Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth climbed greater than 1% within the final 24 hours to commerce at $114,087.95 as of 4:10 a.m. EST, boosted by PPI information that got here in decrease than anticipated yesterday.

Weaker producer costs inflation is an indication that prices should not rising as rapidly by the availability chain, and within the present macro backdrop which means there’s extra room for the US Federal Reserve to chop rates of interest.

🚨US PPI & Core PPI Knowledge Simply Launched.🇺🇸

➡️PPI (MoM)

🔴Earlier: 0.9%

🔴Forecast: 0.3%

🟢Precise: 0.1%➡️PPI (YoY)

🔴Earlier: 3.3%

🔴Forecast: 3.3%

🟢Precise: 2.6%PPI information got here approach under expectations 🔻

Fed is simply too late to chop charges!? pic.twitter.com/frwBhiJUAh

— Brian Rose, Founder & Host of London Actual (@LondonRealTV) September 10, 2025

Consequently, the Bitcoin worth jumped from consolidation close to $111,000 to over $114,000.

This transfer increased was supported by a transparent bounce from the 50-day easy transferring common, which sits simply above the present worth zone.

The PPI report was the cherry on prime. It appears to have erased yesterday’s panic over the adjusted NFP numbers and triggered a rally that pushed $BTC worth again above the development line.

Anticipating resistance across the 50-Day SMA which is near the psychological $115k degree. https://t.co/ReYgbQWng7 pic.twitter.com/VBtqTH4cBr

— Keith Alan (@KAProductions) September 10, 2025

Buying and selling volumes stay regular, and the temper in crypto markets is optimistic as buyers now await contemporary alerts from the US CPI report later as we speak.

Bitcoin Worth: On-Chain Metrics Are Supportive

On the on-chain aspect, Bitcoin metrics stay supportive of the uptrend. Trade wallets proceed to see outflows, which means extra BTC is transferring to chilly storage as holders anticipate long-term beneficial properties.

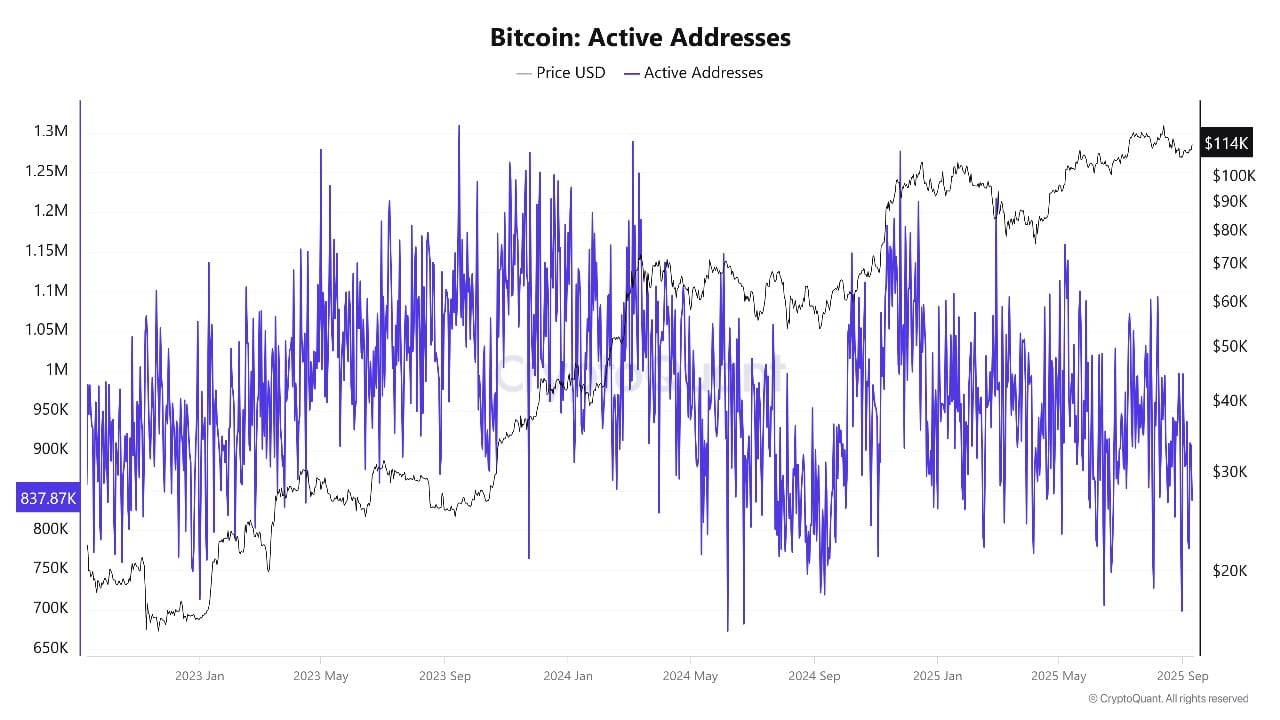

This reduces accessible provide on buying and selling venues and might gas upward strikes within the coin worth as new demand seems. The lively deal with rely doesn’t present main surges, however there’s a transparent development of extra regular, long-term holders preserving cash off exchanges slightly than flipping for fast earnings.

BitcoinActive Addresses Supply: Cryptoquant

Speculative exercise in derivatives is contained for now, and no large-scale liquidations have been seen on current worth swings. These on-chain alerts level to a gradual, net-positive setting for Bitcoin worth within the medium time period.

Bitcoin Worth: Technical Boundaries And Help

On the day by day BTCUSDT chart, Bitcoin is now buying and selling at $114,114, with a session excessive of $114,459. The coin worth has damaged out above the consolidation zone between $111,000 and $114,000, which had held Bitcoin in a decent vary for almost a month.

BTCUSD Evaluation Supply: Tradingview

The key resistance to look at is at $124,474, which marks the subsequent goal for bulls. This degree coincides with current swing highs and represents the higher boundary for the subsequent leg up. If Bitcoin worth can clear this barrier, there may be room for an additional run towards $130,000 within the close to time period.

Help is available in at two key zones. The primary is close to $111,008, which marked the highest of the current consolidation; a drop again to this space ought to discover prepared consumers if there’s a pullback. The second, longer-term help is on the 200-day easy transferring common, presently at $102,066.56.

As for indicators, the Relative Energy Index (RSI) is at 54.76, effectively under overbought, suggesting there may be area for extra upside earlier than merchants turn out to be aggressive sellers. The MACD line is deeply constructive at 573.69, reinforcing the continued bullish development.

In the meantime, the Common Directional Index (ADX) at 14.51 displays a wholesome development however not but on the extremes seen throughout main breakouts.

Bitcoin has a clear technical path towards increased ranges so long as macro information stays supportive. A cool CPI print as we speak may spark renewed shopping for and produce $124,000 into attain rapidly.

If the value dips, it’s prone to discover agency floor effectively above the 200-day common, preserving the broader development intact. The development path stays upward, and as we speak’s inflation report could tip the steadiness for the subsequent transfer.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection