (SEC) delayed a call on staking for BlackRock’s Ethereum ETF.

Tom Lee’s BitMine expanded its ETH holdings for the second time this week. Knowledge from Lookonchain exhibits that the agency has acquired an extra 46,255 ETH valued at roughly $200.43 million.

Bitmine(@BitMNR) purchased one other 46,255 $ETH($200.43M) 5 hours in the past and presently holds 2,126,018 $ETH($9.27B).https://t.co/8wNYBL84rk pic.twitter.com/McHcKYX8S5

— Lookonchain (@lookonchain) September 11, 2025

BitMine had already bought 202,500 Ether on Monday, which despatched its stash previous 2 million ETH for the primary time.

With the most recent buy, BitMine now holds a formidable 2.1 million ETH that’s presently value round $9.27 billion.

The agency has the biggest ETH holdings of any public firm, and it’s now widened the hole f the second-largest ETH holding firm, Sharplink Gaming, which has greater than 837,000 ETH in its treasury, based on Strategic ETH Reserve knowledge.

SEC Delays Choice On BlackRock ETH Staking

In one other improvement, the US SEC has as soon as once more delayed choices on a handful of crypto ETF purposes.

It mentioned it wants extra time to overview purposes to permit staking for Ethereum ETFs issued by BlackRock, Constancy, and Franklin Templeton.

The company has now set a brand new deadline of November 13 for Franklin’s Ethereum staking modification, and November 14 for its Solana and XRP ETFs.

In the meantime, a proposal in search of to allow staking in BlackRock’s iShares Ethereum Belief is now slated for October 30.

Whereas the SEC chairman, Paul Atkins, has remained vocal in his help of digital property, the company continues to delay choices on many ETFs.

Nonetheless, on the OECD Roundtable in Paris, he mentioned, “We should admit that crypto’s time has come,” signaling a bullish stance.

In accordance with a chart by Bloomberg, over 90 crypto ETFs are awaiting SEC approval.

In case you missed it, there are over 90 crypto ETFs pending SEC approval (see chart under by way of @JSeyff )

At this price we’ll have one for each prime 30- 40 #crypto inside 12 months, even with delays. Inflows might shock for some, however others are nonetheless backside bouncing on LT charts. pic.twitter.com/Q6HSl8xNYT

— James McKay (@McKayResearch) September 10, 2025

In the meantime, spot ETH ETFs have recorded two consecutive days of constructive web inflows, based on knowledge from Coinglass.

