Coinbase (NASDAQ: COIN) and Circle (NYSE: CRCL) noticed their shares surge on Thursday, fueled by mounting optimism within the digital asset sector and renewed investor urge for food for stablecoins.

Coinbase Extends Rally to Multi-12 months Highs

Coinbase gained 5%, reaching its highest degree since November 2021 and lengthening a rally of greater than 40% because the Senate handed the GENIUS Act final week. The landmark laws units the stage for a complete regulatory framework round stablecoins, a transfer Wall Avenue analysts say might unlock new progress for digital property.

Bernstein’s Gautam Chhugani, who just lately branded Coinbase the “Amazon of crypto monetary companies,” raised his value goal on the inventory to $510 from $310, assigning it an Outperform ranking. Shares hovered close to $375 on Thursday, marking a staggering rebound of greater than 950% from late 2022 lows when the FTX collapse rocked the trade.

Stablecoin Partnerships Gas Development

Analysts say Coinbase’s success is now tied not simply to buying and selling however to its growth into funds and stablecoins. Earlier this month, Shopify partnered with Coinbase and Stripe to allow international stablecoin funds, a improvement anticipated to spice up mainstream adoption.

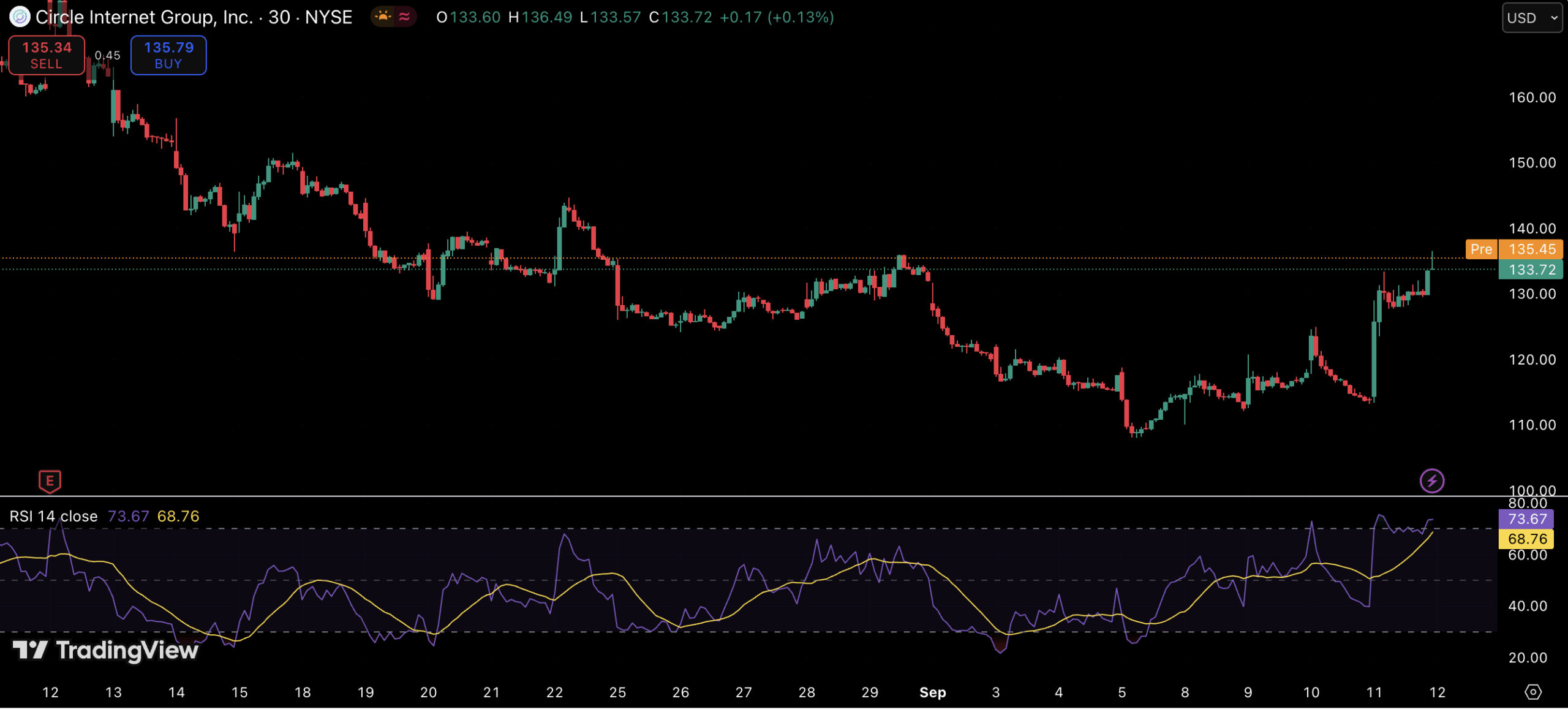

Circle Surges on USDC Demand

Circle, wherein Coinbase holds a minority stake, has additionally emerged as a market favourite. Shares of the stablecoin issuer have surged greater than 575% from their IPO value of $31, pushed by sturdy demand for its flagship USDC token. On Thursday, CRCL inventory traded round $210.

Bernstein initiated protection this week with an Outperform ranking and a $230 goal, highlighting the long-term potential of stablecoins. Chhugani projected that complete provide might develop from roughly $225 billion right this moment to as a lot as $4 trillion over the subsequent decade.

Competitors Looms within the Stablecoin Market

Momentum has additionally been boosted by new entrants. Fintech large Fiserv just lately introduced plans to roll out a stablecoin referred to as FIUSD, leveraging infrastructure from each Paxos and Circle. Nonetheless, competitors stays a looming threat. Compass Level’s Ed Engel warned that growing entrants might stress Circle’s market share and trimmed expectations with a Impartial ranking and $205 goal.

HYLQ’s Wager on Hyperliquid

Whereas Coinbase and Circle dominate headlines, one other participant is quietly positioning itself throughout the digital asset economic system. HYLQ Technique Corp, listed on the Canadian Securities Change beneath the ticker HYLQ and buying and selling within the U.S. as HYLQF, has staked its technique on the Hyperliquid platform.

Hyperliquid, one of many fastest-growing decentralized exchanges, operates on a customized Layer-1 blockchain that leverages HyperEVM expertise able to processing as much as 200,000 transactions per second. Transaction quantity throughout the ecosystem has already surpassed $2 trillion.

HYLQ’s strategy facilities on funding within the $HYPE token, the native asset of the Hyperliquid ecosystem. By doing so, the corporate not solely positive factors publicity to potential token appreciation but additionally contributes to the expansion of the underlying platform. With scalability and efficiency at its core, Hyperliquid is being positioned as a future heavyweight in decentralized buying and selling.

The Highway Forward

The week’s sharp strikes spotlight how regulatory readability and institutional adoption are reshaping the crypto panorama. With Coinbase scaling monetary companies, Circle using the worldwide demand for stablecoins, and companies like HYLQ backing next-generation decentralized platforms, the race to outline the way forward for digital finance is accelerating.

For buyers, this atmosphere not solely boosts confidence in main exchanges and stablecoin issuers but additionally shines a lightweight on the high cryptocurrency shares that mirror this momentum and supply publicity with out holding tokens straight. As these firms increase their affect and win market share, many merchants are beginning to examine their progress trajectory with earlier phases of the crypto market itself.

The rising overlap between blockchain-native tasks and fairness markets underscores how conventional finance is turning into more and more tied to the evolution of digital property, giving buyers a number of pathways to take part within the sector’s subsequent wave of growth.