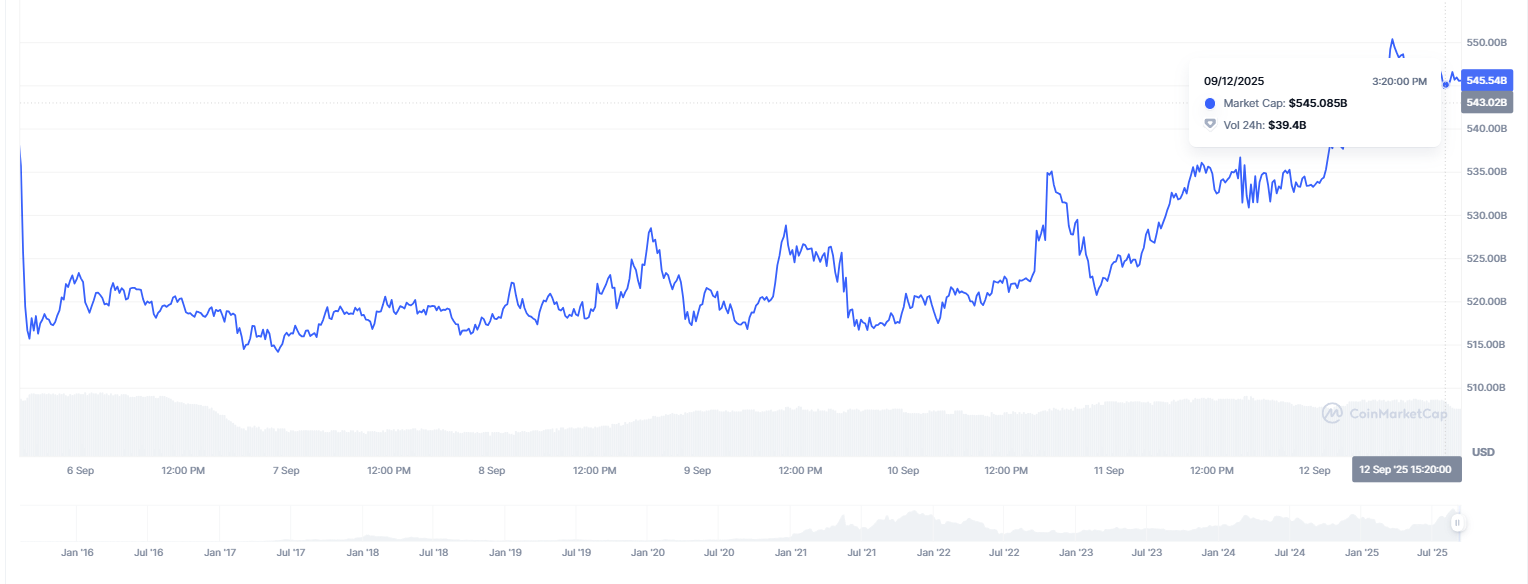

With a market valuation of barely greater than $549 billion, Ethereum is at the moment buying and selling at about $4,550. Regardless that it is a stable place for the second-largest cryptocurrency, ETH reaching $25,000 within the coming years sounds too good to be true, and it most definitely is.

No single asset exterior of worldwide equities has ever maintained a market capitalization of roughly $3 trillion, which might require a value improve of just about six instances. Nevertheless, in probably the most dire circumstances, the path to such a valuation is possible.

By 2026, the three hypothetical elements listed under would possibly make Ethereum much more priceless than Bitcoin appeared in some unspecified time in the future in market historical past.

Unparalleled surge in market

If ETH had been to hit $25,000, the entire cryptocurrency market must endure an unprecedented surge in capital influx and adoption. If Bitcoin had been to commerce between $500,000 and $600,000, it would affect different cryptocurrencies, making Ethereum the main good contract platform. The idea for such development could be a fourfold improve in ETH’s market capitalization, which might be fueled by a mixture of institutional inflows, retail hypothesis and the widespread acceptance of the cryptocurrency as a mainstream asset class.

Institutional market management

The dominance of establishments in ETH buying and selling could also be a second issue. If the market makers of ETFs and massive funds took over the provision of Ethereum, promoting strain is perhaps minimal. Decreased token availability on exchanges might artificially push costs greater. This could be much like the type of supply-demand engineering that happens in standard commodities markets, the place managed liquidity and shortage result in exaggerated valuations. Though there’s a appreciable probability {that a} bubble will kind, it’s doable if Ethereum will find yourself being the regulated alternative for establishments.

Manipulation of provides

By eradicating a portion of ETH from circulation, Ethereum would possibly imitate company inventory break up or denomination methods, the place the circulating provide successfully shrinks if future community upgrades intensify this impact. Exaggerated value ranges might outcome from a fast discount within the provide that’s accessible in addition to persistent demand from establishments and retail.

This could necessitate a drastic tightening of liquidity necessities, which might solely be doable if ETH is firmly established as the muse of not simply crypto’s, however the world’s, monetary system.

Backside line

Ethereum is unlikely to succeed in $25,000 by 2026 given the present circumstances. Nevertheless, such a degree would possibly theoretically be achievable on account of a confluence of institutional dominance, engineered shortage and explosive market development. It’s important for buyers to tell apart between reasonable market trajectories and speculative eventualities, however realizing these dynamics exhibits how necessary Ethereum’s position might turn into if the following bull cycle surpasses all earlier projections.