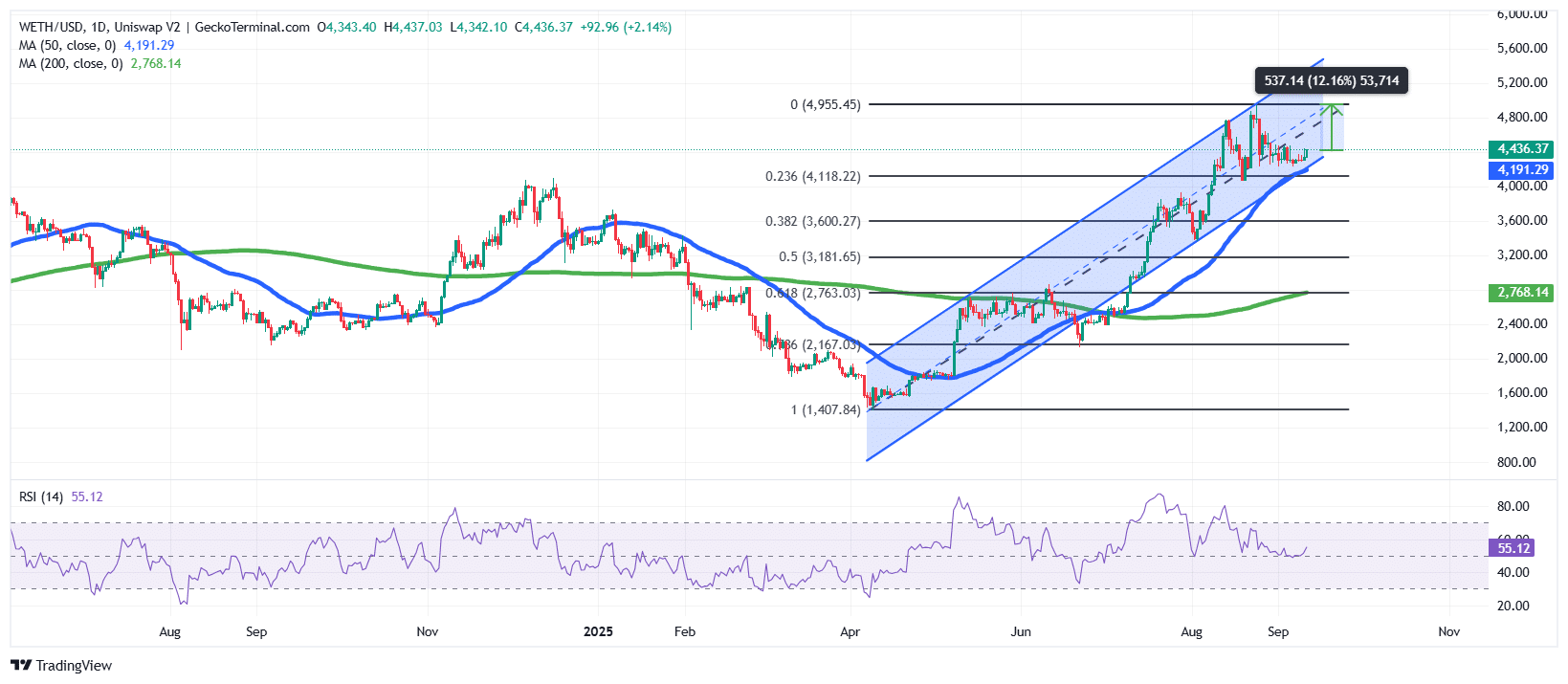

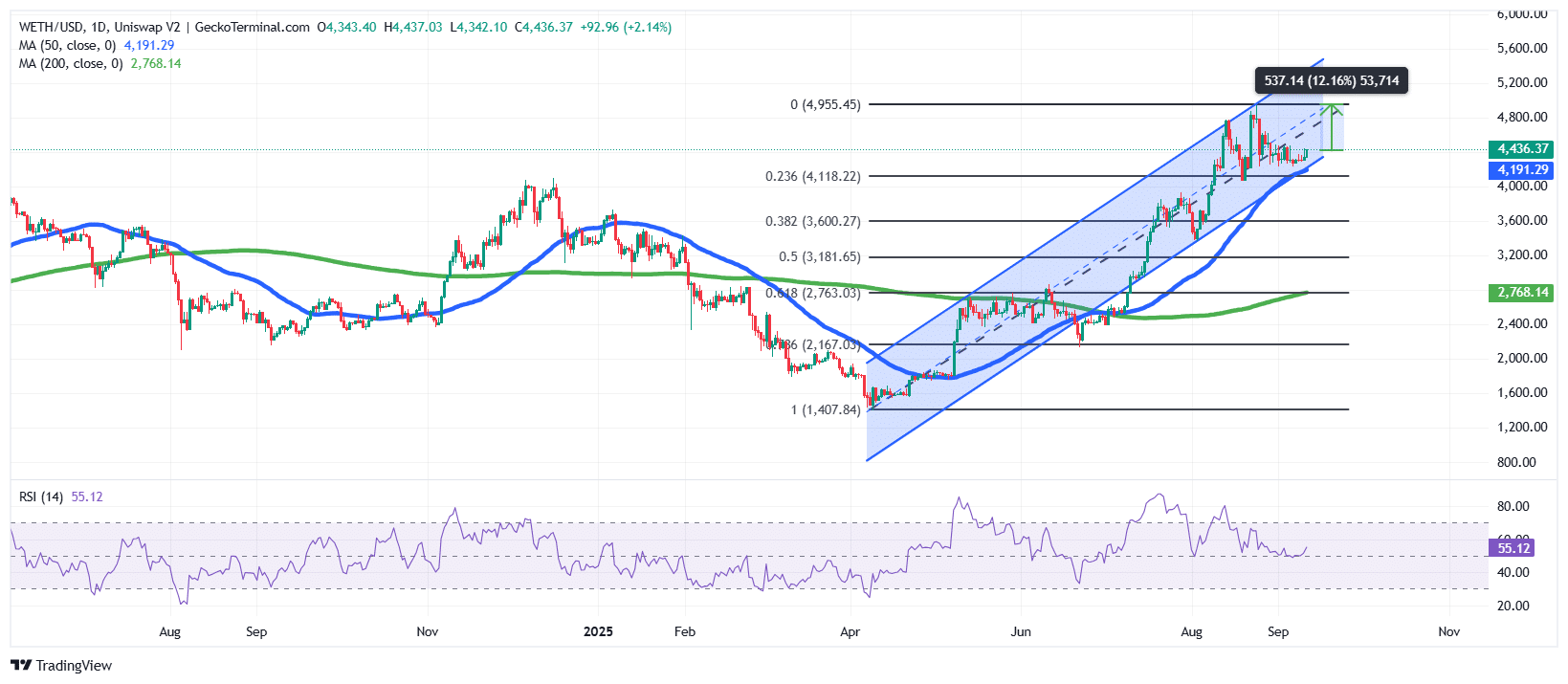

Ethereum Value Driving The Bullish Channel

The ETH value has been shifting inside a transparent rising channel sample since April 2025, signaling robust bullish momentum.

After climbing from lows close to $1,400, the Ethereum value is now buying and selling round $4,436, with the channel offering constant help and resistance ranges.

The latest pullback from the higher boundary close to $4,950 has not damaged the bullish construction, as the value of Ethereum rapidly discovered help and stays throughout the channel.

The Fibonacci retracement ranges reinforce this pattern, with the important thing 0.236 retracement at $4,118 performing as an vital stage that has now was help.

In the meantime, the 50-day Easy Transferring Common (SMA) ($4,191) has been performing as dynamic help, whereas the 200-day SMA at $2,768 stays far under the value of ETH, highlighting robust separation and pattern power.

ETH Indicators Level To Extra Room For Progress

The Relative Energy Index (RSI) sits at 55.12, a neutral-to-bullish studying that exhibits momentum is wholesome with out turning overbought. This means that Ethereum has room for additional upward motion earlier than a serious correction turns into probably.

ETH is positioned to retest the higher channel boundary close to $4,950. If this resistance breaks, the following goal lies round $5,200, providing a few 17% upside from present ranges.

On the draw back, if momentum weakens and the value of Ethereum loses the 50-day SMAs, the $4,118 Fibonacci help and the mid-channel line may very well be the next help ranges.

Basing his evaluation on Bollinger Bands, Ali Martinez believes that the ETH value can see a much bigger transfer.

Count on an enormous transfer for Ethereum $ETH quickly because the Bollinger Bands squeeze! pic.twitter.com/5KgYzuF3Vb

— Ali (@ali_charts) September 10, 2025

One other analyst on X, ‘AltGem Hunter,’ believes that the Ethereum value motion is just like that of Bitcoin in 2021, and may very well be making ready for an enormous rally.

$ETH is repeating Bitcoin value motion from 2021.

If historical past repeats…

An enormous pump is coming! pic.twitter.com/vSzoliM2w2

— AltGem Hunter ⚡🥷 (@AltGemHunter) September 10, 2025

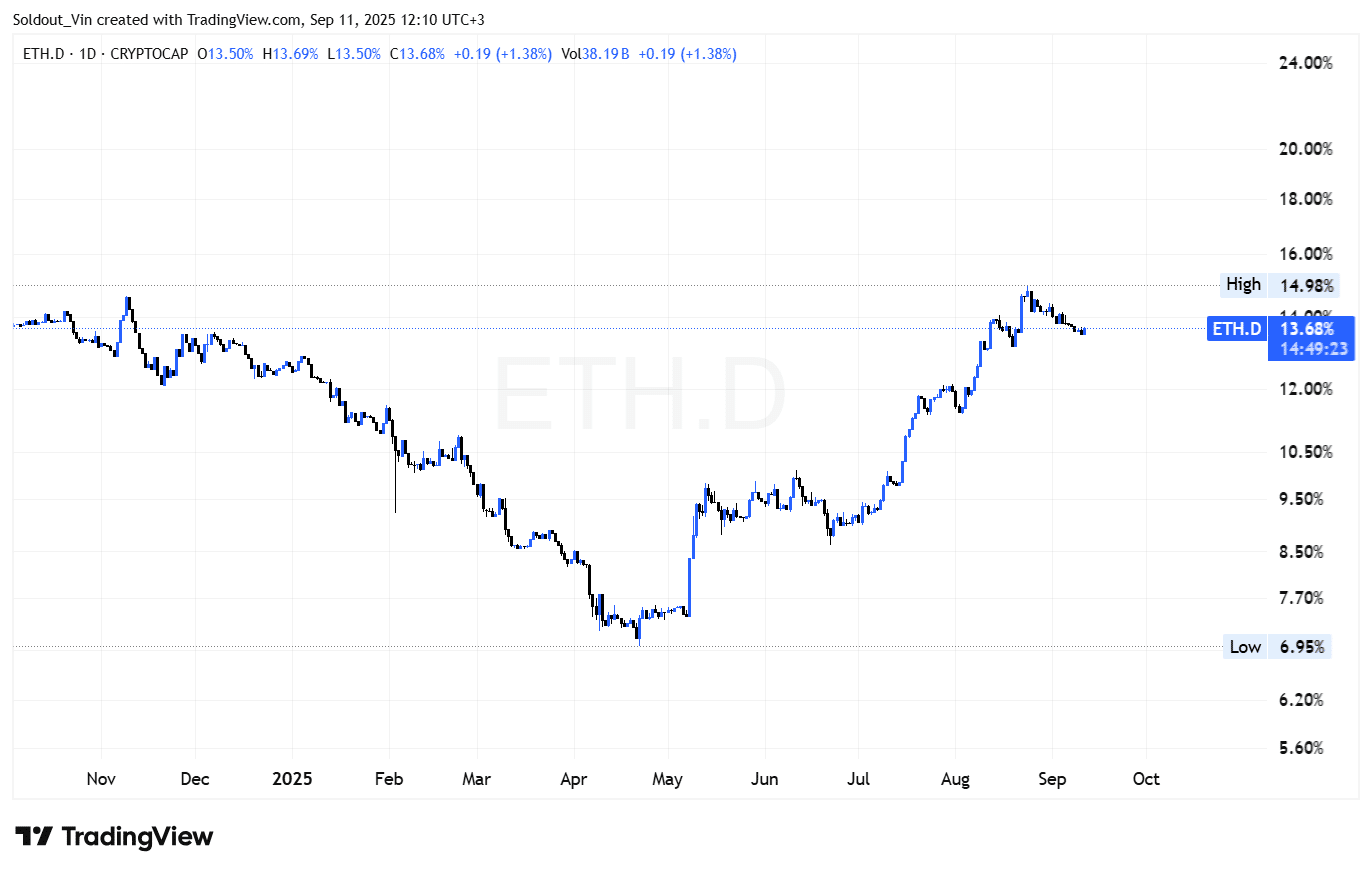

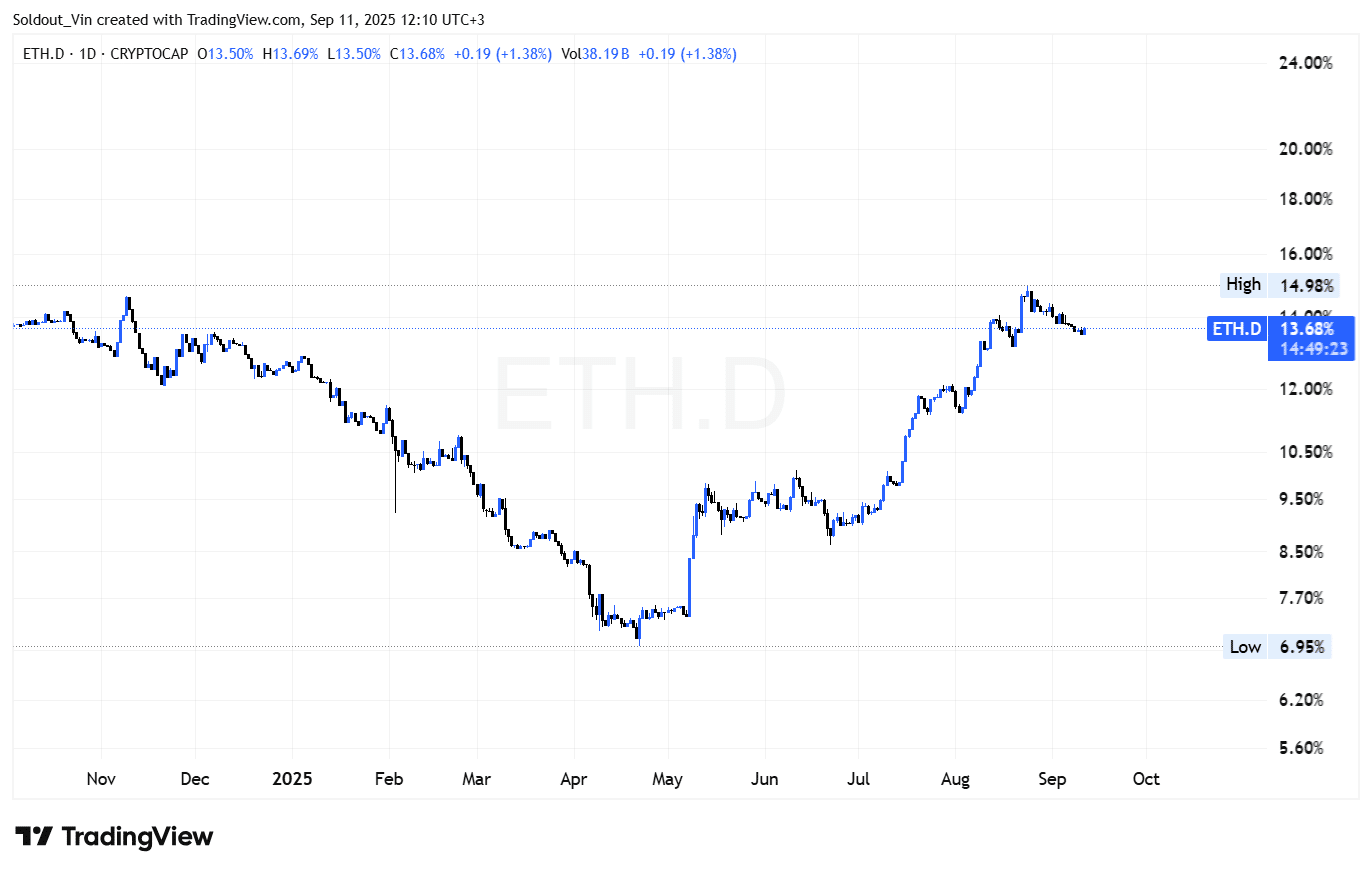

Ethereum dominance (ETH.D) has rebounded strongly from its April low of 6.95% to a September peak of 14.98%, however is now barely pulling again to round 13.68%. ETH has nonetheless been outperforming most different cryptos.

Constructive Ethereum value sentiment is supported by the CMC Altcoin Season Index, which exhibits that the altcoin season is nearing with the index now at a excessive for the yr.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection